The global manganese industry is showing signs of a tentative recovery after a bruising few months, with the lifting of South African lockdown measures enabling production to pick up, and demand fundamentals bolstered by China's strengthening economy and rising global steel output.

China's imports of manganese ore rose to 3.19mn t in August, up by 49pc from a 2.1mn t monthly average in January-June and up by roughly 8pc from July's figure of 2.95mn t, customs data show. A similar trend is seen in South African trade data, with ore exports reaching just over 2mn t/month in July-August, up from 1.6mn t in June. Global manganese ore production had slumped by 8pc year on year in January-August as the pandemic hit both ends of the supply chain, the International Manganese Institute (IMI) said without disclosing the exact volume.

Positive signals are starting to emerge from the global steel industry, which was severely affected by the Covid-19 crisis in the first half of this year. The World Steel Association (WSA) said in June that it expects global crude steel demand to fall by 6.8pc this year to below 1.7bn t, largely because of steep production cuts in February and April. But the second half of 2020 is showing more promise, with crude steel production totalling 156.2mn t in August — a 0.6pc rise on August, which, given this year's challenging conditions, marks a particularly significant improvement. By comparison, output was down by 2.5pc year on year at 152.7mn t in July, and down by 7pc at 148.3mn t in June.

Supply of manganese alloys is also rising, with global silico-manganese production edging up by 1pc month on month in August to 1.4mn t, underpinned by gains in Asia, Europe and the Americas, according to the IMI. That said, pressures persist in some regions with production cuts in Ukraine, Russia and Kazakhstan pulling CIS output down by 23pc in August.

Meanwhile, production of high-carbon ferro-manganese rose by 1pc month on month in August to 310,000t, although this is a 12pc decline from a year earlier.

Caution persists amid price gains

Market participants remain cautious about whether recent signs of a recovery are sustainable. Several traders are buying material for the fourth quarter but not looking to purchase beyond the period in case European governments intensify lockdown restrictions once again. One trader said it is very tough to make decisions now relating to purchases and is holding stock in warehouses owing to concerns about a possible price fall at the start of 2021.

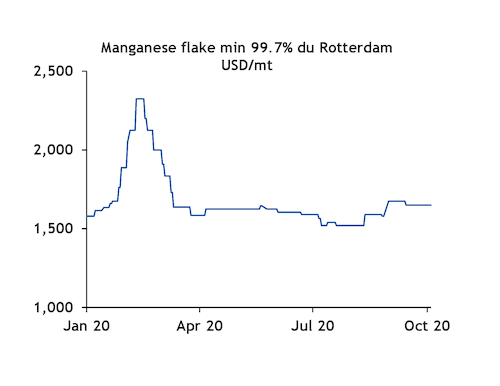

Many traders have welcomed recent price upticks, given the slump manganese prices reached this summer. Argus assessed prices for manganese flake at $1,620-1,680/t du Rotterdam on 6 October, up from the low point this year of $1,480-1,520/t on 21 July. But prices are still lagging behind their year-to-date high of $2,250-2,400/t on 13 February, after lockdowns in China — the world's biggest producer of flake — caused the European market to spike.