US Gulf petroleum coke has been assessed at a premium to South African coal on a cfr India basis for more than six months, surpassing the longest period that coke previously had fetched higher prices than coal in India.

And with supplies tight, coke prices are showing no signs of softening.

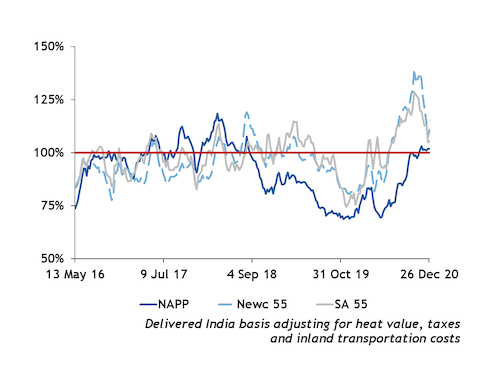

The cfr India 6.5pc sulphur coke assessment rose to 101pc of the cost of delivered India South African NAR 5,500kcal/kg coal the week of 19 June and has remained more expensive ever since. This accounts for the difference in heat between the two fuels, as well as taxes and inland transportation costs. This premium peaked the week of 16 October, at 129pc. It has since dropped closer to parity as coal prices have risen, but US coke was still 105pc of the cost of South African NAR 5,500kcal/kg coal as of last week.

US coke's premium to Australian 5,500kcal/kg coal was even larger, rising to 102pc the week of 19 June and peaking at 139pc on 16 October. Although Australian coal prices have risen rapidly in recent weeks, coke is still 111pc of this coal's cost on a heat-adjusted delivered India basis.

The last time coke was more expensive than coal on a delivered India basis for nearly this long was from 4 January-28 June 2019. At that time, only South African 5,500kcal/kg coal was at a discount, largely because of a steep slump in its price. US Northern Appalachian coal was discounted for a longer stretch of about eight months overall in 2018, but this was not continuous, with coke briefly dipping to a discount at points. US producers at that time intentionally offered NAPP coal at a discounted price in order to build a customer base to make up for the loss of US domestic demand. After Indian buyers widely adopted this coal, it has tended to be relatively expensive. But US coke has even been at a premium to this coal since the week of 13 November.

It looks unlikely that coke will soon drop to a significant discount. A lack of available spot coke cargoes has kept prices stubbornly high. And prices may be buoyed in the first quarter by US Gulf refineries' typical reluctance to raise output significantly during the first quarter, when road fuels demand traditionally is lower. Sharply rising Covid-19 cases continue to dampen US travel demand.

Coke is pricing at a premium to coal in nearly every demand hub. The 6.5pc sulphur coke price has surpassed coal on a heat-adjusted basis in the US Gulf every week since 19 August, in Turkey since 23 September, and in northern Europe since 15 July. These comparisons adjust for heat but do not adjust for taxes and inland transport.

It remains to be seen whether strong prices in the seaborne coal market will be sustained after peak-winter demand eases in the Atlantic basin and Asia-Pacific.

Any downside movement would widen coke's premium even further — assuming that coke prices remain firm. Buyers argue that coke prices will have to come down to preserve demand, as many cement makers have switched kilns to coal. India's coke demand is likely to be significantly lower in the first quarter than in the first quarter of 2020. Even some Latin American cement makers are now taking steps to switch the majority of their kilns to coal.

In the past, coke premiums to coal have often been followed by periods of wide discounts for coke, as sellers adjust to regain lost market share. But buyers are not that optimistic that these historically long premiums will lead to a long period of inexpensive coke. The possibility of sustained lower coke production, along with a strong cement market in many regions, means the market may quickly come into balance once discounts return to a more typical 15-20pc.