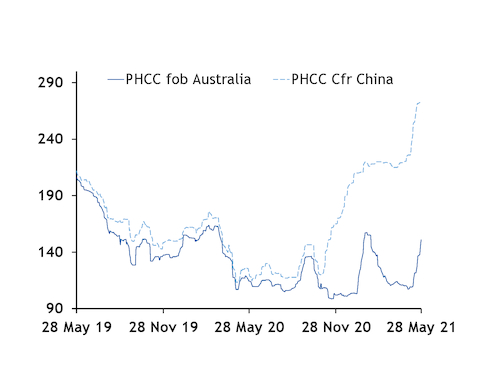

Chinese coking coal import prices have hit record premiums above $140/t above fob Australia prices this month as China's ban on Australian supplies lifted prices for non-Australian origin cargoes. But the gap has begun to narrow with mine maintenance expected to tighten fob supplies.

Chinese steel producers have scrambled to find alternatives as imports from its largest source came to a halt since the unofficial ban on Australian coal took effect in October. A supply gap remains as Chinese steel producers struggle to replace Australian coking coal.

The Argus assessment for fob Australia premium hard coking coal tumbled more than $37/t, or 27.6pc, a month after the ban. But it has since erased earlier losses and increased to $150.85/t fob Australia ahead of scheduled maintenance at mines.

The Argus assessment for premium hard coking coal on a cfr China basis rose by 86.1pc from $146.50/t cfr in early October, as Chinese buyers switched to Canadian and US coal with limited options following the import curb. The cfr-fob spread for tier-one premium low-volatile hard coking coal widened to a record $143.30/t on 18 May from $10.50/t on 1 October 2020. The gap has narrowed to $123.15/t today after a 40.8pc rise in fob prices month-to-date ahead of expected tighter supplies.

China's domestic coking coal mines meets 90pc of its requirements. But Chinese steel producers found themselves facing a double whammy when domestic coking coal prices continued to strengthen. Strict safety and environmental checks done in Shanxi province during April pushed prices for low-sulphur premium hard coking coal from the Liulin region up by 30-100 yuan/t, depending on quality. Depressed Mongolian imports also weighed on China's coking coal supplies. Restrictions at the Mongolian border crossings to contain the spread of Covid-19 slowed deliveries, reaching a 13-month low in April.

Shifts in global coking coal trade flows deepened as Chinese buyers tried to fill the gap left by Australian premium low-volatile coal. China imported 2.42mn t of coking coal from the US in the October 2020 to April 2021 period, a nearly fourfold increase from October 2019 to April 2020, while Canadian imports doubled to 3.83mn t over the same period. China recorded its largest volume of imported US coking coal at 974,700t in April and Canadian coking coal at 1.2mn t in March.

Tighter supplies continued to restrict US exports in the first quarter given maximised term contract commitments. Several requests for spot cargoes from European, Chinese and Brazilian mills were turned down, US mining companies said. The continuing strike at Warrior raised uncertainty about spot availability for Blue Creek 7 cargoes next month, further limiting options for the premium low-volatile segment.

Firm demand has buoyed cfr China prices since October last year. But falling steel prices may limit any further upside. Steel margins have deteriorated with the substantial fall in steel prices this month and may limit Chinese buyers' willingness to accept surging prices of imported coking coal. But Chinese buyers might continue to buy US and Canadian coking coal at higher prices simply because they have no other choice given reduced Mongolian imports, as China's import policy is unlikely to change in the short term, market participants said.

Australian coking coal producers have diverted their cargoes to alternative buyers in the absence of Chinese buying. India became a crucial market as buyers restocked Australian coal aggressively because of its competitive prices. Arrivals of Australian coal in March surged to a record high of 4.8mn t, a 61.4pc increase from a year earlier. But China's absence in the spot market has weighed on fob prices. Remaining spot buyers have been unable to absorb the additional volumes that Chinese mills used to buy, as they were the only buyers in the world before the import ban that bought premium low-volatile coal in such massive quantities. China imported 19.2mn t of coking coal from Australia during January-April 2020 alone prior to the ban. Volumes have fallen to zero over the same period this year.

Australia-China trade tensions persist with no signs of a reconciliation. Beijing suspended its main economic talks with Canberra earlier this month.