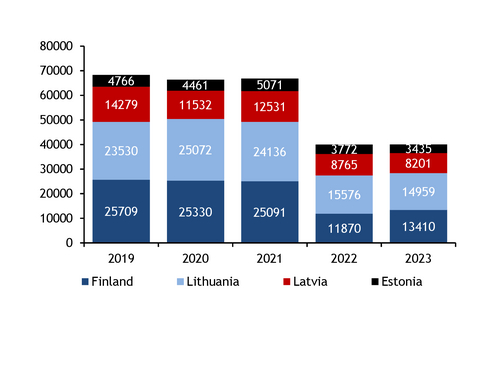

Combined Finnish and Baltic gas consumption was almost identical in 2023 and 2022, although this figure masks rising demand in Finland that was offset by lower demand in the Baltic states.

Consumption across the four countries totalled almost exactly 40TWh in 2023, marginally up from 39.98TWh in 2022 but still well below the pre-2021 level of 66.83TWh (see combined consumption graph). All four countries recorded their highest month of consumption in December, as cold weather swept across the region — combined consumption in December of 5.25TWh was the highest for any month since January 2022.

Finnish gas demand recovered to 13.41TWh from what was a long-term low in 2022 at 11.87TWh, an increase of roughly 13pc. Gas-fired power generation edged slightly higher on the year to a total of 1.81TWh, from 1.79TWh, according to data from Fraunhofer ISE, but its share in the generation mix shrunk to 2.4pc from 2.8pc as nuclear generation soared to 32.7TWh, a record year of production following the commissioning of the 1.6GW Olkiluoto 3 unit in April.

This means that it was mostly industry that was responsible for the increase in gas consumption — industrial consumers accounted for 60pc of consumption in 2022, according to data from Finnish energy regulator Energiavirasto. There is no separate data for industrial demand, but if industry once again accounted for 60pc of overall demand then this would suggest its consumption rose to 8.05TWh from 7.12TWh. That said, one of the country's largest industrial consumers, Neste, confirmed to Argus late last year that it "has replaced most of its natural gas use at its Porvoo refinery with propane" since February 2022, and still continues to use it at present despite lower gas prices.

Demand was down in the Baltics on the year in all three countries. The steepest outright decline was in Lithuania, which dropped by 617GWh to 14.96TWh. In percentage terms, Estonian consumption dropped the most at just under 9pc, falling to 3.44TWh.

In Lithuania, ammonia producer Achema historically accounted for roughly 50pc of total national gas consumption, although rising gas prices meant the firm's Jonava facility only produced at around half its capacity for the second half of 2022. Low or zero production rates in 2023 continued, with Achema briefly reopening the second unit at Jonava in October, bringing back full production for around six weeks before once again closing it for seven months of maintenance starting in November. Achema's weak production had a significant effect on Lithuanian consumption in 2023, shown by how much higher demand was in October when Jonava ran at full capacity, compared with all other months but December. Lithuanian gas-fired generation rose to 640GWh from 500GWh in 2022, but its share of the generation stack fell to 13pc.

A large chunk of total gas consumption in Latvia comes from power production at state-owned utility Latvenergo's large combined heat-and-power plants, which have a total capacity of roughly 1GW. Total Latvian gas-fired power generation reached 1.35TWh in 2023, up from 1.1TWh in 2022 but still well below the 1.82TWh produced in 2021. Strong hydro generation reduced space in the generation mix for gas, reaching 3.71TWh, compared with 2.66TWh in 2022 and 2.62TWh in 2021.

The return in Estonia of district heating companies to using gas this year contributed to higher consumption in the final months of 2023, but was not enough to offset weaker consumption throughout the rest of the year. Several Estonian district heating companies in 2022-23 were given temporary exemptions, allowing them to burn alternative fuels such as fuel oil, but these have since expired and companies were obliged to return to gas. Gas-fired generation in the power sector was marginally higher on the year but Estonia became much more reliant on imports, which jumped to 3.3TWh from roughly 840GWh in 2022. Cheaper power prices in neighbouring Finland because of historically strong nuclear generation helped drive this.

Total gas-fired power generation across the four countries reached 3.84TWh, up from 3.42TWh in 2022, but still drastically below 7.12TWh in 2021 (see table).

Combined sendout from the Inkoo, Hamina and Klaipeda LNG terminals totalled 47.04TWh last year, compared with 32.43TWh in 2022 and just 8.18TWh in 2021. This helped to replace Russian gas, the import of which was banned in all three Baltic states from the start of 2023. Russian vessels are also banned from Inkoo, according to the terminal rulebook.

There were total net injections into Incukalns of 6.61TWh in the 2023 calendar year, compared with total net withdrawals of 777GWh in 2022 and almost 5TWh in 2021.

| Total annual gas-fired power generation | GWh | ||

| 2021 | 2022 | 2023 | |

| Finland | 4,170 | 1,790 | 1,810 |

| Lithuania | 1,110 | 500 | 640 |

| Latvia | 1,820 | 1,100 | 1,350 |

| Estonia | 20 | 30 | 40 |

| Total | 7,120 | 3,420 | 3,840 |

| Fraunhofer ISE | |||

| Numbers rounded to nearest 10 | |||