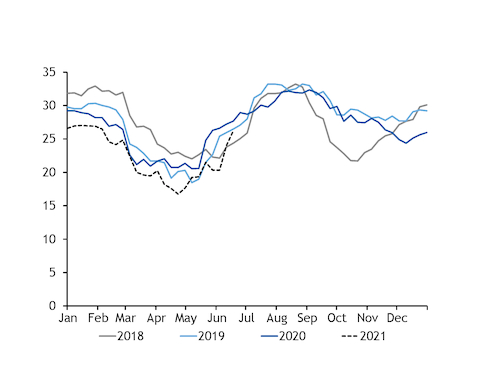

Continuing supply tightness in Asia-Pacific helped to lift northeast Asian coal prices this week.

NAR 5,800 kcal/kg coal prices rose by 71¢/t to $119.16/t cfr South Korea and by $1.33/t to $99.66/t fob Newcastle.

South Korean tender activity remained brisk, with a series of awards for third-quarter loading. State-owned utility Korea South-East Power awarded two Capesize cargoes of NAR 5,700 kcal/kg coal on a NAR 6,080 kcal/kg price basis for loading in August and September to an international trading firm at $104/t fob Newcastle.

Fellow state-owned utility Korea East West Power awarded at least four Capesize cargoes of typical NAR 5,700-5,800 kcal/kg coal on a NAR 6,080 kcal/kg basis at $103-104/t fob Newcastle for August-September loading.

Korea East West Power also awarded two Panamaxes of Indonesian coal in tenders this week at $102/t and $109/t fob on a NAR 6,080 kcal/kg price basis for NAR 4,450 kcal/kg and NAR 4,650 kcal/kg supplies, market participants said. But a third tender for low-CV coal was cancelled because of high prices.

Utility Korea Midland Power is said to have procured at least two Capesize shipments of South African NAR 5,800 kcal/kg coal for August-September loading at around $101/t, on a NAR 6,080 kcal/kg price basis.

And an unknown Kepco utility may also have purchased Russian coal on a fob Taman basis, but details could not be confirmed.

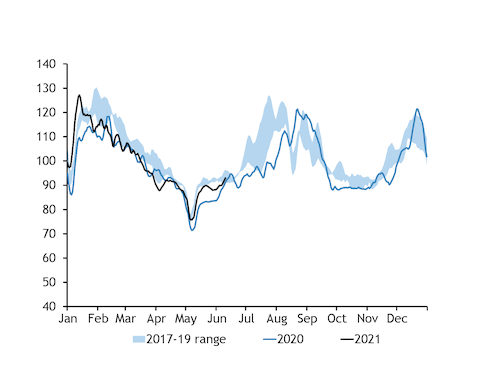

Available coal-fired capacity continues to increase in South Korea ahead of the summer cooling period, which typically drives a steep rise in power demand over June-July to its seasonal peak in August. This, in addition to ongoing unplanned nuclear outages, has kept the short-term demand outlook firm.

The latest maintenance schedule suggests that 26.2GW of state-run Kepco coal capacity will be available over 12-20 June, with only 7.5GW restricted, down from 9.9GW over 5-13 June. Of this total, around 1.7GW will be unavailable because of voluntary restrictions.

In June as a whole, Kepco coal restrictions are due to rise by at least 3.4GW on the year, but this may not preclude an increase in coal-fired generation, as average load factors were unusually low during the peak of the pandemic last year. If capacity utilisation recovers to 84pc this month — the three-year June average — Kepco coal burn would still rise by around 700MW on the year, Argus estimates.

In addition, two new private coal-fired units — the 1GW Shin Seocheon and 1.04GW Goseong 1 — may now be operational, giving a further potential boost to national coal burn this summer.

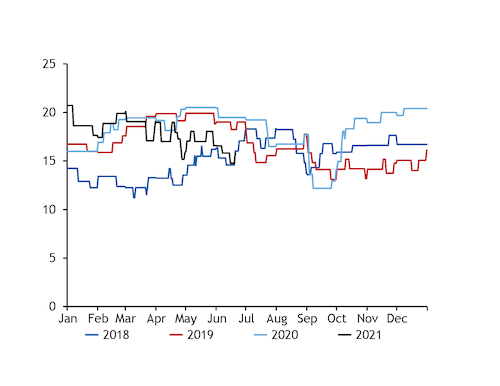

The 1.4GW Shin Kori 4 nuclear reactor remains suspended following a fire, with the duration of the outage still not clear.

Argus estimates that nuclear availability is scheduled to be around 14.6GW over the next week, or 67pc of installed capacity. In addition to the unplanned outage, eight other reactors are currently down for planned maintenance, although 2GW is expected to return later this month.

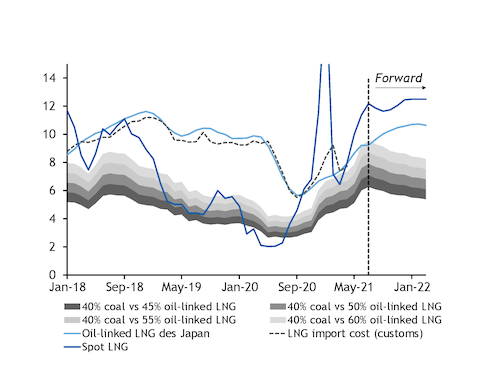

Customs data released today show that South Korea imported nearly 6mn t of bituminous coal at an average cost of $81.59/t in May, from 6.7mn t a year earlier at a cost of $65.74/t. This contrasted with the country's LNG receipts, the volume of which rose on the year but at a lower average cost — 3.4mn t at around $7.81/mn Btu last month, compared with 3mn t at $9.02/mn Btu in May 2020.

Gas-fired generation remains, as a result, relatively more competitive with coal than it was a year earlier. Based on the average import costs from the customs data, the tax-inclusive generation cost for a 38pc efficient coal-fired plant would be around $7/MWh higher on the year at $47/MWh, while gas-fired costs would be $7/MWh lower on the year at $51/MWh, under Argus analysis.

South Korean gas prices are expected to trend higher through the next few months owing to the influence of lagged oil-indexation within term LNG agreements, and state-owned gas supplier Kogas set its June tariff for the power sector at a 20-momth high of $11.28/mn Btu.

But the rapid rise in spot coal prices in recent weeks means that gas is still gaining in competitiveness against coal. Generation from both fuels is due to rise on the year in June to cover the nuclear shortfall and stronger overall power demand, but competitive gas prices are a potential limiting factor for coal burn.

Japan

Coal prices for Japan strengthened this week as fob coal prices and Asia-Pacific freight rates both firmed.

National power demand levelled off in early June but remained up on the year, and consumption typically begins to rise quickly in July, which could support coal use. Japan's meteorological office expects temperatures to be normal or above-average through to August, which could support cooling demand, while a Covid state of emergency is due to be lifted on 20 June and could also boost electricity demand.

Rising oil-linked LNG prices may also be supporting Japanese coal demand as the solid fuel could become more competitive on cost for power generation as the year wears on. Japanese coal consumption is subject to a less onerous tax regime than in South Korea, which means the fuel faces less intense competition on cost from natural gas.