Thermal and metallurgical coal exports from Australia's 102mn t/yr Gladstone port in Queensland fell by 20pc in July compared with a year earlier, as falling metallurgical coal prices prompted some firms to revisit mine plans to aid switching to thermal coal.

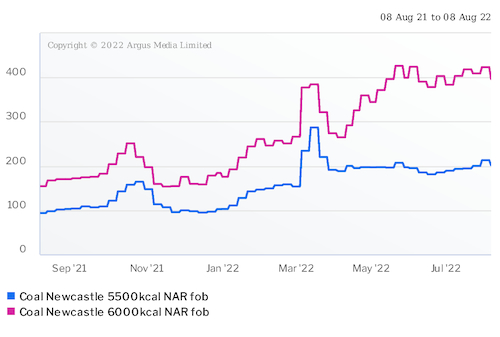

Gladstone shipped 5.15mn t of coal in July, down from 6.17mn t in June and from 6.41mn t in July 2021, according to data from Gladstone Ports (GPCL). The fall was partly because of a wetter than average July after a dry June, although July was not as wet as May. But it also reflected an increasing move to ship thermal coal rather than metallurgical coal in response to the unusual position where high-grade thermal coal prices are around double most metallurgical coal prices for Australian exports.

New South Wales firms that produce semi-soft coking coal switched as much as possible out of metallurgical coal into thermal many months ago. The switch has taken longer for Queensland firms, which tend to produce higher grade metallurgical coal.

The decision to divide production between higher cost coking coal to meet existing sales contracts and lower cost thermal coal spot sales is disrupting production and marketing patterns and has contributed to a slowdown in exports.

Gladstone shipments to India, which include spot metallurgical coal sales, fell to 991,000t in July from 1.39mn t in June and from 1.51mn t in July 2021. India has taken 33.5pc less coal during January-July than it took the same period of 2021. But Japan, which largely buys coal under long-term contracts, has only seen a 2.8pc dip in its shipments from Gladstone.

Gladstone shipped 55,000t of coal to Poland in July, adding to the 76,400t in June and 96,000t in May, which was the first time it has shipped any coal there since May 2014. Australia is increasing coal exports to Europe in the wake of Russia's invasion of Ukraine.

The vessel queue waiting outside of Gladstone was 26 on 8 August, up from 20 on 6 July and above the average queue of around 20.

There were no coal shipments from Gladstone to China for the 21st month in a row.

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at $396.62/t fob Newcastle on 5 August, up from $383.82/t on 1 July but down from a peak of $425.90/t on 20 May. It assessed the premium hard low-volatile metallurgical coal price at $203/t fob Australia on 5 August, down from $301/t on 1 July and from $664/t on 15 March.

| Gladstone coal shipments | (mn t) | |||||

| Japan | India | South Korea | Taiwan | Vietnam | Total | |

| Jul '22 | 1.93 | 0.99 | 1.10 | 0.34 | 0.21 | 5.15 |

| Jun '22 | 1.51 | 1.39 | 1.71 | 0.40 | 0.48 | 6.17 |

| Jul '21 | 1.39 | 1.51 | 1.33 | 0.81 | 0.23 | 6.41 |

| YTD 2022 | 12.06 | 7.68 | 8.93 | 1.80 | 2.32 | 36.99 |

| YTD 2021 | 12.41 | 11.55 | 8.43 | 2.35 | 1.48 | 40.86 |

| Source: GPCL | ||||||

| Total includes all destinations not just those listed | ||||||