Italian hydropower stocks last week edged up to their highest in January, flipping to a year-on-year surplus for the first time in nine months, but hydro generation declined amid poor rainfall in the northern regions.

Hydropower reserves stood at 2.24TWh last week, edging up by just 0.3 percentage points, or 7.1GWh, from the previous week, according to statistics from European grid operators' association Entso-E. These are the highest stocks to have been recorded in January, although rainfall in the northern provinces of Malpensa and Paganella fell to a cumulative 0.4mm and 3mm, respectively, from 5mm and 5.6mm across the previous week.

But hydro reservoirs in week 4 shifted from a year-on-year deficit of 5.5pc, or 155.3GWh, to a surplus of 2pc, equivalent to 44.5GWh. This is the first time that Italian hydropower stocks have reached a year-on-year surplus since the week ending 29 May 2022.

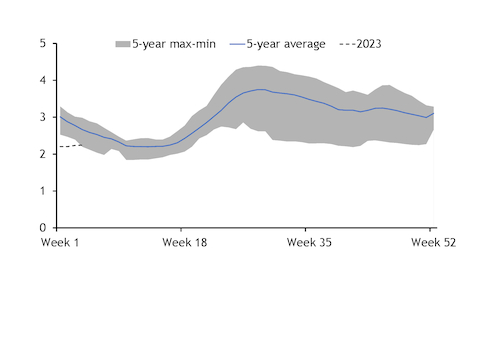

Hydro reservoirs at this time last year fell to a five-year minimum of 2.19TWh, Argus data show, owing largely to a year-long drought that depleted the large natural basins of northern Italy (see graph).

And the deficit to the five-year average narrowed to 16pc, or 425.8GWh, from 19.5pc, or 541.5GWh, across the previous week. Hydro stocks at this time of year averaged 2.67TWh over the 2018-22 period.

Output from hydropower plants declined for the first time in two weeks, by 367MW to 3.1GW. Hydro generation in week 4 stood at 4GW last year and at 5GW in 2021. And hydropower output has averaged 3.0GW in the first four weeks of January 2023, down from 3.3GW during the same period last year and from 5.1GW in 2021.

The Po river's flow rate remains at minimum lows last seen in 2021, according to Italian hydrological association Anbi, and below-average water volumes persist in the great northern lakes. Filling rates at the Sebino and Lario lakes sit at 20pc and 22.4pc of their filling capacity, respectively.

Forecasts indicate cumulative rainfall in Malpensa next week will rise to 2.7mm, while Paganella is expected to receive just 1.5mm. And Enel's 1.1GW Entracque hydro pumped-storage plant in the north zone will be curtailed by 266MW on 4-21 February for maintenance, further weighing on hydro generation during the period.