Denmark's failure to attract bids in an offshore wind tender was partly caused by the country's lack of firm commitment to a hydrogen pipeline network, according to Danish and European hydrogen associations.

For Denmark's hydrogen industry the failed tender is raising concerns that Copenhagen might resort to state aid for offshore wind, which could jeopardise renewable hydrogen production that is compliant with EU rules.

Denmark unsuccessfully offered three areas totalling 3GW in a first part of the auction that ended on 5 December, and will offer another 3GW in a second part ending in April 2025.

The "very disappointing" result will now be investigated by the Danish Energy Agency to discover why market participants failed to bid, energy minister Lars Aagaard said.

Wind project developers may have worried that low electricity prices in an increasingly saturated power market and inadequate export routes — either via power cables or as hydrogen via pipeline — would deny a return on investments, industry participants said.

Ample offshore wind potential could allow Denmark to generate power far in excess of its own needs. But in order to capitalise on this the country would need to find a way of getting the energy to demand markets.

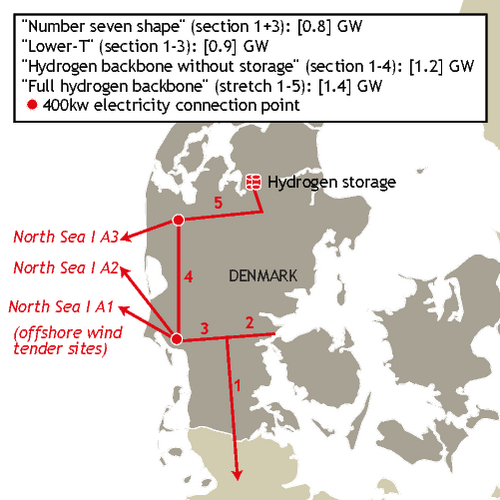

Turning offshore wind into renewable hydrogen for export was "a very attractive solution" for developers, Hydrogen Europe chief policy officer Daniel Fraile said, but would rely on timely construction of a network "all the way from the coast to Germany's hydrogen-hungry industry."

Denmark's hydrogen network was recently pushed back to 2031-32 from an initial 2028, partly because of an impasse over funding that provoked anger from industry. The government has said it will only help fund the hydrogen transport network if there are sufficient capacity bookings guaranteeing its use.

But this approach increases risks for developers, according to Fraile.

"You need to handle the risk of winning the offshore tender, finding a hydrogen offtaker in Germany and commit to inject a large amount of hydrogen over several years. Then deliver the project on time and on cost," he said. "This is a hell of an undertaking."

Industry association Hydrogen Denmark's chief executive Tejs Laustsen Jensen agreed, calling the failed tender "a gigantic setback".

"The uncertainty about the hydrogen infrastructure has simply made the investment too uncertain for offshore wind developers," he said. "Now the task for politicians is to untie this Gordian knot."

"Of course, the tender must now be re-run, but if the state does not guarantee in that process the establishment of hydrogen infrastructure, we risk ending up in the same place again," he said. The booking requirement as a prerequisite for funding the network "must be completely removed," Jensen said.

Green energy association Green Power Denmark said "there is still considerable uncertainty about the feasibility of selling electricity in the form of hydrogen," but pointed to other factors that may have led to the tender failing to attract bids.

Wind turbines and raw materials have become more expensive because of inflation while interest rates have risen sharply, reducing the viability of such projects, the group's chief executive Kristian Jensen said. Unlike some other countries, Denmark does not intend to fund grid connections or provide other subsidies, he said.

Unwanted help

Hydrogen Denmark's Jensen warned against the government resorting to subsidies to help get offshore wind farms built.

"State support for offshore wind would be the death knell" for the hydrogen sector and would "de facto kill all possibilities for a green hydrogen adventure in Denmark," he said.

Granting state support for offshore wind farms would mean these assets would not comply with the additionality requirement of the EU's definition for renewable fuels of non-biological origin (RFNBO), which are effectively renewable hydrogen and derivatives.

EU rules state renewable assets are only considered 'additional' if they have "not received support in the form of operating aid or investment aid," although financial support for grid connections is exempt from this.

"If state aid is provided for the offshore wind that is to be used to produce the hydrogen, we will lose the RFNBO stamp, and the Danish hydrogen cannot be used to meet the green EU ambitions for, among other things, industry and transport, and the business case is thus destroyed," Jensen said.