The Australian government's commodity forecaster has lowered its iron ore price forecasts on weaker Chinese demand, but maintains that Australian exports will continue to rise as low-cost producers remain profitable.

The Office of the Chief Economist (OCE) expects prices to average $142/t in 2021, $77/t in 2022 and $66/t in 2023. This will pressure the remaining higher-cost producers in Australia, with very few that use road haulage likely to be profitable at the $77/t price forecast for 2022.

The most marginal iron ore mines, many of which were started opportunistically to take advantage of record pricing in the first half of 2021, were closed in September-October with only those with hedged sale prices continuing to operate into November. Other larger and less marginal mines may also be forced to close at prices around the $66/t predicted by OCE for 2023, with mid-sized mining firms such as Atlas Iron and Mineral Resources struggling to compete at this price.

High coking coal prices have increased the premium for higher grade ores, making it difficult for lower grade iron ore producers, like Atlas and MinRes, to remain profitable. China's winter season and the Beijing winter Olympics have seen tight emission controls put on steelmakers, increasing the preference for high-grade iron ore, which may persist through January-March, according to the latest Resources and Energy Quarterly (REQ) published by the OCE.

The OCE in its latest REQ downgraded its price expectations for each year until 2023, from the previous report released in September. But it increased its Australian export expectations for this year to 874mn t from 870mn t as exports continued to grow after a weak January-March quarter and with tie-in activity at major mining replacements completed by large Pilbara producers BHP, Rio Tinto and Fortescue Metals.

The OCE cut its 2022 export outlook as the expected lower prices delay or derail major projects planned by higher cost producers, and could see the lower-cost producers ramp up production more slowly.

China has kept its 2021 steel production volumes below 2020 levels, with the OCE expecting China to produce 1.054bn t of steel in 2021, down from 1.065bn t in 2020, before rebounding to 1.068bn t in 2022.

Australian exports of coal and other commodities have been constrained from entering China since the second half of last year as diplomatic tensions between the two countries continue.

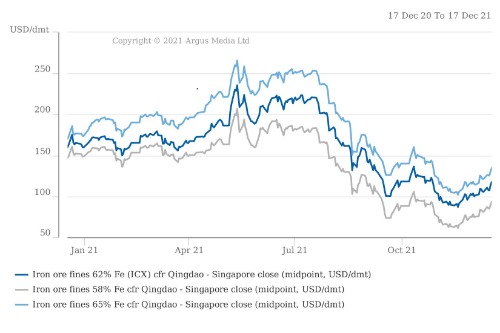

The OCE's 2021 average iron ore price forecast of $142/t is down from the $150/t it forecast three months ago. This is lower than the average ICX iron ore price for 62pc Fe ore that Argus assessed at around $160.97/t for the year to 20 December, although the average grade of Australian ore this year remains below 62pc Fe. Argus last assessed the ICX at $117.50/t cfr Qingdao on 20 December, down from a high of $235.55/t on 12 May.

| OCE's iron ore export and price analysis | ||||

| 2020 | 2021 f | 2022 f | 2023 f | |

| Export volumes (mn t) | ||||

| December update | 867 | 874 | 923 | 948 |

| September update | 867 | 870 | 934 | 948 |

| June update | 867 | 860 | 949 | 962 |

| March update | 868 | 897 | 950 | 963 |

| Price expectations ($/t)* | ||||

| December update | 100 | 142 | 77 | 66 |

| September update | 100 | 150 | 91 | 77 |

| June update | 99 | 152 | 106 | 90 |

| March update | 119 | 110 | 86 | 78 |

| Source: OCE | ||||

| f = forecast, *in 2021 US$ | ||||