A cyberattack affecting IT systems at some of northwest Europe's busiest oil terminals is hampering the flow of refined products in the region, adding to existing supply issues and helping push up margins.

The 11 Oiltanking terminals in Germany that were at the centre of the unclaimed 29 January cyberattack are now not expected to resume loading operations until 10 February at the earliest. Oiltanking, along with at least two other suppliers, declared force majeure after the attack.

The disruption has spread to at least six storage terminals in the Amsterdam-Rotterdam-Antwerp (ARA) hub, including Oiktanking terminals in Amsterdam, Ghent and Teneuzen that were bought by Dutch firm Evos last year, and the SEA-Tank terminal in Antwerp. Another former Oiltanking terminal in Malta is understood to have similar issues.

The attack has disrupted the software that some operators use to process the documents necessary to load and unload material from storage tanks. Loading and unloading operations are still possible but are taking longer than normal because documents are having to be prepared and submitted to the relevant authorities manually rather than as part of what is typically a largely automated process.

The impact on oil product loadings in ARA has been limited according to those directly involved, with many terminal operators finding ways to avoid completely halting the loading and discharge of refined product cargoes. But the disruption, together with the possibility that delays will spill over into the barge and cargo market, have caused product prices and margins in northwest Europe to rally.

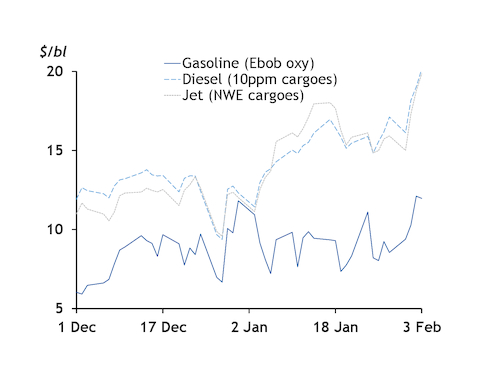

In Hamburg, where Oiltanking has its biggest German terminal with a capacity of 869,805 m³, gasoline and diesel prices are rising, while Eurobob gasoline barges have been bid steadily higher in ARA, with oxy grades changing hands as high as $9/t above the underlying March swap earlier today, up from a $2/t premium at the start of this week. Eurobob's notional premium to the Ice April Brent futures contract has reached two-and-a-half month highs of over $12/bl, wider by 30pc from a week earlier. Naphtha margins have followed gasoline higher, reaching premiums to the front-month Ice Brent contract of around $4/bl, up from $3/bl on 29 January.

The price of middle distillates — already under pressure from supply constraints stemming from lower European refinery runs and tensions around the Russia-Ukraine crisis — have also reached fresh highs. French 10ppm diesel cargoes hit a $20/bl premium to Ice April Brent yesterday for the first time since October 2019, wider by 25pc on the week. Jet fuel cracks are not far behind, at $19.84/bl above Ice Brent yesterday, another 25-month high. This is despite air travel demand slowing substantially in Europe last month.

Record backwardation

Paper markets are pricing in increasingly tight supply. The Ice gasoil forward curve was already steeply backwardated before the cyberattack, and the gap between the front- and second-month contracts has since widened. The Ice March gasoil contract was $23.50/t above the April contract at 10:45 GMT today. It was $17.75/t higher at yesterday's close and $13.75/t higher a week ago. Backwardation between the front- and second-month gasoil contracts has not been this steep since 2008.

Meanwhile in the European gasoline market, the February Eurobob oxy swap is $8.50/t above the March swap today, whereas it was only $5/t higher a week ago. The gasoline market is usually in a contango structure at this time of year during a seasonal lull in road fuel demand. The same is normally true of the jet fuel market, with firmer air travel demand anticipated in Easter and summer. But it too is bucking that trend amid supply concerns. The forward curve is currently flat for jet fuel swaps.

04022022123926.jpg)