Asia-Pacific condensate values are expected to remain largely steady in 2023, but prices could face downward pressure following an increase in Qatari production in 2026.

Condensate prices in Asia-Pacific were depressed for most of 2022, as weak naphtha margins curbed demand. Prices are unlikely to see a sharp rebound in 2023, as naphtha margins may remain weak, traders said. But condensate prices may not fall much further from 2022 levels either, as the market is not expecting Iranian condensate exports to re-emerge just yet, traders added. The prospect of Iranian South Pars condensate returning to the global market seems bleak as trade sanctions remain enforced and US-Iran negotiations have stalled.

But condensate supplies will increase by around 2026 as Qatar pursues LNG expansion through the North Field East project. Along with LNG, the project will also yield 254,000 b/d of condensate, as well as ethane, LPG and sulphur, Qatar's state-owned QP said in July 2021.

Additional condensate supplies may emerge in Australia, but volumes could be smaller than initially expected. Australian independent Woodside Energy trimmed the production capacity of its proposed Browse gas to North West Shelf (NWS) LNG venture offshore Western Australia. Woodside in July 2020 deferred the timing of a final investment decision on the Browse project to 2023. But it has given little indication since then about when it will develop the project. The Browse development includes two floating production, storage and offloading (FPSO) facilities that will produce LNG, LPG, condensate and domestic gas.

The bulk of condensate produced in Asia-Pacific and the Mideast Gulf goes into condensate splitters in South Korea, Singapore, China and Indonesia. The splitters extract naphtha for use in petrochemical plants, as condensate has a high yield of naphtha. The jet-kerosine and gasoil produced from splitting condensate are usually sold off. Condensate has little residue, which makes it more economic to run through a splitter than in a crude distillation unit.

Condensate prices

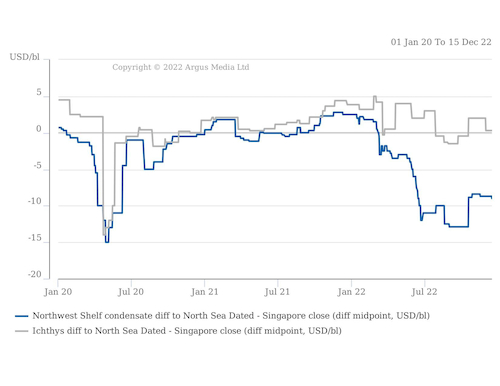

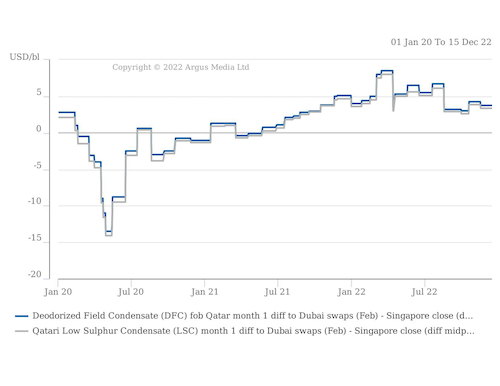

Weak naphtha margins in early 2022 led to a plunge in spot differentials for several condensate grades.

Australian NWS condensate fell to a $12/bl discount to North Sea Dated in June, the deepest discount since May 2020. The grade hovered around a $10-$13/bl discount to Dated between June and October. Indonesian Tuban-based splitter TPPI — a key NWS condensate buyer — purchased less condensate in the third and fourth quarter of this year, dampening prices. NWS condensate prices recovered slightly around late October, on demand from Chinese refiners that were buying cheap condensate to blend with heavy sour crudes to reduce the density and possibly sulphur content of these crude grades. Chinese refiners increased their purchases of NWS condensate from mid-2022 when prices were low, and have taken 2-3 cargoes/month of NWS condensate in recent months. But NWS condensate prices in December were at discounts of around $8.50-$9/bl to Dated, despite the new demand. Prices remained well below that in 2021, when the grade was sold between a $1.15/bl discount and a $2.80/bl premium to Dated.

Malaysian condensate grades Muda and Cakerawala also traded at a discount of around $7-$9/bl to Dated in the second half of 2022, because of weak naphtha refining margins. Cakerawala traded between a $3/bl discount and a $5.50/bl premium to Dated back in 2021, while Muda condensate was between a 70¢/bl discount and a $3.50/bl premium to Dated in 2021.

Some Asia-Pacific condensates, such as Australian Ichthys, fared better with prices holding firm in 2022 as Ichthys is slightly heavier and often purchased by refiners in Singapore, Australia, South Korea and Thailand for refining or blending. Qatari Deodorized Field Condensate and Low Sulphur Condensate were also supported in 2022, trading at firm premiums to Mideast Gulf benchmark crude Dubai, because these grades are not only rich in naphtha but also have a high yield of gasoil and jet-kerosine. Firm middle distillates margins in Asia-Pacific in 2022, and a wide discount of Dubai to North Sea Dated likely encouraged buyers to pay a premium for these Qatari condensate grades.