Pakistan's DAP stocks dropped to 237,000t at the end of July, their lowest since the end of January 2022, as the market prepares for the start of the major Rabi wheat season.

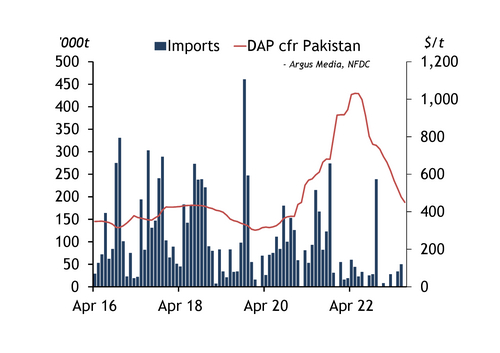

DAP inventories fell from 275,000t at the start of last month, as sales to end users of 113,000t outstripped domestic production of 73,000t, according to the country's National Fertilizer Development Centre (NFDC). A sharp drop in imports has pressured stocks throughout this year, with no deliveries last month, as was the case in April and February. Imports slumped to 120,000t in January-July, from 250,000t a year earlier, as buyers held back from purchasing owing to falling international phosphates prices, a weakening exchange rate and credit problems. DAP cfr Pakistan dropped from an average of around the mid-$690s/t cfr in January to $450/t cfr in July.

Stocks have fallen to their lowest since early last year, having started this year at 436,000t. Pressure is now mounting on importers as they prepare for the all-important wheat Rabi season from October-March, for which importers aim to receive product by October-November. But stocks are now markedly below typical levels at the start of August, having averaged 391,000t at the start of the month in 2017-22. Importers returned to the market earlier this month, last week lining up around 110,000t of DAP for arrival in October. But further purchases will be required.

International phosphates prices have surged since mid-June, initially driven by strong demand in the Americas, then compounded by tight availability from China for cargoes loading in August-September and increased appetite for imports from the Indian subcontinent. Argus assessed DAP at $565-580/t cfr Pakistan last week.