A slowdown in port efficiency in China because of stricter Covid-19 quarantine requirements and safety checks has weighed on bunker fuel demand at Chinese ports since May.

Spot demand for very low-sulphur fuel oil (VLSFO) captured by Argus at China's largest bunkering port of Zhoushan in east China has fallen to about 2,600 t/d as of 25 June, compared with 3,400 t/d in May and 3,700 t/d in April.

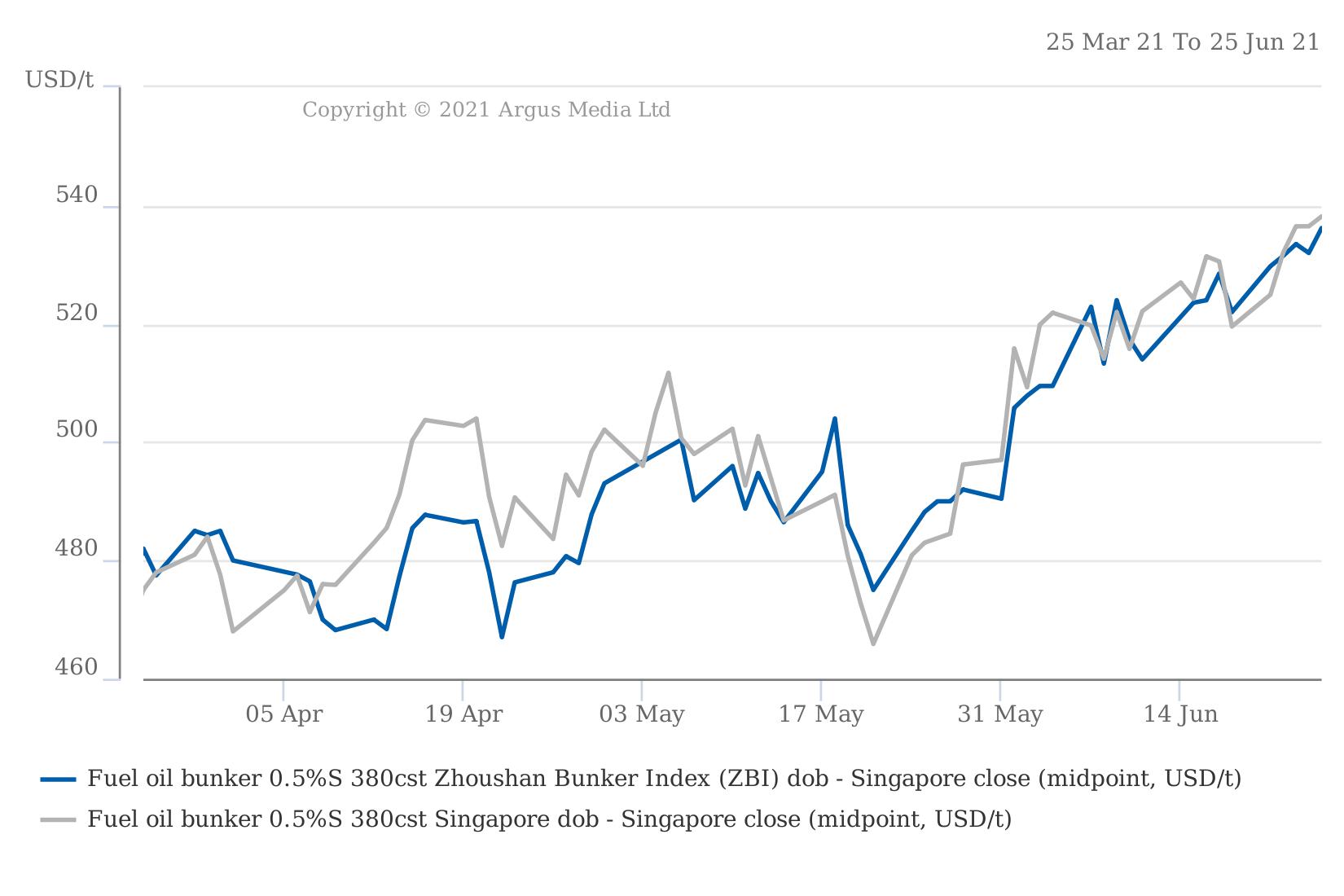

Zhoushan bunker fuel suppliers offered more aggressively at lower prices during April-May to boost sales. This prompted some vessels that usually call at major southeast Asian ports to switch to China, especially Zhoushan (see first graph). But the lower prices were less attractive for bunker sales from the second half of May onwards as port operational efficiency fell.

