Chinese steelmaker Ansteel has applied to expand the 8mn t/yr Karara magnetite concentrate project in Western Australia (WA) to as much as 37.6mn t/yr, as strong premiums for higher-grade concentrates and more stable production rates drive expansion in the industry.

Ansteel envisages developing stage two to reach 15.4mn t/yr, before ramping up to 22.8mn t/yr and then to 37.6mn t/yr over the following stages. This would add to new magnetite concentrate capacity being developed by Australian mining firm Fortescue through its 22mn t/yr Iron Bridge project, which is due to come on stream late this year, and continued improved throughput at Chinese firm Citic's 24mn t/yr Sino Iron project.

Australia's magnetite concentrate industry has had a difficult growth period, with the Karara project only reaching steady state production of 8mn t/yr in 2016-17 after commissioning in 2011 and after Ansteel threatened to cut all funding unless cost savings were made. Sino Iron also experienced significant cost blowouts, technical difficulties and delays during the construction and nine-year ramp-up phase, although it now seems to be operating just below its 24mn t/yr nameplate capacity.

Both projects operated at significant losses during their ramp-up phases, but strong iron ore prices and premiums for high-grade concentrate have seen their profitability turn around in the past few years. Citic reported a 280pc increase in the net profit of its advanced materials segment in January-June 2021 compared with a year earlier, largely because of the strong received prices at Sino Iron.

Australia's oldest concentrate and magnetite producer Grange Resources reported a full-year profit of A$321.6mn ($240.7mn) for 2021, up from A$203.2mn in 2020 and compared with a loss of A$277.8mn in 2015.

The increased profitability is prompting a range of new projects to seek financing, including the 70pc Fe 10mn t/yr Hawsons concentrate project in New South Wales and Hancock Prospecting's Mount Bevan project in the Yilgarn region of WA.

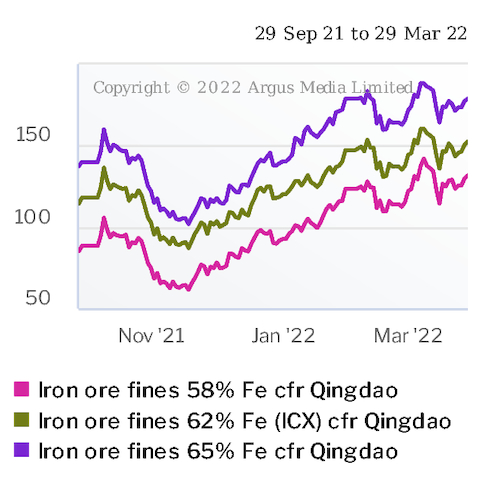

Argus last assessed Australian iron ore concentrate premiums at $7.30/dry metric tonne (dmt) basis the April 65pc index on 24 March, with cargoes of Karara concentrate awarded through a tender on 10 March at a premium of $7-7.50/dmt.

Argus last assessed the 65pc Fe iron ore price at $178.80/dmt cfr Qingdao on 28 March, up from $140.20/dmt on 1 January and $95.95/dmt five years ago.