Australian coal producer Whitehaven is receiving inbound enquiries from European buyers for metallurgical rather than thermal coal, as the embargo on Russian coal entering the EU enters its third week.

Whitehaven is fielding the enquiries from European buyers and is looking at opportunities to assist them, the firm's chief executive Paul Flynn said on 25 August as he announced a profit of A$2bn ($1.4bn) for the 2021-22 fiscal year to 30 June compared with a loss of A$500mn a year earlier.

It is unclear how much assistance Whitehaven will be to European buyers looking for metallurgical coal, given the large discount its semi-soft coking coal is selling at compared with its thermal coal. The turnaround in Whitehaven's profitability was driven by record-high thermal coal prices, which have prompted the firm to include more of its semi-soft coking coal into thermal coal blends rather than sell them as metallurgical coal. This trend will continue into 2022-23, with the proportion of metallurgical coal sales to fall to the lowest level for several years, Flynn said.

High-grade thermal coal production made up 77pc of Whitehaven's sales during April-June compared with 72pc in January-March and 61pc in April-June 2021.

Whitehaven has existing term contracts with Japanese and South Korean coal buyers, some of which are negotiated at fixed prices. But while thermal coal prices are rising, Flynn said Whitehaven would rather stay in or close to the spot market than lock in long-term pricing. It is also blending its premium high-grade coal with lower grade 5,500 kcal/kg grades to create a product that sells based on the 6,000 kcal/kg price, allowing it to capture the $200/t premium for the 6,000 kcal/kg fob Newcastle.

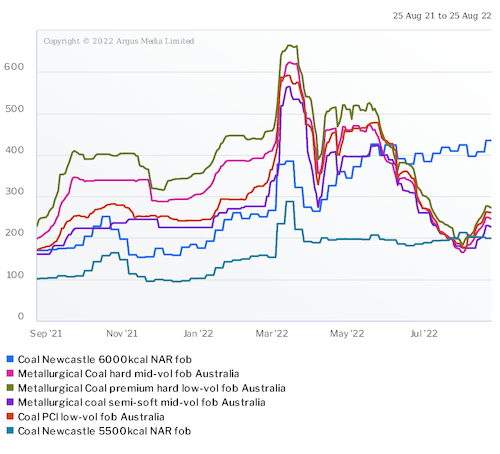

Argus last assessed high-grade 6,000 kcal/kg NAR thermal coal at a record high of $434.84/t fob Newcastle on 19 August, up from $383.82/t on 1 July and above the previous peak of $425.90/t on 20 May. It assessed lower grade 5,500 kcal/kg NAR coal at $199.28/t fob Newcastle on 19 August, up from $188.73/t on 1 July but down from a peak of $287.15/t on 11 March.

The heat-adjusted premium for higher grade thermal coal on a NAR 6,000 basis was at $217.04/t on 19 August, up from $177.93/t on 1 July and above the previous peak $202.35/t on 20 May. This compares with a low $1.65/t in 2019 before a Chinese ban on imports of Australian coal took full effect.

Argus last assessed the semi-soft coking coal price at $226.35/t fob Australia on 24 August, up from $175.50/t on 2 August but down from $422.20/t on 26 May.