US oil executives remain on the defensive following forecasts for a sharp shale production growth slowdown this year, despite President Donald Trump's 90-day trade truce with China helping oil prices bounce back from four-year lows.

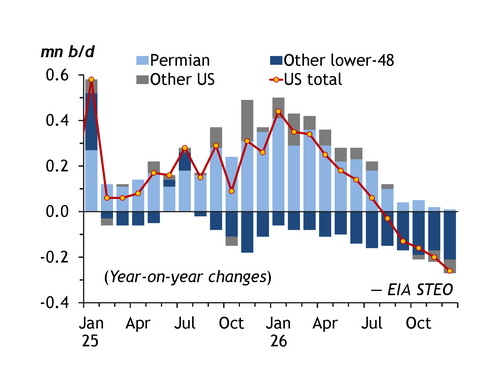

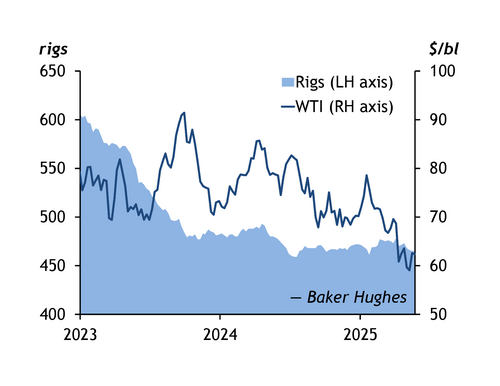

The US oil sector is having to contend with surging Opec+ supplies at a time when worldwide demand is flagging, as well as steel tariffs that have raised the cost of oil field equipment. Some companies are already starting to cut spending and drop rigs after warning that the sector is near or already at peak output. And with oil prices still hovering around levels needed to profitably drill new wells, any renewed weakness could accelerate the downturn.

Hundreds of producers and suppliers gathered at the Super DUG Conference & Expo in Fort Worth, Texas, earlier this month to discuss how best to navigate the growing challenges facing the industry. Many of them said they were bracing for further headwinds, but they also argued the industry is in better shape to withstand the latest slump after spending the years since the Covid-19 pandemic getting its finances in order. Some attendees expressed frustration that tariffs remain a moving target and are hard to plan for as a result, but services firms noted some upside from a rush of bookings from customers looking to avoid getting hit.

Others believe the industry may be able to come together and figure out how to mitigate the effects of tariffs, but consider Opec+ a bigger concern as additional barrels hitting the market from the producer group have the potential to sink prices. Trump has ruffled feathers with his unwavering push for lower oil prices to help tackle inflation, but executives are giving him the benefit of the doubt, given his promise to roll back costly environmental regulations and free up permitting bottlenecks — both of which could bolster the industry in the long term.

But oil field services companies are bearing the brunt of this year's slowdown, with the share price of Liberty Energy — founded by US energy secretary Chris Wright — down by about 45pc since January. The company's calendar is "full" and activity looks to be "quite solid" through to the end of the second quarter, Liberty chief executive Ron Gusek told the conference. "My expectation is we are going to see a reduction in activity over the back half of the year, barring some meaningful change in the macro," he said.

Drilling down

An uncertain outlook for oil prices could spur a reduction in drilling programmes as companies look to shore up balance sheets and protect free cash flow. "I don't know how steep that will be... I think it's going to be tens of rigs. Maybe it's in the 30-40 range," Gusek said, referring to the number of drilling rigs that are likely be shut down by US onshore producers. For Liberty, that could translate into a decline of 10-15 hydraulic fracturing crews.

"I don't view that as catastrophic by any stretch of the imagination, but I do think we're going to see a wind down," Gusek said. "Certainly, by the time we get out into the fourth quarter, where capital programmes are normally winding down for the year, I think we're going to see a real taper-off there." It is too early to say what 2026 has in store for the industry but "we'll have to be ready for that", Gusek said

Meanwhile, upstream independent Continental Resources founder and chairman Harold Hamm — who helped kick-start the shale boom by combining horizontal drilling with fracking in North Dakota's Bakken basin to tap previously hard-to-access reserves — warned that the current bout of oil price weakness could continue as oversupply is likely to remain for some time yet. "Should people expect lower for longer at this point, with prices where they're at? Probably," Hamm said.

