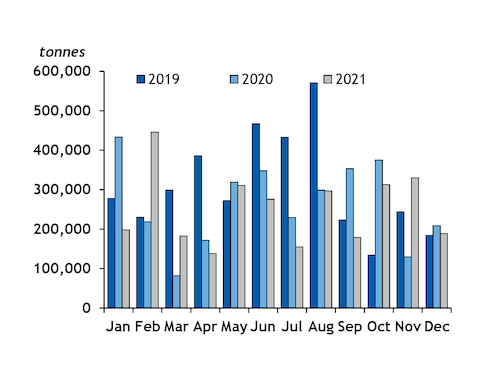

Argus Eurobob gasoline combined traded volumes slipped in December as Covid-19 travel restrictions returned in several European countries. For the year as a whole combined volumes were little changed, but non-oxy continued to take market share from the benchmark oxy grade.

Volumes rose to 247,500t in December from 379,500t in November and 313,000t a year earlier. The entire year saw 4.2mn t traded.

A total of 188,900t of Eurobob oxy barges changed hands in December, from 329,800t in November and 209,000t a year earlier. Rising Covid-19 cases and the emergence of the new Omicron variant saw the return of restrictions in several European countries last month, including full national lockdowns in the Netherlands and Austria.

BP was the largest buyer at 82,000t, up from 4,000t in November. Mabanaft purchased 23,900t, up from 16,800t the previous month. ExxonMobil, Gunvor, Shell, Varo and Vitol all bought over 10,000t. BMV Mineral, Hartree, and Trafigura purchased the remaining volumes. Litasco was the largest seller, parting with 165,900t of oxy gasoline in December after none in November. TotalEnergies sold 10,000t, from 169,000t a month earlier. Shell, Trafigura, Varo and Vitol sold the remainder.

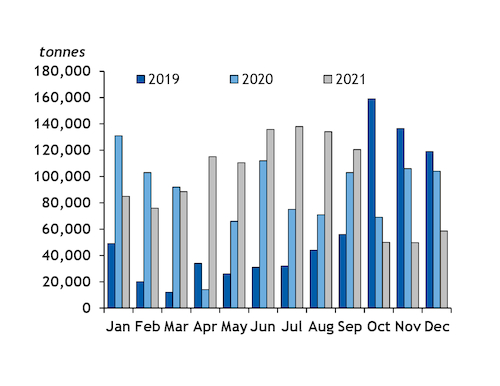

Non-oxy barge volumes rebounded to 58,600t in December, from a 19-month low of 49,700t in November. This compares with 104,000t a year in December 2020.

Varo returned as the largest buyer, purchasing 36,000t in December from 8,000t previous month. ExxonMobil slipped back to second place at 13,600t, from 19,000t in November. BMV Mineral, BP, Finco and Mabanaft bought the remaining non-oxy barges. TotalEnergies was the largest seller for a third month, parting with 30,600t compared with 28,700t in November. Shell sold 27,000t from 6,000t the previous month. Glencore parted with a single 1,000t barge, from 13,000t in November.

2021 in review

Eurobob oxy volumes totalled 3.01mn t in 2021, down by 5pc from 3.17mn t in 2020 and 19pc lower than 3.72mn t in 2019.

TotalEnergies was the largest buyer of oxy gasoline in 2021 at 561,100t, representing 19pc of purchases, up from 381,000t or 12pc in 2020. The company reduced sales to 530,800t from 666,300t in 2020. Gunvor went from the biggest buyer of oxy gasoline in 2020 to the largest seller, parting with 869,700t in 2021 or 29pc of the market, from 761,600t or 24pc in 2020. Gunvor reduced purchases to 492,000t in 2021, from 878,000t in 2020.

Litasco greatly increased participation, selling 658,600t of oxy gasoline last year from just 72,000t in 2020. Its purchases went to 357,000t in 2021 from 294,000t in 2020. Shell bought 284,000t of oxy gasoline last year, up from 151,500t in 2020, and it increased sales to 321,800t from 286,000t the previous year. BP bought 376,500t in 2021 from 543,000t in 2020, and sold just 82,000t from 399,000t the previous year.

Eurobob non-oxy volumes reached a new high of 1.16mn t, up by 11pc from 1.05mn t last year and 62pc more than 718,500t in 2019. Non-oxy continued to take market share from the benchmark grade, accounting for 28pc of all volumes in 2021 compared with 25pc in 2020 and 16pc in 2019. The UK became the latest country to offer E10 at the pump, making non-oxy the standard grade for domestic blending from September.

Varo remained the dominant buyer of non-oxy gasoline in 2021, but its market share slipped to 68pc of purchases from 73pc in 2020 and 82pc in 2019, even as the number of buyers fell to 14 from 17 in 2020. Varo bought a new record 791,700t of non-oxy gasoline in 2021, up from 762,000t a year earlier.

Litasco was the second largest buyer of non-oxy gasoline at 74,000t last year, from 6,000t in 2020. It sold 24,000t, from 32,000t a year earlier. TotalEnergies was the largest seller, parting with 482,300t or 42pc of the market in 2021, up from 345,000t and 33pc in 2020. It bought 25,000t in 2021, steady on the year.

Shell increased non-oxy sales to 235,400t last year accounting for 20pc of market share, from 182,000t or 17pc in 2020. The company purchased 26,000t, from 12,000t a year earlier. ExxonMobil sold 204,200t in 2021, from 169,000t, and sold 48,200t from 30,000t. Gunvor increased sales to 89,100t from 17,000t and decreased purchases to 48,000t from 111,000t.

Sahara Energy and GST both traded their first Eurobob oxy barges on Argus dates, but participation fell to 18 counterparties from 19 in 2020. Eni sold its first non-oxy barges, with participation also lower at 15 counterparties in 2021, from 17 a year earlier.