Portuguese utility EDP's 562MW Abono 2 facility in Asturias was the only one of 25 individual coal-fired power units in mainland Spain to operate during several days of May, effectively preventing the country from reaching a historic coal output of zero as happened in the UK.

And rather than economics, it was technical issues — particularly constraints in the distribution network in a region heavy with electro-intensive industries — that was the main explanation for the resilience of coal in the Spanish mix, even at times of deeply negative margins for the technology.

Coal-fired generation in peninsular Spain reached only 343GWh in May — or an hourly average of just 461MW — which at the time was the lowest for any month since at least January 1990, according to historical data from power grid operator REE. That record low was narrowly beaten in August, at 341GWh.

The May low came amid higher wind and solar power output, and as gas-fired generation displaced a substantial share of coal from the generation mix as a result of firmer EU emissions trading system (ETS) prices, low European gas hub prices, and the removal of the "green cent" tax on gas-fired generation in Spain from October 2018.

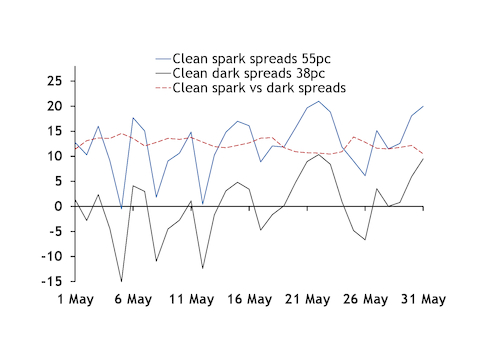

Day-ahead clean dark spreads for a 38pc-efficient coal plant were actually positive for a number of days in May. But they were consistently at discounts above €10/MWh to corresponding clean spark spreads for a 55pc gas efficiency, based on day-ahead power prices on Iberian exchange Omie, PVB prices on the Mibgas exchange, and Argus assessments of API 2 coal swaps and EU ETS allowances (see chart).

Coal-fired output reached daily hourly averages below 300MW on nine days in May, and the entire output in eight of these days came exclusively from Abono 2, REE figures show. The grid operator only publishes generation data per individual unit 90 days after actual dates.

Separate data from Iberian power exchange Omie — also released with a 90-day lag — showed Abono 2 managed to consistently enter the day-ahead pool market in May. But in most days of that month, only 683MWh from that unit — an hourly average of 28.5MW — made it to the day-ahead basic schedule with competitive offers in hours 1-3.

Such offers were only possible because the unit would already be operating in the evenings to deal with technical constraints in the distribution grid. It could therefore offer power in the day-ahead market at very low prices — even below cost — for the first few hours of the following day, as it would necessarily generate electricity even when ramping down production.

Daily operating schedules

REE's day-ahead basic schedule, called PBF, is the result of Iberian power exchange Omie's pool — whose bidding period closes at 10:00 local time — and the inclusion of bilateral contracts and scheduled output from subsidised renewable units reported by market participants.

A subsequent programme, called the provisional daily viable schedule (PVP), includes changes to the base daily operating schedule as a result of technical constraints — mainly issues in the transmission or distribution grids, as well as insufficient amounts of reserve capacity for the ancillary services market. Generation units that solve the technical constraints are duly compensated, at values calculated by REE.

In all of the days in May when Abono 2 was the sole coal unit operating in mainland Spain, its PBF schedule was only 683MWh — 252MWh in hour 1, 251MWh in hour 2 and 180MWh in hour 3 — while PVP volumes were much higher, ranging from close to 3,000MWh to over 6,500MWh. Final output figures were even higher because of additional volumes from deviation management mechanisms and ancillary services (see table).

EDP said the electricity system typically requires the existence of power plants close to zones with strong industrial activity such as the region where Abono 2 is located in Spain's northwestern Asturias, which explains why this unit regularly operates in the market.

"The sharp drop in spot gas prices, together with the high CO2 prices and the environmental tax on coal consumption, meant that practically only gas-fired power plants operated in the Spanish electricity system this summer," the company said.

"The exception is [coal] plants that must operate for reasons external to the daily market, as is the case with Abono 2, and which did so due to supply security technical restrictions," it said.

Abono 2 only entered the PBF schedule with small volumes in hours 1-3 in most days of May because a coal-fired plant usually needs between one and three hours to fully stop. "It's an almost mandatory operation, so offers can be usually made below cost when a unit operated the previous day," EDP said.

The resilience of Spanish coal power in May contrasted with the situation in the UK, a country that shares many similarities with Spain in its generation mix. The UK registered 18 consecutive days without any coal-fired power output between mid-May and early June this year, a new record since 1882. Coal output averaged only 28MW in May.

High efficiency, low start-up costs

But beyond solving technical constraint imbalances, Abono 2 is one of the most efficient coal-fired plants in Spain, which also contributes to it regularly being in the market, EDP said.

It is located around just 2km from the El Musel port in Gijon, where it receives its coal imports. And it is even closer to an ArcelorMittal steelmaking plant whose industrial gases are also used to produce electricity.

"And since it is operating almost every day, it has the advantage of not having to integrate start-up costs, which allows it to be on several occasions very competitive among coal plants in Spain," the firm said.

Abono 2 was the coal-fired unit with the highest utilisation rate in Spain last year, followed by Spanish utility Endesa's two Litoral de Almeria units, REE data show (see table).

