The EU has turned to Australia for durum wheat supply in the 2021-22 marketing year amid supply tightness in Canada — the world's largest producer of crop.

Australian durum wheat exports to the EU totalled 65,000t in the first 12 weeks of the 2021-22 marketing year — which runs to 19 September — provisional data from the European Commission show. This was up from just 41t over the same time a year earlier.

Deliveries from Australia accounted for 23.1pc of the EU's overall imports so far this marketing season. In comparison, Canada exported 170,100t during the period, considerably below the 485,000t a year earlier, when the country supplied nearly 72pc of the EU's durum needs.

The EU last year imported a record 2.92mn t of durum wheat in the 2020-21 marketing year, up from 2.32mn t a year earlier. This was largely a result of a recovery in pasta production to pre Covid-19 levels — particularly in Italy, the largest importer of crop in the bloc. At the same time, lower domestic output within the EU further increased the call on imports.

Higher demand was mostly met by Canada, which exported a record 2.03mn t to the EU in the past marketing year. The country was able to step up shipments on the year, with its domestic production hitting 6.57mn t in 2020-21, its highest in four years.

But persisting dry and hot weather in North America this summer has heavily weighed on Canada's wheat yields, with government statistical agency StatCan pegging the country's 2021-22 durum wheat output as low as 3.55mn t last week. This also implies Canadian durum exports could nearly halve on the year.

Reduced output this year has boosted durum prices, with Canada's second grade western amber durum (2 CWAD) quoted around $640/t fob Vancouver today, more than doubling on the year.

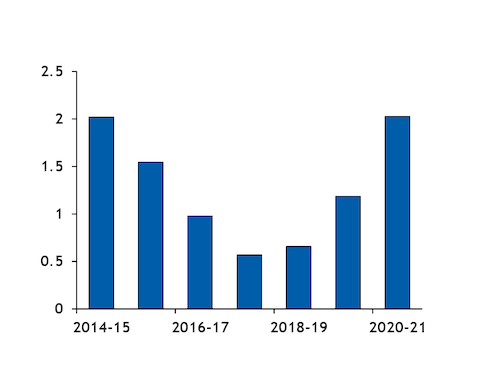

But Australia's comparatively smaller durum production suggests that the country may not supply the EU's requirements alone, even with high yields. Australian durum exports to the EU previously hit a record 400,000t in 2001-02 and have averaged below 300,000 t/yr since 2012-13. The country was also almost fully displaced from the EU market in 2018-20 when drought conditions hit its wheat production.

This also suggests Italy in particular might need to return to Canada for durum supply later this year and could purchase up to 700,000t from the latter, participants said.

French pasta-maker groups Sifpaf, CFSI, as well as Italy's Unione Italiana Food have warned since last month that European pasta prices could go up this year due to limited and costlier imports.