Australian iron ore producer Mount Gibson expects to come in at the bottom of its 3.2mn-3.7mn wet metric tonne (wmt) sales guidance and top of its cost guidance for its Koolan Island mine in Western Australia (WA) for the 2022-23 fiscal year to 30 June.

The firm sold 1.1mn wmt in July-December, as repairs to its fire-damaged processing plant took longer than expected and logistics were interrupted by tropical cyclone Ellie. It expects the crusher to be repaired in March, allowing it to ramp up sales, but it needs to increase shipments to 2.1mn wmt in January-June to hit the bottom of its guidance.

Operating costs rose to A$89/t ($63.14/t) fob Koolan in October-December, up from A$67/wmt in July-September, and it will be difficult for the firm to return costs to within guidance of A$70-75/wmt for the fiscal year. The increase in costs was driven by lower sales volume and the need for interim crushing arrangements while the processing plant was being repaired.

The firm realised an average price of $92/dry metric tonne (dmt) fob Koolan for October-December, down from $96/dmt in July-September, but still operating at a good cash margin.

Mount Gibson shipped 655,000wmt of 65pc Fe iron ore from Koolan Island in October-December, up from 451,000wmt in July-September and just 196,000t in October-December 2021 when the mine was ramping back up from closure. It established 800,000wmt of stockpiles for processing when the plant came fully back on line.

Koolan is Mount Gibson's only producing iron ore asset after it closed its low-grade Shine mine in 2021 following a sharp drop in iron ore prices.

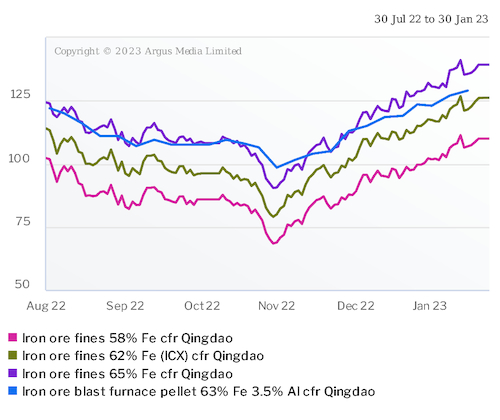

Argus last assessed the 65pc Fe iron ore price at $139.25/dry metric tonne (dmt) cfr Qingdao on 27 January, up from $101.20/dmt on 25 October, but down from $160.20/dmt on 1 June. It assessed the ICX iron ore price at $126.20/dmt cfr Qingdao on a 62pc Fe basis on 27 January, up from $89.70/dmt on 25 October, but down from $136.35/dmt on 1 June.