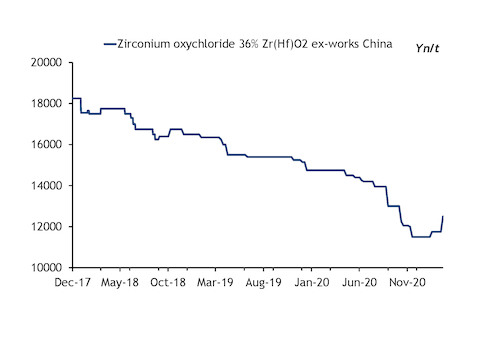

Prices for zirconium products have increased for the first time in over two years, as demand along the supply chain has rebounded from oversupply and the impact of Covid-19.

Argus assessed prices for 36pc grade zirconium oxychloride at 12,000-13,000 yuan/t ($1,856-2,010/t) on an ex-works China basis on 23 February, up from the previous assessment of Yn11,500-12,000/t. This is the first time the price has risen since October 2018, when it was trading at Yn16,500-17,000/t.

Similarly, prices for fused zirconia rose to Yn23,000-23,500/t ex-works from Yn22,000-23,000/t ex-works and the price range for 65pc grade zirconium silicate was up by Yn200/t at the low end to Yn12,000-12,500/t ex-works.

Raw material zircon prices stabilised in the second half of 2020 and are expected to increase this year as demand for downstream products rises, producers said in their fourth-quarter earnings results.

Zircon demand in China weakened in late 2019 and the first half of 2020, as trade tensions with the US and disruptions to operations at zircon consumers during the pandemic reduced output and product exports.

The rise in prices comes as the oversupply that plagued the market in the past two years has tightened, owing to a combination of production cuts and a rebound in demand. Consumption in markets including the ceramics industry in China and Europe has risen following lockdowns. And Chinese consumers have run down domestic zircon inventories, further increasing buying interest.

"China has been on a gradual improvement trajectory now for some time. And European demand for zircon has picked up strongly," African mineral sands producer Base Resources general manager of marketing Stephen Hay said. "There's certainly a growing optimism now that zircon prices will trend upwards through the course of this year."

Hay said that major suppliers continue to manage their output in response to market conditions, supporting prices in the second half of 2020 — the first half of its financial year. Base reduced its zircon production by 15pc to 12,677t during the period and expects full-year production for its 2021 financial year of 23,000-27,000t, down from 31,657t the previous year.

US-based Tronox reported a 48pc year-on-year and 70pc quarter-on-quarter rise in zircon sales during the fourth quarter, driven by higher demand, primarily in China. Tronox sold zircon at prices 10pc lower than in the fourth quarter of 2019, consistent with the downward trend in the market. The company expects zircon demand to remain strong in the first quarter, resulting in record volumes, interim co-chief executive John Romano said.

Australia-based Iluka Resources reduced its production of zircon sand and zircon in concentrate in April in response to the market uncertainty associated with the pandemic, reducing global supply by approximately 10pc.

Iluka's full-year 2020 zircon production of 185,200t was down by 42.5pc on the year, while sales fell by 12.4pc to 239,600t — the relatively smaller decline in sales against production reflecting the recovery in demand later in the year. The increase in purchases was most evident in the fourth quarter, which is traditionally a subdued sales period. The plant retains flexibility to return to higher production quickly, the company said.

The ceramics industry in China is operating at around 60pc capacity, as demand for exported tiles is yet to fully recover. But demand for opacifiers — glaze additives used for ceramics and glass — appears to have stabilised, owing to increased use in higher-end large tiles offsetting some declining use in lower-quality products, Iluka said.

Tile manufacturer operating rates increased across India, Europe and Latin America during the fourth quarter. Demand for glass, glazes, and inks from consumers based in Castellon, Spain — home to the world's largest hub of tile manufacturers — continued to outperform other markets during the quarter, despite the impact of the pandemic.

"Fused zirconia markets remain stable. Foundries in China reported receiving fresh orders, while refractory markets were steady," Iluka said. "Zircon chemicals markets in China are mixed, with increased exports, while domestic demand remains subdued."