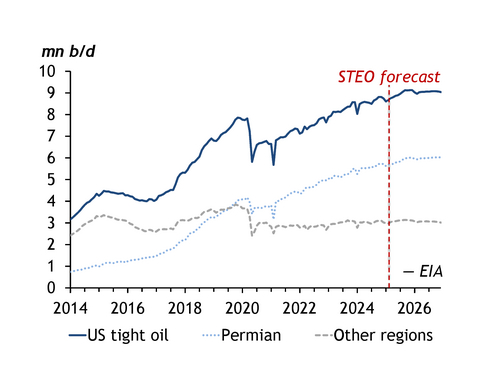

Hamm still sees potential for US crude output to increase by a further 1.5mn-2mn b/d before levelling off — even though the talk in industry circles is that shale is reaching a peak. Continental has recently expanded overseas and is looking at developing resources in Turkey, but the bulk of the company's spending will remain in the Lower 48 US onshore, Hamm said.

The Bakken has been written off many times in the past, but the play keeps coming back. "It just doesn't go away," Hamm said. "We still find out every day new stuff that works really well."

A major campaigner for Trump, Hamm said he plans to source as much of the oil field equipment needed for his company from domestic suppliers in future, after being shocked to discover how much comes from overseas. "We're going to buy as much as we can right here in the US. We think it's the right thing to do."

Peak or plateau?

Leading operators from Diamondback Energy to Occidental Petroleum have recently talked about US crude output peaking sooner than previously expected, with shale remaining under pressure as prices hover below the $65/bl average breakeven price flagged by executives in a recent Federal Reserve Bank of Dallas shale industry survey as necessary to profitably drill a new well.

Diamondback, the largest pure-play producer in the Permian, warned in a recent widely circulated letter to shareholders that US output is at a "tipping point", with geological headwinds starting to outweigh the benefits from improvements in technology and operational efficiencies.

"I would maybe caveat it just a little bit different and not call it a peak, necessarily, but I think we're in for a period of a plateau," Continental chief executive Doug Lawler told the conference. But he agreed that the industry's ability to offset the impact of lower oil prices is limited. "There's nothing that we can use in the industry to absorb a $10/bl drop in price from a technology standpoint," Lawler said. "There are no capital efficiencies that can be captured that make up $10/bl."

Still, recent market volatility might not be enough to deter investors that have gradually returned to the sector as returns have improved. The fear of missing out has brought back a growing number of investor groups — from pension funds to endowments — and that is unlikely to change for as long as returns are forthcoming — with the exception of funds modelled along environmental, social and governance investing. "Most of our investors don't worry about short-term volatility," Pearl Energy Investments founder and managing partner Billy Quinn said. "They rely on us to make good investment decisions through volatile cycles."

The industry is on a much firmer footing these days, having learned the hard way about the pitfalls of spending beyond its means, which resulted in multiple bankruptcies in previous downturns. Gone are the days when shale reinvestment rates exceeded 100pc as producers sought to boost output at any cost. Shareholder distributions are now the priority. "It's just a much healthier industry than it once was," Houston-based EIV Resources' partner and chief executive, Claire Harvey, said.

Others spoke about how a sector that has suffered the ups and downs of past downturns has learned over time to prepare for the leaner times. This has meant targeting top-quality acreage, ditching assets with high breakeven prices and using the latest technology to maximise returns. "Necessity is the mother of invention," Denver-based independent SM Energy chief executive Herb Vogel said. SM Energy operates in west Texas' Midland basin, south Texas' Maverick basin and the Uinta basin of northeast Utah. "Low price cycles make us stronger," Vogel said.