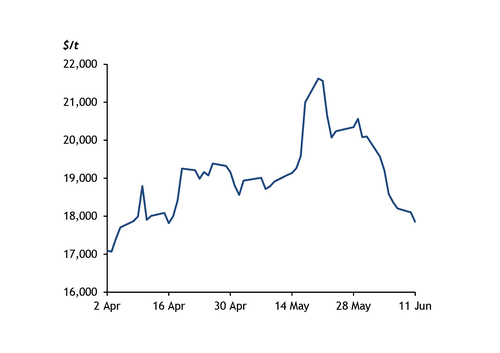

Benchmark nickel on the London Metal Exchange (LME) has declined sharply in June after a mainly speculative fund-based rally through April and May. Declining stainless steel prices in top producer China, planned rises in nickel supply in Asia, and increasing stocks in LME warehouses are now at the centre of focus to drive this month's slide, but remnants of technical buying support together with a tightness in ore supply in top producer Indonesia are expected to keep price movement volatile in the near term.

Between the end of the first quarter and 20 May, three-month nickel bounced by nearly 30pc to reach $21,625/t. Speculative investment funds were the biggest driver of this support, with funds shifting to net long positions in April for the first time since May 2023 from record net short positions in February, according to LME data. Nickel prices further benefited from a trend of overbuying in the copper market during May as excess funds were increasingly diverted to nickel and other industrial metal contracts.

But the tide has turned as benchmark nickel has since shed 17.7pc to settle at $17,855/t today, reflecting more physical fundamentals. While the contract continues to be net long on the LME, combined long and short positions declined by 4,761 lots between 17 May and 31 May, LME data show, to suggest a possible easing of fund money movement into the market. Prices are now finding lower ground on declining Chinese stainless steel prices, which themselves are under pressure from Beijing's planned curbs on steel production for this year.

Despite a market-wide correction of the nickel market surplus from more than 200,000t to much less than 100,000t now, the metal's rising Asian supply profile in both the class 2 and class 1 spaces continues to pull prices back from any move higher. According to major producer Norilsk Nickel (Nornickel), Indonesian nickel pig iron production is expected to rise by 13pc on the year to 1.57mn t this year, with refined nickel production expected to rise by 8pc year on year to 1.1mn t on the back of new capacities in China and Indonesia. Rising stocks in LME warehouses are also back in focus, as on-warrant nickel stocks have now jumped by 40pc this year to 81,468t as of 11 June.

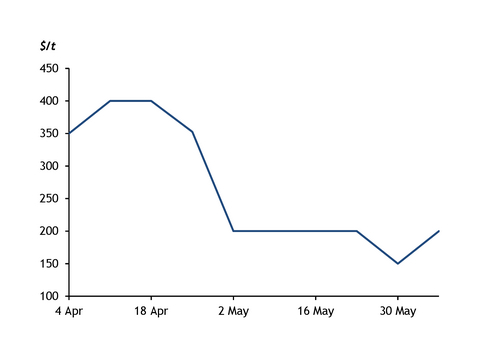

Nickel's recent rally caused hefty discounts to emerge between LME cash nickel and Asian NPI prices, which has incentivised the conversion of Asian NPI into LME-deliverable products and further driven the flow of large volumes of Indonesia-produced cathode products into Europe. LME official cash nickel prices averaged $18,841.85/t during April-May, up by 13.62pc relative to the January-March average, but the average for the Argus/Indeks Komoditas class 2 nickel benchmark Indonesian Nickel Index (INI) for 10-14pc NPI fob Indonesia rose by just 1.7pc over the same period to $11,676/t. With analysts pegging costs of converting NPI into nickel sulphate at $3,000/t and an additional $1,500/t needed to turn it into class 1 nickel, the price gap has proved profitable to new class 1 producers and has consequently driven a collapse in European cathode premiums.

The Argus assessment for the nickel cathode full-plate premium (non-Russian origin) in-warehouse Rotterdam more than halved from an average of $350/t on 28 March to average of $150/t on 30 May on the back of new Indonesia production flowing into Europe, while the corresponding premium for 4x4 inch cathode (non-Russian origin) fell by nearly 30pc over the same period to $400/t on 30 May.

Along with downside forces, restricted ore supply in Indonesia is providing support to nickel prices amid continued uncertainty around the approval of mining quotas. Even as approved quotas are heard to be approaching 240mn t covering the next three years, actual availability to producers is much less and supply is also not uniform across major mining and smelting regions. Civil unrest in New Caledonia has further tightened ore supply to lift transaction prices for battery-grade nickel products, with the Argus assessment for nickel sulphate minimum 22pc cif China rising by 7.3pc to 32,550 yuan/t.

Market participants surveyed by Argus this week expect wild price swings to continue, as the wider theme of oversupply in class 1 and some class 2 products is juxtaposed with limited ore supply and improving macros in the western world. A prolonged spell of three-month nickel below $18,000/t could bring class 1 production from NPI and sulphate under pressure, with further supply cuts potentially causing a sharp uptick back above the $20,000/t level.