Russia and Ukraine have significantly increased their shares in the EU's 2021-22 rapeseed oil (RSO) imports, with both countries covering over 50pc of overall RSO supplies to the bloc so far this season, compared with 38pc last season.

The EU 27 has imported 142,561t of RSO from Russia since the start of the 2021-22 marketing year in July, while arrivals of Ukrainian-origin product reached 127,129t, provisional European Commission data show. This compares with a respective 63,512t and 52,698t imported over the whole 2020-21 marketing season.

The sharp increase in Black Sea RSO supplies to the EU 27 follows rising rapeseed crushing in Russia and Ukraine amid bumper crops in both countries in 2021, as well as strong demand from European operators amid lower rapeseed imports this season.

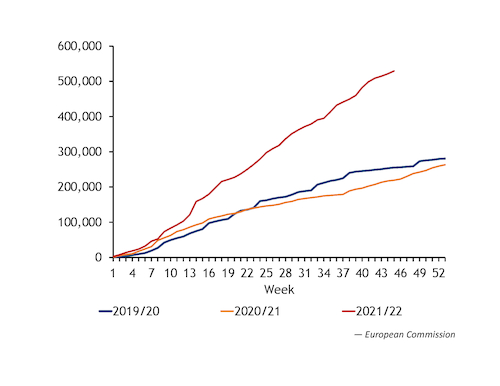

The EU's overall RSO imports this marketing year have already reached 529,599t, up from just 219,407mn t a year ago, with 8,318t received in the week ending 8 May. The Netherlands has accounted for 138,014t of overall receipts since 1 July, with Poland receiving 112,221t.

Rising RSO imports have been offsetting lower rapeseed arrivals to the EU 27, standing at 4.55mn t so far this season, compared with nearly 5.73mn t a year ago. Some 68,399t of product was received by the bloc on 2-8 May, down from 176,652t over the previous seven days, following decreasing arrivals from Australia.

That said, Australia remained the EU's largest rapeseed supplier, with almost 2.03mn t of Australian-origin product sourced so far this year, followed by Ukraine, which supplied 1.64mn t of rapeseed to the bloc.

As for other vegetable oils, the EU 27's sunflower oil (SFO) and soybean oil (SBO) imports fell in the week to 8 May — to 23,529t and 7,059t, respectively, from 31,416t and 12,683t a week earlier.

The bloc imported a combined of 1.68t of SFO in weeks 1-45 of the 2021-22 marketing year, compared with around 1.52mn t a year earlier, while cumulative 2021-22 SBO imports hit 453,432t, up from 416,349t in 2020-21.

Meanwhile, the EU's palm oil imports remained relatively stable in the last reporting week at 46,506t, compared with 42,267t a week earlier. This takes the bloc's palm oil imports this marketing season to almost 4.15mn t, down from 4.6mn t a year earlier.