Approval for the restart of utility Shikoku Electric's 890MW Ikata 3 reactor could weigh on thermal power demand in Japan early next year. But the country's coal imports remain firm on strong winter restocking requirements, while coal-gas fuel-switch economics have tilted in favour of the solid fuel.

Shikoku has finally secured permission from local authorities to reactivate its 890MW Ikata reactor on 2 December. The unit will resume power transmission on 6 December with a return to normal operation scheduled for 4 January next year.

Ikata 3 has been off line since December 2019 because of regular maintenance, installation of anti-terrorism measures, several work errors and a safety breach.

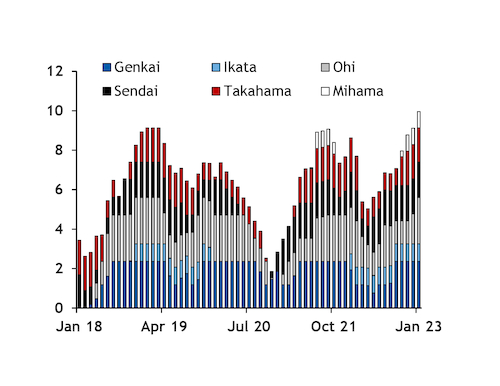

The Ikata restart bolsters Japan's electricity generation options heading into the peak December-January demand period. And Japan's nuclear availability is now projected at 8.6GW in January 2022, up by 5.1GW on the year and the highest January capacity since 2019, according to the latest operator schedules.

This builds on a period of firm nuclear supply, as availability has exceeded 7GW every month since May this year. But available capacity will taper off towards the end of the first quarter of next year and into the shoulder season. Monthly availability will return to a year-on-year deficit from April 2022, with several units off line for maintenance. Availability is scheduled to drop to 7.7GW in February, 5.4GW in March and a 13-month low of 5GW in April.

Coal-gas switching

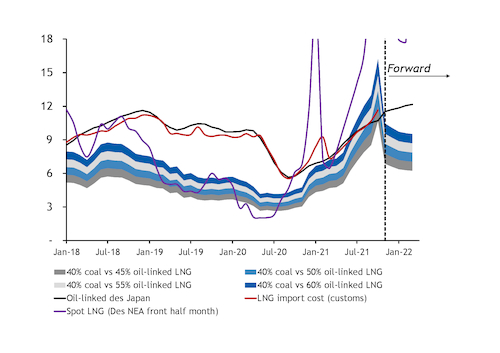

The restart of Ikata 3 is likely to eat into overall thermal demand in Japan. But a steep drop in spot coal prices relative to oil in recent weeks has shifted fuel-switch economics for the first quarter of 2022 firmly back in favour of coal.

Even the highest-efficiency gas-fired plants running on oil-indexed LNG are now less economic to run than 40pc-efficient coal-fired plants in early 2022, based on Argus' forward coal and LNG price assessments and relevant taxes.

This is in stark contrast with the picture in the fourth quarter of this year, when even low-efficiency gas-fired plants were in the money relative to 40pc-efficient coal (see chart). Northeast Asian spot LNG prices were well above fuel-switching thresholds required to be competitive with coal in the fourth quarter. But given that the bulk of Japan's LNG imports are sourced through longer-term oil-indexed contracts, the comparison between oil-indexed and spot coal costs is more relevant for generation economics.

This generation cost outlook implies that coal could displace some gas from the power mix this winter as coal is also more competitive than oil-indexed LNG and spot LNG pricing than year-ago levels.

Coal vs LNG import trends

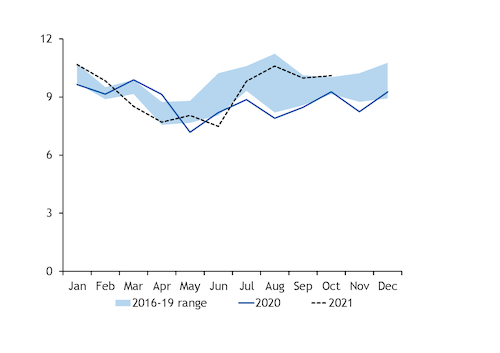

Japanese coal imports have been running at an elevated level over the past few months, a trend that continued into October, according to provisional finance ministry data released last week.

October imports rose by 840,000t on the year to 10.1mn t, the highest October import figure since at least 2014. Overall January-October imports were 92.7mn t, up by 5.1mn t from last year and by 1mn t from the pre-pandemic 2019 level.

Australian coal continued to drive the growth in Japanese imports in October, with deliveries from this origin increasing by about 1.5mn t — or 26.8pc — on the year to 7.2mn t.

This total may include small volumes of South African, Canadian or Colombian coal, which are not broken down in the provisional data.

Imports from the US increased by 200,000t to 290,000t. But deliveries from Indonesia and Russia declined by 266,000t and 550,000t to 931,000t and 1.5mn t, respectively.

LNG imports low

In contrast with coal, Japan's LNG imports in October fell by 320,000t on the year to 5.6mn t, their lowest October level since at least 2014. Year-to-date imports of 62.4mn t were up by 1.8mn t on the year but 1.4mn t lower than in 2019.

Utilities were rebuilding LNG stocks earlier this year following a cold winter and because of government demands to boost inventories. But the pace of inflows has since slowed amid lower-than-expected demand for electricity and reduced gas-fired power output during the summer. Supply-side constraints at LNG projects where Japanese buyers have offtake agreements may also have contributed to the muted imports, particularly Russia's Sakhalin and Malaysia's Bintulu.

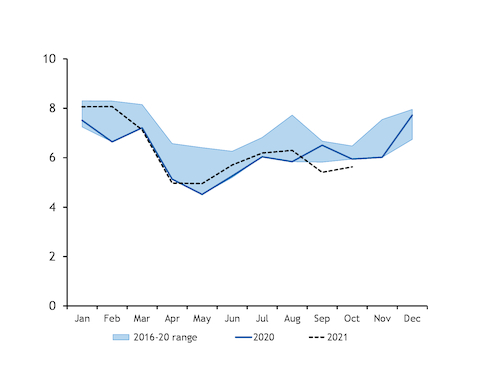

Japanese utilities held 2.2mn t of LNG as of 15 November, up by 6.3pc from 2.07mn t at the end of October, according to a survey by the country's trade and industry ministry (Meti). This was 37.5pc higher on the year and 20pc above the four-year average for the time of year.

Japan's coal stocks were 7.7mn t as of the end of June, 2.7mn t lower on the year, according to the latest available Meti data.