High fixed costs are forcing Australian thermal coal mining firms to maintain production, despite operating at a loss because of a severely oversupplied seaborne market. Inflexible take-or-pay contracts for port and rail use mean it is better to endure losses than to cut production, as suppliers are still forced to pay fees for infrastructure.

Australian independent Whitehaven and Chinese-owned Yancoal both managed to report slim operating profits in their latest reports to 30 June, but UK-Australian firm BHP, Switzerland-based Glencore and Thai-owned Centennial Coal all made losses at their Australian coal divisions.

Of these big four Australian thermal coal producers, only Glencore has announced plans to cut production this year through the closure of most of its mines for 2-3 weeks in September-October. BHP is reviewing its Australian operations, which it is trying to sell, to see how it can cut costs, while Centennial expects production to ease slightly because of difficult mining conditions.

Yancoal, which made a loss at all its joint-venture mines except for Moolarben in January-June, has maintained its guidance of 38mn t for 2020, up from 35.6mn t in 2019. The slight increase in planned production follows its increased stake in the Moorlaben mine and previously approved plans to increase its output there.

Whitehaven, which reported a 95pc drop in profit for the year to 30 June, plans to increase production to 18.5mn-20mn t from 17.5mn t despite shrinking margins caused by oversupplied seaborne thermal and coking coal markets.

The difficulty for Australian mining firms to cut production, like their rivals in Indonesia and North America, is well illustrated in Whitehaven's financial results. Its costs included around A$44mn ($32mn) of fee payments that it had to make to port and rail providers for capacity it did not use, because it shipped just 17.5mn t of coal rather than the expected 19mn-20mn t. It hopes to reduce these costs for unused allocations on port and rail infrastructure by raising its output.

The legal agreements on take-or-pay costs linked to train and port utilisation are long-term and inflexible for most producers. The costs vary depending on the individual agreements between counterparties and can easily amount to several dollars per ton of coal. But producers will normally be locked in for the contracted period even in cases when mines have had to be closed years earlier, market participants say.

Digging into cash reserves

The take-or-pay costs, combined with a stronger Australian dollar and rising labour costs, have left many Australian mines operating at a loss at current coal prices. Firms are using cash reserves to keep operating in the hope that demand and prices will rebound. But stockpiles are growing at Australian mines and ports, ready to be shipped at the first uptick in demand, potentially putting downward pressure back on prices.

This is forcing some mines to move forward or lengthen planned maintenance periods, or to cut overtime and weekend work. Sales to key markets such as Japan and China have come under pressure in recent months because of an economic slowdown linked to the Covid-19 epidemic and global oversupply exacerbated by Beijing's informal restrictions on coal imports.

China's curbs on Australian coal cargoes have been stepped up since May and there have been long delays and inspections of cargoes at customs offices in southern and northeastern Chinese ports, as political tensions escalate between Beijing and Canberra.

The bulk of Australian high-CV coal sales to Japan are done through long-term agreements and some Japanese utility buyers have told Argus they are wrestling with several major Australian producers to delay the shipping of scheduled term cargoes.

Suppliers have been hit hard since April by the twin impact of slowing demand from major buyers, as the severity of the Covid-19 outbreak began to be felt, together with China's decision to tighten enforcement of import quotas against Australia in particular since May to protect its own domestic producers.

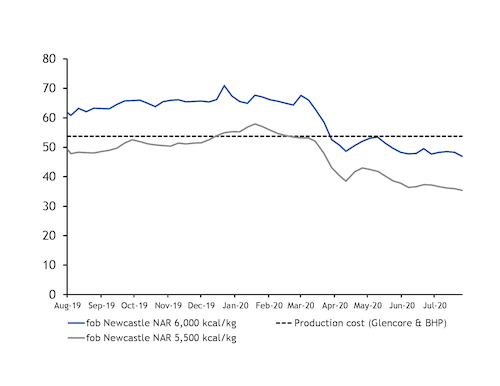

The problems have contributed to a 31pc fall in the price of fob Newcastle NAR 6,000 kcal/kg coal from 1 April to 21 August, the most recent assessment. The Argus-assessed price for cargoes of 50,000t and above fell to $46.95/t, down by $20.63/t over the same period, and the lowest price since November 2006.

The fob Newcastle NAR 5,500 kcal/kg market has been even harder hit proportionally, with a 33pc price fall over the same period, as this coal is most dependent on China demand. Prices fell to a new record low of $35.39/t on 21 August, down by $17.79/t since 1 April.

By Jo Clarke and Claire Pickard-Cambridge