There is no coal on the ground waiting to be railed to port in Queensland or New South Wales, as mining firms struggle to respond to record high thermal coal prices, according to Australian rail firm Aurizon.

Aurizon expects to haul more coal in 2022-23 than the 192mn t moved in the 2021-22 year to 30 June, as coal firms work through changes to mine plans designed to ramp up production to meet strong demand for Australian coal.

"Eventually, rising coal prices will drive a supply response, but it cannot be in the short term because the coal is not there," a senior Aurizon executive said on 8 August.

Aurizon missed its revised guidance of around 202mn t for 2021-22, and shipped 10.1mn t less than the 202.1mn t achieved in 2020-21. It was vague in its target of "more coal" to be hauled in 2022-23 than 2021-22, and did not repeat the initial 2021-22 guidance of returning to pre-Covid-19 levels of 213.9mn t achieved in 2019-20.

The volume of coal hauled on Aurizon's coal network in Queensland by Aurizon and third-party rail-haulage firms fell to 206.5mn t in 2021-22 from 208.3mn t in 2020-21. The Queensland Competition Authority, which regulates the network, expects it to carry 226.6mn t of coal in 2022-23

The firm is diversifying its customer base away from its reliance on coal, investing in bulk commodity trades such as grain, iron ore and other minerals, including through its acquisition of One Rail that it completed last month.

Aurizon and its customers have faced operational issues such as protestors disrupting trains and port deliveries, wetter-than-average weather with Queensland experiencing its wettest November on record, and persistent Covid-19 absenteeism since borders reopened late last year.

Aurizon reported an underlying profit of A$525mn ($364mn) in 2021-22, down from A$533mn in 2020-21, as weaker coal volumes were offset by higher haulage fees associated with consumer price index contract resets in the higher inflation environment.

Rail haulage fees have been under pressure over the past few years and Aurizon expects this to bring its coal haulage earnings lower in 2022-23, despite higher volumes.

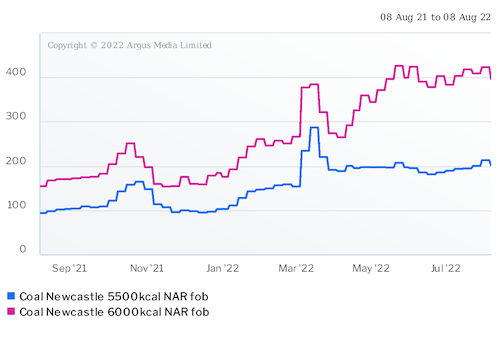

Argus last assessed the premium hard low-volatile metallurgical coal price at $203/t fob Australia on 5 August, down from $301/t on 1 July and from $664/t on 15 March. It last assessed high-grade 6,000 kcal/kg NAR thermal coal at $396.62/t fob Newcastle on 5 August, up from $383.82/t on 1 July, but down from a peak of $425.90/t on 20 May.