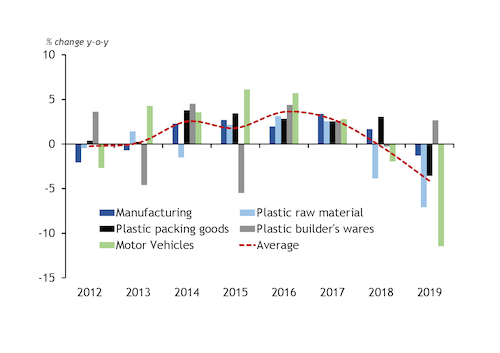

Industrial production data for the EU-28 in 2019 from Eurostat show a continuation of the slowdown noted by Argus in 2018, with year on year drops in production of plastics and in the output of key plastic-consuming industries. The downward trend could be a pointer for underlying polymer demand in 2020.

Comparing 2019 with 2018, production of plastic in primary forms declined by 7.1pc in the EU-28. This is more than double the contraction that occurred in 2018, which in turn was the sharpest decline since 2009. Part of the drop can be blamed on an unusually large amount of steam cracker maintenance in the spring and autumn. But it also coincides with a period when low margins led polyethylene (PE) producers to trim their operating rates, and during which some downstream industries also slowed down.

The index for the manufacturing sector as a whole showed a 1.3pc year on year drop in 2018, its first annual decline since 2013. This includes falls of 3.5pc and 11.2pc, respectively, in the plastic packaging sector and the automotive industry, which are the largest and third-largest consumers of plastic in Europe.

Each industry has different dynamics. The packaging industry is beset by concerns about the effect of improperly-disposed single-use plastics on the environment, which is leading to legislative pressure and pledges from end-users to avoid packaging their products in plastic. But, while avoidance of plastic undoubtedly has some effect at the margins of the consumer packaging industry, converters are more concerned in the short term about slower demand for industrial packaging, which they link to the contraction of the wider manufacturing sector.

Packaging is the largest market for PE, polypropylene (PP) and polyethylene terephthalate (PET) in Europe. Low and linear-low density PE and PET will be most affected by a slowdown, as packaging makes up a particularly high percentage of their demand.

The automotive industry is yet to recover from a collapse in mid-2018, precipitated by some carmakers struggling to manage the introduction of new emissions standards. European new car registrations showed a gradual improvement towards the end of 2019, but production of cars continued to fall. The fourth quarter was the slowest for car production in six and a half years. European auto industry body ACEA's forecast of a 2pc decline in new car registrations in 2020 will not help.

In addition to slow demand in Europe, Europe's car manufacturers are seeing slow demand in China, their largest export market. Chinese industry and information technology minister Miao Wei expects the country's car market to remain depressed in 2020.

Weakness in the automotive market is most problematic for PP — the most common automotive plastic — but also impacts high density PE and more specialised engineering polymers. A counterpoint is that lightweighting measures — particularly in the case of electric vehicles — is increasing the amount of plastic used in each car.

Conversely, the construction industry — Europe's second largest consumer of plastic — continues to outperform the manufacturing sector. Production of plastic builders' wares rose by 2.7pc year on year, mirroring a rise in total output in the EU-28 construction industry. Manufacturers of PE and PP pipes and pipe grade resins, and polyvinyl chloride, will particularly hope that this continues in 2020, although there is concern that general softness in the economy could discourage new investment in large-scale construction projects.

By Will Collins