LNG loadings worldwide rose in July compared with a year earlier, underpinned by a rebound in US exports, but fell short of the output produced earlier this year.

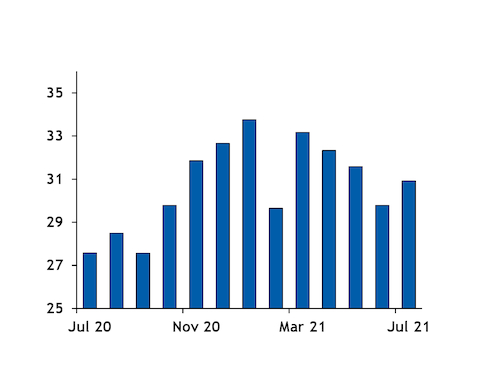

Aggregate LNG exports rose to 30.9mn t of LNG, from 27.6mn t a year earlier and 29.8mn t in June, preliminary shiptracking data from oil analytics firm Vortexa indicate. Worldwide output had exceeded 33mn t in January and March, and a record high of 34mn t in December 2019, but loadings have since failed to reach similar levels.

The increase was mainly driven by stronger Atlantic basin supply, with combined loadings within the basin rising to 11.6mn t last month from 8.2mn t a year earlier and 10.7mn t in June. Loadings at US LNG export facilities reached 6.15mn t last month from 1.93mn t in July 2020, when a spate of cargo cancellations weighed heavily on US output and the third train at the 15mn t/yr Corpus Christi terminal was not in operation.

Australian production also recovered and exports rose to 7mn t in July from 5.8mn t a year earlier, when loadings from the 7.8mn t/yr Gladstone LNG export facility fell to a two-year low.

Brisker exports, largely from the US and Australia more than offset slower Qatari, Nigerian and Norwegian exports, which in total fell by around 1.5mn t from a year earlier. Norway's 4.2mn t/yr Hammerfest facility has remained off line following a fire at the facility, and is not expected to resume loadings until March next year.

Trinidadian exports also slowed considerably, with the country producing only 488,400t, down from 1.3mn t a year earlier. Faltering feedgas supplies to Trinidad's 14.8mn t/yr Atlantic LNG complex resulted in the first train at the facility being put in an "indefinite turnaround" at the start of this year.

And maintenance at the 9.6mn t/yr Sakhalin export facility in Russia's far east may have curbed the country's aggregate output, with Russian LNG production falling to 1.8mn t in July from 2.17mn t a year earlier.

Struggling Peruvian output also contributed to limit the increase in global exports last month, with the country's 4.4mn t/yr Pampa Melchorita terminal not loading any cargoes last month, after exporting 415,815t a year earlier, PeruPetro data show. Weak upstream production, coupled with faults at the export facility in recent months, may have disrupted Peru's LNG output last month.