A cold snap across the northern hemisphere and fiercer inter-basin competition for fuel amid a decline in Russian natural gas deliveries to Europe supported coal prices across northeast Asia this week.

The decline in Russian natural gas deliveries along the 33bn m³/yr Yamal-Europe pipeline at the Mallnow entry point from Germany to Poland and colder weather across the northern hemisphere sent the gas market higher, with the price of solid fuels moving in tandem. Most of Argus' spot coal assessments rose on the week, although China-delivered prices slipped amid ongoing government interventions.

Argus assessed NAR 5,800 kcal/kg coal at $144.69/t fob Newcastle and $165.08/t cfr South Korea, up by $20.81/t and $17.15/t on the week, respectively.

In South Korea, state-owned Korea Midland Power (Komipo) reportedly purchased a Capesize cargo of NAR 5,400 kcal/kg Canada-origin coal at about fob $141/t on a NAR 6,080 kcal/kg basis for February loading.

Fellow state-owned utility Korea Western Power (Kowepo) issued a five-year term tender on 26 November, seeking 1.44mn t of NAR 3,700-5,000 kcal/kg coal, with the first shipment to be made in January 2022. The tender is scheduled to close on 2 December.

South Korea's ministry of industry and energy (Motie) on 24 November finalised its seasonal coal restriction plan covering the December-February period. The number of shutdowns imposed on state-owned Kepco's 53 coal-fired units is roughly unchanged from last year's level, although the output cap being placed on the remaining operational units will have more flexibility in the event of a power demand spike and tight LNG availability.

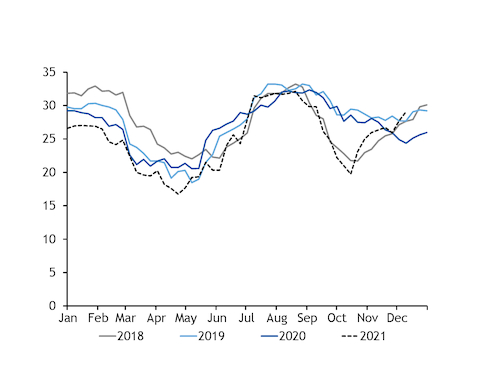

Kepco added more maintenance to its schedule this week with the 500MW Samcheonpo unit 5 and the 250MW Honam unit 2 being put off line for the whole of December, according to the latest schedule released by the Korea Power Exchange (KPX). But the company's coal availability is still scheduled to rise on the year, to an average of 28.2GW in December, compared with a 25.01GW average availability a year earlier.

Assuming the available capacity is dispatched at the same rate as a year ago, state-owned Kepco's coal-fired power generation could increase by 2.41GW on the year. This is equivalent to 498,400t more NAR 5,800 kcal/kg coal burn at 40pc efficiency, according to Argus analysis.

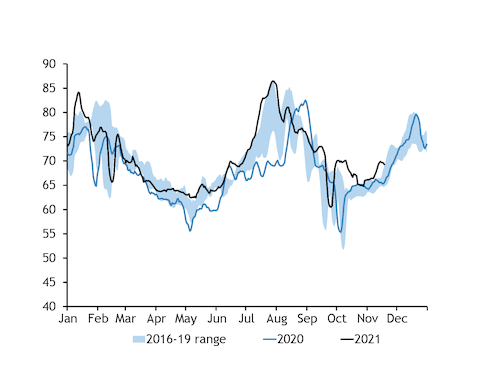

KPX forecasts that South Korea's average and peak power demand will increase by 2.2pc and 4.2pc on the year, respectively, to 69.4GW and 89GW in December, according to its latest power report. The report shows peak power demand in January is projected to further increase to 90.1-90.3GW, while the energy ministry's announcement on 25 November shows peak demand could reach as high as 93.5GW this winter.

The Korea Meteorological Administration projects a 40pc chance of lower-than-usual temperatures for December-January.

Temperatures in Seoul are forecast to fall below the seasonal average on 1-5 December by as much as 7.15°C before rising above the norm until 10 December, Speedwell data show.

The government aims to retain a reserve capacity of at least 10.1GW and "will inject 9.7-13.5GW more capacity in a timely manner to ensure stable electricity supply and demand", the energy ministry said.

Coal shutdowns, nuclear restarts in Japan

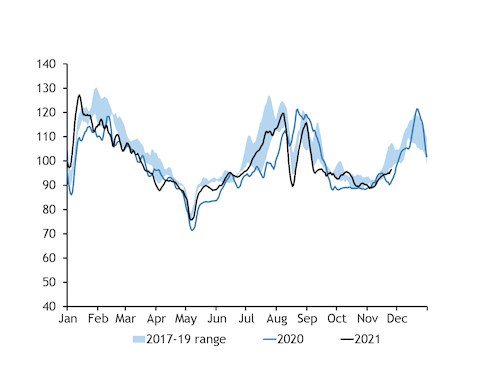

Strength in global coal prices supported implied landed prices for Japan this week, although the outlook for thermal generation in Japan was weaker on returning nuclear capacity.

Japan's Shikoku Electric Power secured permission from local authorities to restart its 890MW Ikata reactor 3, with the restart date for normal operations scheduled on 4 January.

This contrasts with an unplanned shutdown at J-Power's 1GW Matsuura coal-fired unit 1 on 23 November as a result of a boiler tube leakage. The 112MW Hibikinada No 1 coal-fired unit has also been forced to close over 24 November-1 December. But the 1GW Matsuura coal unit 2, owned by Kyushu Electric Power, was expected to return on line today after scheduled maintenance since 12 September, which could partially mitigate the impact of the unexpected shutdown at unit 1.

Firmer-than-expected nuclear availability will help the country meet peak winter power demand, while winter is expected to be colder this year across Japan's southern regions. The Japan Meteorological Agency projects a 50pc chance of below-average temperatures for the Kyushu, Shikoku and Chugoku regions and a 40pc likelihood for the Kinki, Chubu and Kanto regions for December-February, according to a forecast issued on 24 November.

Wholesale power prices on the Japan Electric Power Exchange (Jepx) hit ¥80/kWh for several hours ($697/MWh) this week for deliveries to Tokyo and Tohoku areas amid a cold snap.

Japanese market participants are getting ready to ensure market stability over the peak heating period in a bid to avoid a repeat of last winter's power shortage. Jepx recently revised the methodology used to calculate spot power prices to better reflect its marginal fuel costs — ie, spot coal and LNG prices. Jepx spot power prices historically have been determined by a weighted average of term and spot contracts, leaving generators with less incentive to produce more power in the event of a fuel price spike.

Japan's largest utility, Jera, also announced a plan to maintain a minimum 3pc electricity reserve margin throughout winter, by securing a combined total of up to 1.06GW of additional thermal generation capacity for January for Tokyo and Chiba prefectures.