Early last year, EDP converted one of Abono 2's furnaces to run on natural gas instead of fuel oil, which cut its sulphur and carbon dioxide emissions, shortened start-up times and increased efficiency.

Before that, Abono 2 was the first coal-fired unit in Spain to be fitted with nitrogen oxide (NOx) reduction technology to meet EU emissions standards.

The unit will be one of the few Spanish coal facilities to continue operating after stricter emissions rules take effect from July 2020 — and in fact it could operate until at least 2030.

EDP said Abono 2 would continue to operate "as long as market competitiveness justifies it". It declined to disclose the unit's nominal thermal efficiency.

REE did not reply to queries on the technical constraints. The company had planned a series of investments to generally tackle technical constraints in Asturias for the 2015-20 period, but it was unclear whether any of them would help minimise the issues that frequently make Abono 2 necessary to the Spanish system.

Even though generation data per individual unit is only published 90 days after actual dates, preliminary figures show that only Asturias registered coal-fired power generation on several days in August. Besides Abono 2 and the smaller 342MW Abono 1, Asturias also hosts EDP's 346MW Soto de la Ribera 3, Iberdrola's 348MW Lada 4, and Naturgy's 154MW Narcea 2 and 347MW Narcea 3 units.

Iberdrola and Naturgy have requested the closure of all their coal-fired plants and have been waiting for final governmental approval.

As with Abono 2, EDP has already completed environmental works to continue operating Soto de la Ribera. But the company is yet to decide about the future of Abono 1, which could include converting it to a gas-fired operation or continuing to run it post-2020 but for a limited number of hours.

Taken as a single plant with a combined capacity of 904MW, Abono 1 and 2 represented 83.5pc of EDP's 5.95TWh of coal output in Spain last year. Soto de la Ribera 3 accounted for the remaining 982GWh of generation in the country. EDP's coal-fired production in Spain last year was down by almost 20pc from 7.42TWh in 2017.

EDP produced 8.06TWh of coal-fired power in Portugal in 2018, down from 9.42TWh in the previous year.

The Portuguese utility has installed coal-fired capacity of 1.22GW in Spain and 1.18GW in Portugal. Its coal fleet was available for 93pc of the time in Spain last year and 94pc in Portugal.

| Peninsular Spain's coal-fired plants — 2018 | GWh | |||

| Capacity (MW) | Output | Hours working | Utilisation rate* | |

| Abono 2 | 562 | 3,306 | 7,609 | 77.6 |

| Litoral de Almería 1 | 558 | 3,612 | 7,748 | 76.3 |

| Litoral de Almería 2 | 562 | 3,341 | 7,227 | 70.6 |

| Puentes 1 | 351 | 2,125 | 7,204 | 69.5 |

| Los Barrios | 570 | 3,009 | 7,581 | 69.3 |

| Puentes 4 | 351 | 1,905 | 6,397 | 67.0 |

| Puentes 3 | 350 | 1,975 | 6,556 | 65.4 |

| Puentes 2 | 351 | 1,951 | 6,980 | 65.0 |

| Abono 1 | 342 | 1,660 | 6,344 | 57.3 |

| Puentenuevo 3 | 300 | 908 | 4,073 | 56.1 |

| Meirama | 557 | 2,351 | 5,181 | 52.2 |

| Lada 4 | 348 | 1,205 | 4,234 | 43.6 |

| Teruel 1 | 352 | 1,088 | 4,938 | 40.1 |

| Teruel 2 | 352 | 996 | 4,535 | 36.7 |

| Teruel 3 | 351 | 857 | 3,830 | 34.2 |

| Soto de la Ribera 3 | 346 | 982 | 3,923 | 32.7 |

| Compostilla 3 | 323 | 887 | 3,380 | 32.6 |

| La Robla 2 | 355 | 819 | 2,892 | 31.9 |

| Compostilla 5 | 341 | 725 | 2,768 | 24.7 |

| Guardo 2 | 342 | 415 | 1,420 | 14.5 |

| Narcea 3 | 347 | 332 | 1,268 | 12.0 |

| Anllares** | 347 | 233 | 1,027 | 8.4 |

| Compostilla 4 | 341 | 212 | 974 | 7.7 |

| Narcea 2 | 154 | 0 | 0 | NA |

| Guardo 1 | 143 | -3 | 0 | NA |

| La Robla 1 | 264 | -10 | 0 | NA |

| Total | 9,562 | 34,882 | 4,703 | 45.3 |

| — REE | ||||

| *"Utilisation rate" is the ratio between actual output and the maximum output the plant could have reached if running at full capacity in all the hours it was available | ||||

| **The Anllares plant was permanently closed late last year | ||||

| Abono 2 — May 2019 output* | MWh | ||

| Day | PBF | PVP | Peninsular Spain's output |

| 5 May 19 | 683 | 2,916 | 6,794 |

| 6 May 19 | 683 | 5,565 | 6,984 |

| 8 May 19 | 683 | 6,407 | 7,035 |

| 11 May 19 | 683 | 3,888 | 6,879 |

| 12 May 19 | 683 | 2,916 | 6,942 |

| 18 May 19 | 683 | 5,444 | 6,952 |

| 25 May 19 | 683 | 6,628 | 7,023 |

| 26 May 19 | 683 | 5,166 | 6,596 |

| — REE | |||

| *On days when Abono 2 was the only coal unit to operate in peninsular Spain | |||