The northeast Asian coal market retreated this week in line with wider price weakness in Asia-Pacific. Lacklustre market activity as utilities have finished winter restocking also weighed on prices.

Argus assessed NAR 5,800 kcal/kg coal at $129.71/t fob Newcastle and $153.62/t cfr South Korea, down by $14.98/t and $11.46/t on the week, respectively.

State-owned Korea Western Power (Kowepo) reportedly procured cargoes of NAR 3,800 kcal/kg coal at about $60/t fob from Chinese trading firm CCS on 2 December, although additional details could not be confirmed. Kowepo was looking for a combined total of 1.44mn t of low-calorific-value (CV) coal through a five-year term tender, with the first two shipments of 80,000t to be delivered in January next year.

At the Special Countermeasures Committee on Fine-Dust meeting on 29 November, Seoul announced its intention to retire the 250MW Honam units 1 and 2, meaning daily coal-fired plant suspensions can increase to up to 18 units during December-February. Honam unit 2 was taken off line on 1 December, while the latest maintenance schedule shows that the first unit will be taken off line from 11 December.

At first glance, the measure would seem to suggest more stringent coal-fired plant restrictions for this winter. But given the relatively small capacity of the two coal-fired units added to the schedule this week, the government appears to be trying to minimise coal-related disruption as much as possible, at least for this month, and has left the door open to boosting coal-fired availability at short notice, given its flexible cap on the remaining coal-fired units.

The government has imposed an 80pc output cap on the remaining 35-45 units not covered by the winter restriction measures. But there is flexibility to ease this restriction, depending on the prevailing power demand and LNG supply situation.

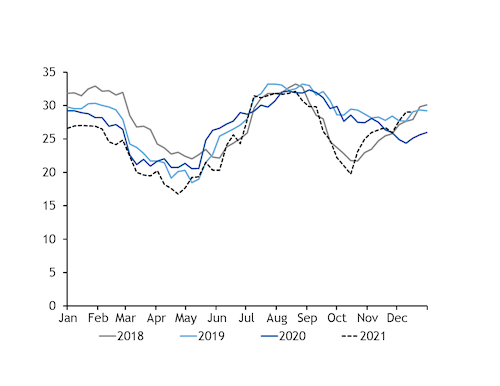

An average of eight coal-fired units are currently scheduled to be taken off line on 1-15 December, setting average coal-fired availability for the month at 28.05GW. By comparison, an average of 16 coal-fired units were taken off line during the same period last year, with availability averaging 25.01GW for that month. South Korean coal burn averaged 21.1GW in December last year.

South Korea has increased coal availability in the first half of December despite a warmer weather outlook for this month. Temperatures in Seoul are forecast to rise above the historic norm on most days in the next two weeks by as much as 5.7°C, Speedwell data show. This is also in line with more favourable generation economics for coal burn in South Korea, as the marginal cost for a 55pc-efficient gas-fired unit running on Kogas supply is about $24/MWh more expensive than it is for a 38pc-efficient coal-fired plant for December delivery, according to Argus analysis.

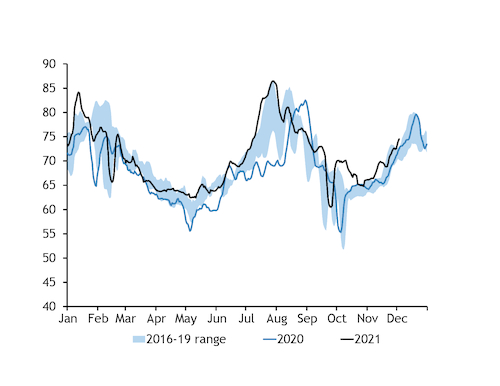

The real-time power data provided by Korea Power Exchange shows that coal-fired generation had a flat profile on 3 December, running at a consistent 23-24GW intra-day, as of 22:00 local time (13:00 GMT), with nuclear output also remaining stable at about 21GW.

Gas-fired generation fluctuated in the 13-28GW range, which shows gas burn is being used to meet peak rather than base-load demand.

Japanese power market retreats on ample supply

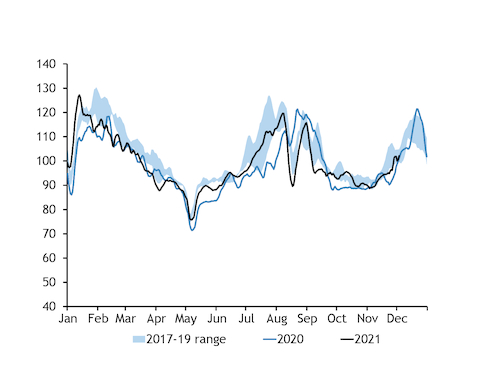

Japan's Shikoku Electric Power restarted its 890MW Ikata 3 reactor on 2 December, weighing on the demand outlook for thermal generation.

The reactor will resume power transmission on 6 December and is scheduled to return to normal operation on 4 January next year. Japanese nuclear availability is now expected to average 8.6GW in January with the newly restarted reactor, implying year-on-year growth of 5.1GW.

The Ikrata reactor was taken off line in December 2019 for scheduled maintenance but the restart date was delayed by legal proceedings amid safety concerns.

Firmer nuclear availability is likely to have a stronger impact on Japanese gas-fired generation. Based on 26 November–2 December prices, the theoretical profit margin for a 44pc-efficient coal-fired power unit held a ¥88/MWh (0.78¢/MWh) premium against the equivalent profit margin for a 58pc-efficient gas-fired unit running on oil-linked LNG.

And gas-fired plants running on spot LNG would have made an average loss of ¥3,971/MWh ($35.08/MWh) over the period, based on Argus' northeast Asia delivered LNG assessment, compared with a ¥3,082/MWh average loss a week earlier.

The Japanese power market retreated this week as a result of ample solar power output. The average price of wholesale day-ahead power contracts trading on the Japan Electric Power Exchange dropped to ¥19.16/kWh ($167/MWh) from 27 November-3 December, down by 12.3pc on the week.

Japan plans to resume a combined total of 10.2GW of thermal capacity during the week ending 5 December, more than offsetting a 545MW closure over the same period. This is expected to further weigh on power prices and on margins for thermal generators.