The pressure points are spreading throughout the supply chains and prices could move in unpredictable ways

Oil markets are displaying increasing signs of stress as the impact of recent Opec+ export cuts ripples through tightening global supply chains. Buyers are short of crude and narrowing sweet-sour spreads are distorting normal trading patterns. Refiners also face renewed capacity constraints this winter as governments in Russia and China impose restrictions on products exports.

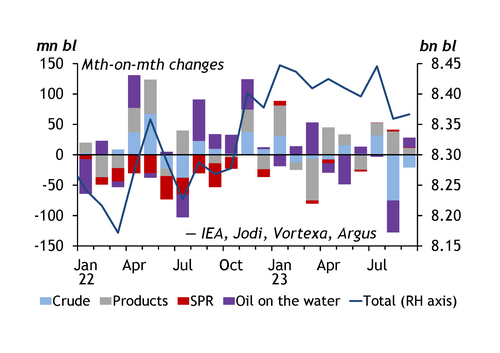

Global inventories fell sharply in September after Saudi Arabia extended its 1mn b/d unilateral production cut from July into August (see graph). Crude stocks on land dropped by 75mn bl and oil on the water by 53mn bl, Argus estimates — a massive stockdraw totalling 4.1mn b/d — as refiners used inventories to sustain high throughputs to capture strong margins. But there is no sign that depleted crude inventories can be replaced after Saudi Arabia and Russia doubled down commitments to maximise prices by extending 1.3mn b/d of export cuts to the end of this year. November Brent futures surged by more than $2/bl against the December contract in late September, indicating an increasingly tight market.

Key Opec+ sour crude producers have cut supplies by 2.5mn b/d over the past year, forcing refiners to run much more light sweet crude. For many, this is less than optimal. Light crudes generate higher yields of distillation products — LPG, naphtha and gasoil — using more crude unit capacity for every barrel processed. Global distillation capacity is already tight after nearly 4mn b/d of refinery closures in three years and more constraints on crude throughputs are unhelpful.

High demand for replacement light sweet crudes from global refiners is distorting US markets. Record exports of light sweet US crude have drained crude tanks at the Cushing hub over the past three months. Stocks there are down to 22mn bl, close to historic lows for the past decade. It gets harder to pump crude out of storage at Cushing when stocks fall below 21mn bl, traders say. Backwardation on Nymex light sweet crude futures — based on delivery at Cushing — steepened to over $2/bl for the November-December spread as stocks fell.

With restricted crude supplies, growing dependence on light sweet crudes and worsening refinery capacity constraints, product supplies are struggling to keep up with demand. Refinery margins strengthened for all main products over the summer as inventories remained unusually low. Derivative markets for gasoline, gasoil and fuel oil are all backwardated, indicating tight markets for the entire refinery output yield. Although gasoline margins are easing with the end of the summer demand peak, margins for jet, diesel and gasoil are strengthening as winter approaches. And margins for residual fuel oil and upgrader feedstocks such as vacuum gasoil remain firm owing to the squeeze on sour crude supplies.

Now Russia and China have announced their intention to restrict products exports for the fourth quarter, limiting global access to these essential "dark pools" of refinery capacity that do not always respond to wider market signals. China issues clean products export quotas that enable refiners to supply global markets using domestic capacity. But Beijing rejected requests for further quotas this year despite strong arbitrage opportunities. Oil markets usually find a way to resolve apparently insoluble challenges. But prices may move in strange and unpredictable ways as the pressure grows.