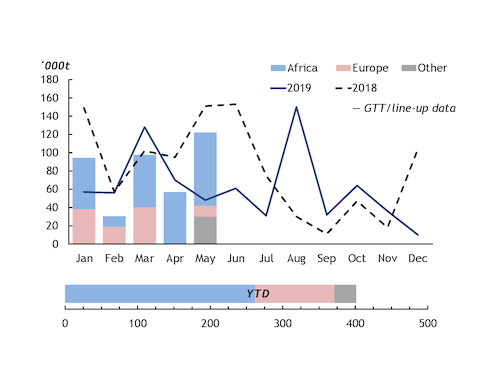

Morocco exported its largest monthly volume of NPKs this year in May and shipments rose on the year for the first month since January, as a result of state-owned producer OCP's diversification of its destination markets.

May exports rose by 154pc year on year, compensating for consecutive drops in February-April. Shipments included OCP's first NPK cargo to India and cargoes of 10-26-26 for Ukraine, which OCP began producing in January to fill the supply gap for the grade created by Ukraine's import ban on Russian fertilizers. These shipments reflect OCP's efforts to expand its market share outside of Africa since the Nigerian government's import ban on NPKs in late 2018. The ban removed OCP's largest export market, representing 300,000-400,000t of demand, which could not be entirely replaced in Africa. OCP has largely maintained its strong presence in the region, with all remaining May exports shipped to African destinations.

January-May exports rose by 12pc year on year. Ivory Coast was the top destination, accounting for 23pc of total exports, followed by Mozambique, with a 15pc share and Togo with 13pc. OCP did not ship any cargoes to Mozambique in January-May 2019. Shipments from Morocco to Mozambique are usually 10-20-10+6S, known as Compound D, for onward shipment to Zambia. The Zambian government typically tenders for Compound D in the second quarter, for deliveries in the second half of the year. But the 2020 tender has been repeatedly delayed since March-April and there was speculation that only companies awarded portions in previous tenders would be invited to submit offers, which may have prompted importers to secure cargoes outside of the typical tender process. Several firms are building stocks in Zambia, market participants have said, but it is unclear whether they are destined for government purchase or private buyers.

Shipments to Benin, the top destination in January-May 2019, fell sharply after the country's Interprofessional Cotton Association awarded its annual NPK purchase tender to a trading firm offering Russian product, instead of OCP. The tender takes place in the fourth quarter for first-quarter delivery.

Ukraine was the top January-May destination outside of Africa, followed by India.

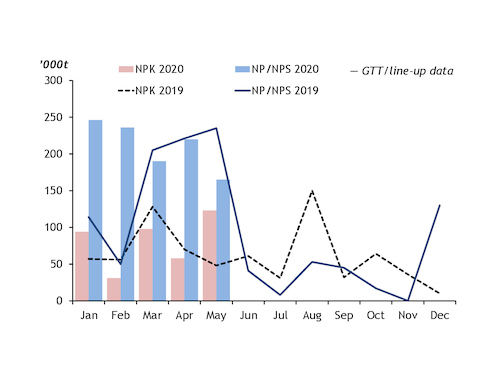

Exports of NP/NPS rose by 28pc in January-May. Djibouti was the top destination, representing shipments under the Ethiopian Agricultural Business Corporation's (EABC) annual NPS purchase tender award. Aggregate exports to Djibouti and Ethiopia rose by 5pc year on year, as the volume of Ethiopia's 2019 tender award — for first-half 2020 delivery — was higher than the 2018 award.

Shipments to Brazil rose by 161pc on the year. The main grade imported to Brazil from Morocco — 12-46-0+7S — is not applied in large quantities until September, so Brazilian importers appear to have shifted buying patterns to build stocks well in advance of application.

| Moroccan exports | '000t | ||

| Destination | Jan-May | Jan-May 19 | ±% |

| NPK | |||

| Total | 403.1 | 359.9 | 12.0 |

| Ivory Coast | 91.5 | 66.0 | 38.6 |

| Mozambique | 60.5 | 0.0 | na |

| Togo | 50.5 | 48.1 | 5.0 |

| Ukraine | 35.1 | 0.0 | na |

| India | 30.2 | 0.0 | na |

| France | 29.7 | 4.4 | 569.2 |

| Senegal | 22.6 | 0.0 | na |

| Benin | 14.7 | 218.2 | -93.2 |

| Other | 68.3 | 23.2 | 194.4 |

| NP/NPS | |||

| Total | 1,056.4 | 825.4 | 28.0 |

| Djibouti/Ethiopia | 708.8 | 678.1 | 4.5 |

| Brazil | 221.0 | 84.7 | 161.0 |

| Other | 126.6 | 62.6 | 102.2 |

| — GTT | |||