No crew change is allowed in Zhoushan unless crew members' on-the-spot nucleic acid test results are negative. It is the same case at the southern Chinese ports of Shenzhen and Guangzhou. This has discouraged vessels from calling at these ports for bunkering operations.

China's port authorities have requested that ports step up safety checks even if that means operations may slow, in turn weakening bunker fuel demand growth. China is tightening safety controls ahead of the 100th anniversary of the Chinese communist party on 1 July, according to local bunker suppliers.

The lower spot VLSFO demand levels in Zhoushan so far this month indicate that China's May and June bunker fuel sales may have also fallen from April. The country's total bunker fuel sales rose by just 1pc to around 16.9mn t in April from 16.7mn t in March despite bigger discounts from suppliers, according to data from bunker suppliers. A major bunker supplier said it could have lost about 100,000t in bunker fuel sales at Shenzhen in May-June compared with March-April.

VLSFO stocks at Zhoushan remain high, and buying interest for ex-wharf VLSFO among bunker suppliers is still sluggish as there is no obvious need to replenish inventories.

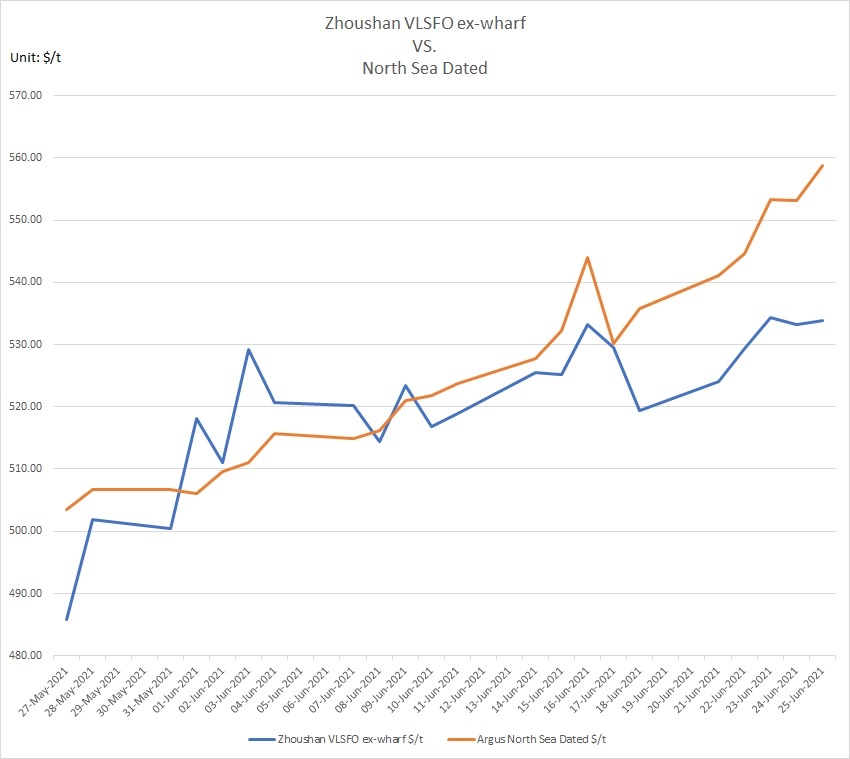

Ex-wharf Zhoushan VLSFO has been lagging gasoil so far in June, with its discount to Singapore 10ppm gasoil cargo values staying above $65/t after falling to $50-60/t in early June from $70/t at the end of May (see second graph) as expectations of VLSFO supplies remaining ample have dampened prices for the grade.

Ports in north China have shrugged off the impact of recent virus outbreaks in the country with looser requirements for vessels, but are still strictly monitoring safety.

VLSFO spot bunker prices at northern Chinese ports such as Qinhuangdao, Caofeidian, Dalian and Tianjin are more than $10/t higher than those at Zhoushan and some southern Chinese ports. Spot VLSFO at Zhoushan, Shenzhen and Guangzhou are trading at similar levels.

Separately, Hong Kong's bunker fuel sales during January-May could have fallen by 1.5mn-2mn t/yr from the same period a year ago, according to estimates from a major state-owned oil firm. Local maritime associations successfully lobbied the Hong Kong government to lift restrictions requiring vessels to be quarantined for 14 days when they call at the port for bunkering operations at outer port limits.

Major Hong Kong bunker supplier New Oceans fell to a loss in 2020 compared with a profit in 2019 because of the effects of the Covid-19 pandemic. Hong Kong's bunker sales volume also fell by around 14pc from 6.5mn t in 2019 to 5.7mn t in 2020, according to market estimates.