Russia's wheat exports doubled on the week in the seven days to 11 February, spurred by the country's introduction of export restrictions from 15 February.

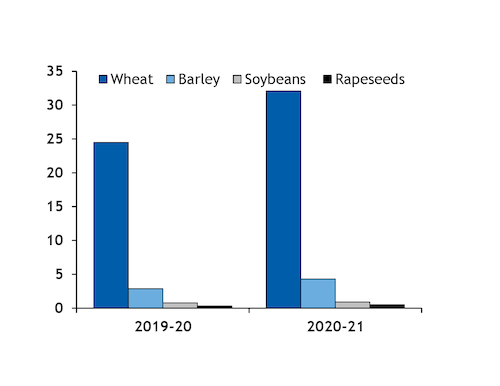

Russia exported 1.6mn t of wheat over the week, taking total exports since the start of the marketing year in July to 32.1mn t, around 31pc higher than a year earlier, according to data from its veterinary and phytosanitary surveillance service.

Wheat shipments to Egypt and Turkey — the largest buyers of Russian wheat — stand at about 7.1mn t and 5.8mn t, respectively, up by 600,000t and 300,000t on the week.

Market participants expect wheat exports to slow after the Russian government launched yesterday a €25/t duty on wheat shipments, which will be raised to €50/t from 1 March. But the full impact of export duties is likely to be seen in the next marketing year, when shipments out of the country could fall sharply following the introduction of a floating export tax from 2 June.

Barley exports from Russia remained strong in the week, reaching 100,000t, taking total volumes to 4.3mn t for the season, up by 50pc year on year. Russian corn shipments rose by 100,000t on the week, with total exports this season standing at 1.5mn t on 11 February.

Total grain exports from Russia stand at 38.1mn t for the season, with 1.8mn t having been shipped in the week to 11 February. But for oilseeds, Russia's soybeans, sunflower seeds and rapeseed exports were almost unchanged on the week, with total shipments this season now at 900,000t, 600,000t and 500,000t, respectively.

The slowdown in Russian oilseed exports is being blamed on the 30pc export duties that the government introduced in January and February, and which remain in place until 30 June 2021.