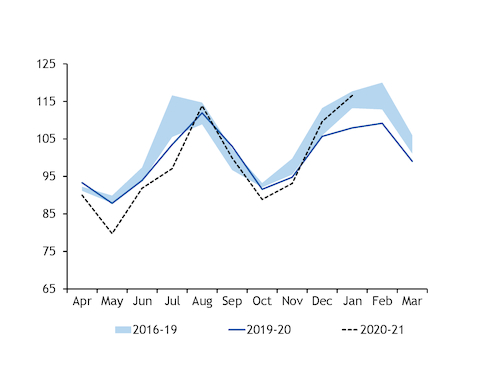

Japanese thermal coal imports fell on the year in December despite a likely increase in coal-fired power generation, suggesting a stockdraw ahead of the peak winter demand period in early 2021.

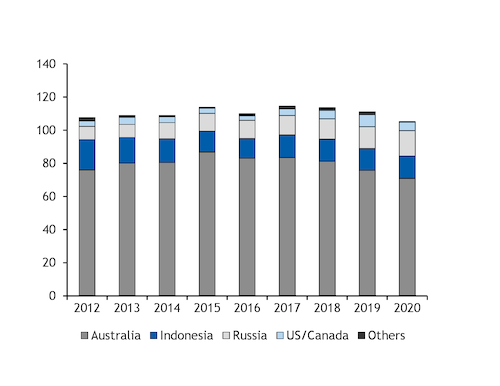

Japanese imports fell by 1.5mn t on the year to 9.3mn t in December, according to provisional finance ministry data released today. This brought last year's annual total to 105mn t, from 111.2mn in 2019 and the lowest since 2011.

The annual contraction in December came at a time when coal-fired generation likely grew strongly because of colder-than-usual conditions and a year-on-year shortfall in nuclear availability.

Generation data for December are not yet available, but national power demand rose by 3.8pc on the year to an average of 109.7GW, according to grid operator data. And nuclear availability was reduced to just 2.8GW, from 7.3GW a year earlier, amid suspensions for maintenance and upgrade works.

The spike in demand and nuclear shortfall will have increased Japan's reliance on fossil fuels at the end of last year, with average generation from coal, gas and oil likely to have increased by more than 8GW, according to Argus analysis.

Assuming coal and gas retained the 42pc and 54pc shares of the fuel mix recorded in December 2019, output from the respective fuels may have increased by 3.6GW and 4.6GW on the year to 39.3GW and 50.3GW. This is equivalent to about 11.3mn t of NAR 6,000 kcal/kg coal at 37pc efficiency and 4.9mn t of LNG at 50pc efficiency.

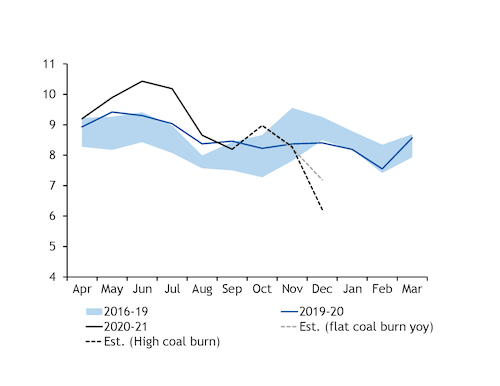

In December 2019, Japanese imports of 10.8mn t narrowly exceeded implied consumption of about 10.3mn t, but stronger seasonal demand this winter looks to have forced a net draw on stocks ahead of the peak demand months.

Granular power generation data by fuel and stock levels are published by the government with a lag in Japan, with data currently available through to September 2020. But based on import data and assuming flat coal-fired power generation on the year in October-December, Argus estimates that coal inventories may have been drawn down from 8.2mn t in September to 7.2mn t in December, from 8.8mn t in December 2019.

Higher fossil fuel generation

Generation from fossil fuels rose by 1.3GW and 4.1GW on the year in October and November, respectively, and potentially by more than 8GW in December, which means coal-fired generation is unlikely to have been flat on the year in the fourth quarter, likely reducing inventory even further, to less than 7mn t, by the end of December.

Based on government data back to April 2016, power-sector coal stocks reached as low as 7.3mn t in October 2017, while the three-year average for December in 2017-19 was 8.8mn t.

Having likely started this year with a storage deficit, Japan's reliance on coal has probably increased again this month because of a further spike in power demand driven by freezing conditions. National power demand over 1-20 January averaged 117.6GW, according to grid operator data, compared with about 106GW in the whole of January last year.

Coal-fired generation may have been further supported by LNG supply constraints. Japanese utilities have limited their gas-fired power generation since late December in a bid to maintain minimum stock levels and continue operating power generators. And despite strong purchases in the spot market, LNG inventories fell from 1.8mn t in December to less than 1mn t on 10 January, according to the energy ministry.

Nuclear availability is expected to only marginally increase, to about 3GW this month, which would be down from 6.6GW a year earlier. And the latest weather forecasts for Tokyo indicate temperatures will remain well below average until 26 January before shifting to above-average levels in early February, which could provide some relief for the strained power network.

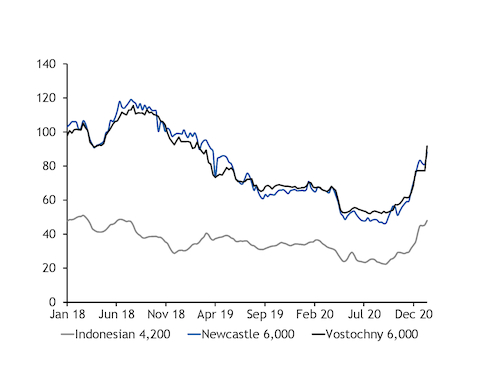

The spike in power demand and likely increase in coal-fired output — together with a similar squeeze in China this winter — has fed strength to Asia-Pacific coal prices in recent weeks. NAR 6,000 kcal/kg Australian coal was last assessed by Argus at $88.14/t fob Newcastle, up by 56pc, or $31.81/t, since early October last year.

Imports wane

Japan's coal imports from nearly all origins were down on the year in December, although receipts from Russia climbed by nearly 500,000t on the year to a record high of 1.6mn t.

This growth was easily offset by a 900,000t drop from Indonesia — where recent strong Chinese demand has likely tightened availability — and an 800,000t drop from undifferentiated countries, which include Japan's biggest supplier, Australia, as well as Colombia, South Africa and others.

Lower imports from Australia was the leading driver of the overall contraction in 2020, as Japan took less than 71mn t from its main supplier, compared with 75.7mn t in 2019. This trend could reverse in 2021, with Australian exports facing a ban in China and Japanese utilities likely to have stronger restocking needs ahead of the summer.

Imports from Russia climbed by 2.3mn t on the year to 15.4mn t and Indonesian arrivals edged higher, to 13.4mn t, despite the strong decline in December, while US volumes dropped by 1.9mn t to 2.3mn t.