An extension by a number of months to continuing maintenance at two South Korean nuclear reactors has boosted the demand outlook for fossil fuel-based generation in the coming months. Capacity restrictions will limit the upside potential for coal in March-April, but competitive costs compared with natural gas may drive year-on-year growth in coal burn over May-July.

South Korea's state-owned nuclear operator Korea Hydro and Nuclear Power (KHNP) this month extended the scheduled end date for maintenance on its 1GW Hanbit reactors 4 and 5 until 17 August and 24 July, respectively. The units were previously scheduled to restart in March, under plant schedules published by KHNP.

The Hanbit nuclear plant has an installed capacity of 5.9GW across six reactors, but units 2 and 3 — both 1GW — are currently the only ones on line. Hanbit 1 and 6 are under planned maintenance and scheduled to restart in April and May, respectively, although repairs at unit 4 and 5 may risk extending the downtime at reactor 6, according to a research note published by South Korea's Hana Financial Group.

In addition, KHNP's Hanul 1 and 2 reactors — both 950MW — were automatically suspended today owing to an influx of marine organisms, according to a statement published on its website. It is unclear when these units will restart, but the operator will need to consult with South Korea's Nuclear Safety and Security Commission (NSSC) about their return, a KHNP worker told Argus.

The maintenance extension at Hanbit 4 and 5 has created a 2GW shortfall in availability compared with the previous outlook, while outages at the Hanul plant will curtail a further 1.9GW for as long as they remain off line.

Impact on thermal generation

Weaker nuclear availability has lifted the outlook for coal-fired generation in the coming months, although maintenance and restrictions across the coal fleet looks likely to cap output in March and April.

State-owned Kepco utilities' coal-fired availability is currently scheduled to average 21.38GW in April, which is already down from 21.4GW in April 2020. Maintenance schedules are updated weekly, which means further stoppages could be added in the coming weeks.

Kepco utilities' coal-fired output averaged 18.4GW in April 2020, representing 86pc of the available capacity that month, according to Argus analysis.

But coal-fired power generation is more likely to strengthen over May-July, when restrictions across the coal fleet are typically lower, with coal's rising cost advantage against gas for power generation potentially encouraging utilities to maintain high load factors across their available coal capacity to cover the nuclear shortfall.

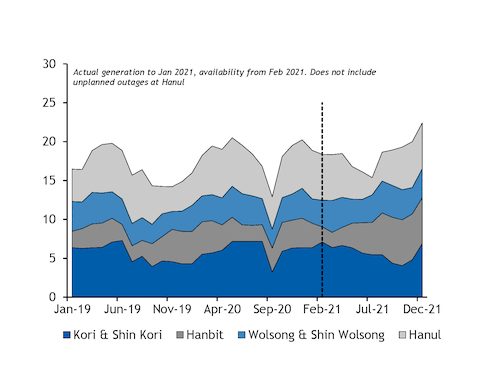

Assuming today's unplanned Hanul outages are resolved by next month, current maintenance schedules show that nuclear availability will be 3.7GW, 3.4GW and 3.1GW lower on the year in May, June, and July, respectively, compared with actual generation last year. The majority of this shortfall will need to be covered by coal and gas, although the exact balance will depend on overall power demand and growth in renewable generation.

Rising oil-linked LNG costs and firm domestic gas prices look likely to keep coal-fired generation competitive for power in the months ahead, which could prompt utilities to cover much of any increase in demand for fossil fuel-based generation with coal.

Available Kepco coal-fired capacity was dispatched at only a 75-77pc load in May-July 2020 during the height of the first Covid-19 lockdown measures. This was down from 85-87pc in 2019, illustrating the upside potential for coal if the nuclear outages create a shortfall for thermal generation to fill.

Argus analysis shows that coal burn could rise by around 2GW on the year over the May-July period — equivalent to around 520,000 t/month of additional NAR 5,700 kcal/kg coal burn — assuming overall power demand is flat and coal maintains a flat share of total generation from coal and gas.

But KHNP's nuclear availability is still expected to be stronger on the year in the second half of 2021, which could weigh on fossil fuel demand later in the year. Nuclear availability is expected to average around 19.9GW in the August-December period based on the current maintenance schedule, and could be 1.4GW higher still if the new Shin Hanul reactor begins operation as planned in July. South Korean nuclear generation averaged 17.5GW in August-December last year.

Kepco projects that South Korea's overall power demand in 2021 will rise by as much as 2.7pc on the year assuming economic recovery based on successful vaccine roll-out, according to the Kepco Management Research Institute's (KEMRI) latest power market outlook report. KEMRI projects that annual power demand will edge higher by only 0.9pc on the year under a pessimistic scenario.