Calls for US shale oil producers to change tack and boost output are being ignored, as firms now drill more for cash than barrels.

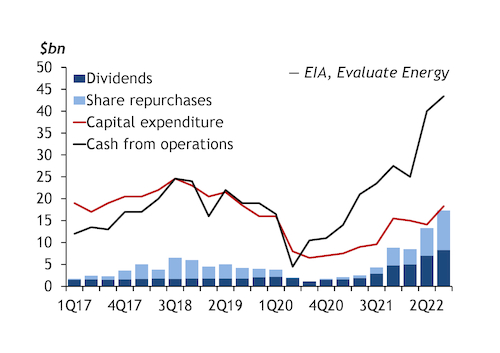

White House chief energy adviser Amos Hochstein this month attacked US shale firms for failing to invest more in raising output when they are making record profits. "It's not only un-American, it is so unfair to the American public," he said. But the shale industry is unlikely to change its stance. Shareholders now insist on a return on their investment, so firms are no longer willing or able to pursue output growth at the expense of profits.

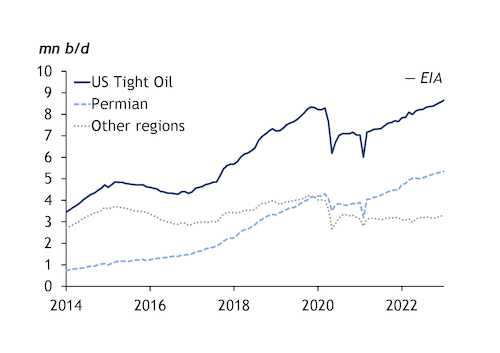

US upstream companies reinvested more cash than they earned from operations in 2017-19, the EIA says in a recently updated review of financial results from 50 publicly traded upstream firms whose crude output comes mostly from the US. Over this period, US tight oil output almost doubled from 4.4mn b/d to 8.3mn b/d — average monthly growth of just under 2pc (see graph). Yet shareholders received only 10pc of cash from operations in the form of dividends as firms focused on output growth at almost any cost.

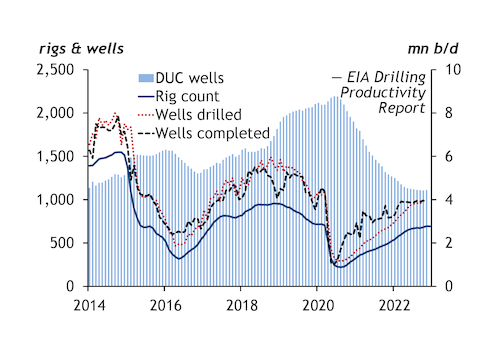

"Drill, baby, drill" is no longer the watchword of the shale industry. Since the pandemic, shareholders want a bigger share of profits and firms have throttled back upstream investment despite surging cash flow as oil prices recovered (see graph). Capital expenditure last quarter was only 42pc of cash from operations, while shareholders received 22pc as dividends. Firms also directed a further 21pc of cash generated to share repurchases and continued to pay down debt. Since the pandemic — when firms were forced to borrow to survive — debt-to-equity ratios fell from 96pc in the second quarter of 2020 to 47pc last quarter.

With average annual investment in 2021-22 only two-thirds of 2017-19 levels, the pace of recovery of US tight oil production after the pandemic is inevitably slower. Output is projected to exit this year 1.5mn b/d up on December 2020 — an average monthly growth rate of just under 1pc, barely half the rate achieved in the boom years of 2017-19. But producers have no regrets. The high growth rates in 2017-19 came at a substantial cost, with rapidly accelerating legacy decline rates needing ever-increasing investment just to maintain output — let alone grow — taking a rising share of profits. With slower growth, firms spend less to offset rapid legacy decline rates and can employ efficiency and technology gains to help expand production.

Permian focus

Switching objectives from output growth to rewarding shareholders has concentrated investment activity in the less mature, but much more prolific, Permian basin. Output remains below pre-pandemic levels in more mature shale producing regions — such as the Bakken and Eagle Ford formations — and growth has stalled. Operators in these regions are investing only enough to sustain output and keep the cash flowing. The Permian accounts for effectively all the 1.5mn b/d increase in US tight oil production since December 2020 — an average monthly growth rate of 1.3pc, compared with 2.8pc in 2017-19.

Expectations for US oil output growth next year are being revised down as forecasters accept that firms are unlikely to revert to past behaviour and spend more on boosting production, despite strong pressure from Washington to over-ride shareholder interests. The EIA's latest Short-Term Energy Outlook foresees onshore oil output in the lower 48 states rising by 510,000 b/d by the end of next year, an average monthly gain of 42,000 b/d, or just 0.4pc. And there are concerns that shortages of labour, drilling pipe, pumping equipment and fracking sand will persist next year, further constraining growth — whatever firms plan to achieve.