Overview

Our data science capabilities are unique. By pairing the latest data science and machine learning techniques with access to our one of a kind datasets and our decades of market knowledge, we can reveal otherwise unknown insights.

Through the insights derived from our constant market interaction, we are able to customise our algorithms. Our system provides access to a rich universe of macroeconomic and financial drivers, selected for their relevance to energy and commodity markets.

The Argus Data Science Studio is used by physical and financial market participants around the world to manage risk and to inform trading and hedging decisions. Through forward curves and probabilistic forecasting data, our clients unearth unique solutions and greater insights, faster.

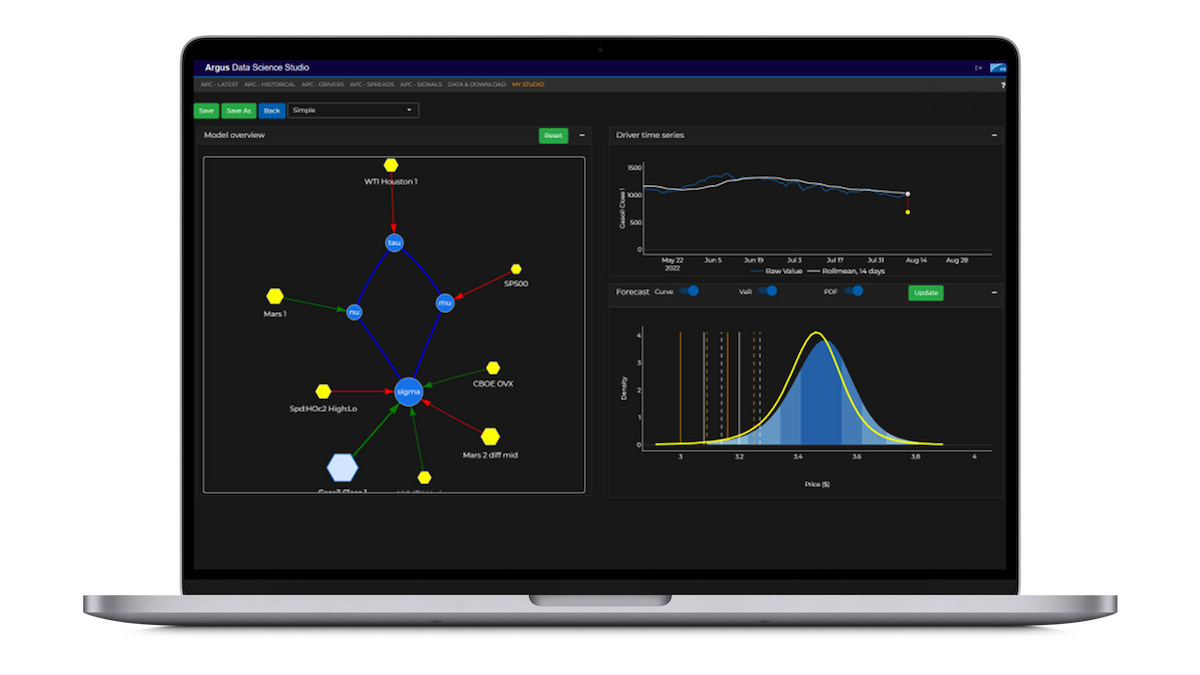

Argus Data Science Studio

The Argus Data Science Studio is a powerful modelling tool designed to support your analytics, trading, hedging and risk management decisions. Using the latest machine learning technology for probabilistic forecasting and location-based trading data, the studio integrates physical and financial commodity prices. The machine learning models that power the studio are inherently explainable and fully customisable, giving you the perfect platform to generate the most relevant price forecasting insights.

Find out more

Argus Possibility Curves

Each day we publish a price forecast for all major grades of crude oil and key refined oil products, along with the probability to observe that price associated with each quantile. Produced by combining the latest data science and machine learning techniques with Argus’ proprietary pricing database, the Argus Possibility Curves is the only way to confidently estimate volatility and balance of risk associated to oil prices.

Find out more

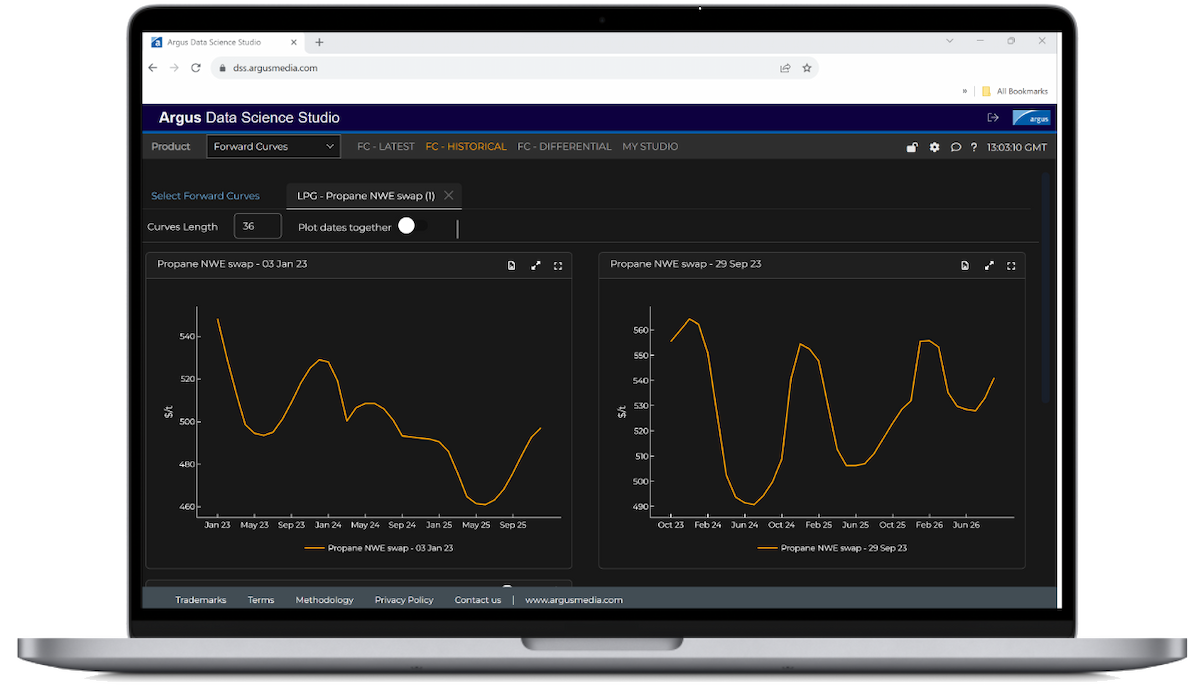

Argus forward curves

No matter which region, market or specific price you require, we provide forward curve data free from distortion or bias to support your risk management, market valuation and investment decisions. Built from transparent, industry-specific methodologies that produce representative market values free from distortion, Argus forward Curves ensure you can act with confidence.

View our forward curve portfolio