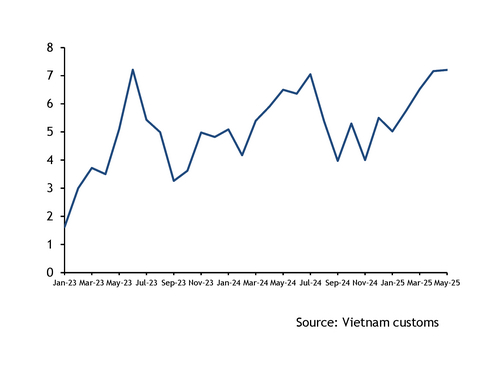

Vietnam's coal imports in May rose on the year to the highest level in 23 months, supported by restocking by utilities to cater for an increase in power demand in northern parts of the country.

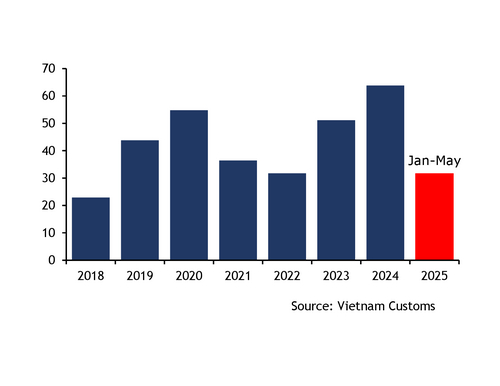

Seaborne receipts reached 7.2mn t in May, up from about 6.5mn t a year earlier and 7.16mn t in April, according to customs data. This marks the highest level since the 7.21mn t of coal imported in June 2023. Imports reached 31.64mn t in January-May, up from 27.06mn t a year earlier, Vietnamese customs data show. The data do not differentiate between coking and thermal coal.

Receipts rose in May on restocking by utilities and steady industrial coal consumption in line with the economic activity in the country. The country's industrial output grew by 9.4pc in May from a year earlier, according to Vietnam's General Statistics Office (GSO), supporting its economic growth outlook.

The utility restocking comes as hot weather peaks in June in northern Vietnam, which could buoy power demand and prompt utilities to boost coal-fired generation. This could support imports as power plants could continue to restock imported cargoes given that seaborne prices are at multi-year lows. Argus assessed the GAR 4,200 kcal/kg coal market for geared Supramaxes at $42.41/t fob Kalimantan on 6 June, the lowest since 26 March, 2021, when it was marked at $39.37/t.

The country's overall generation last month stood at 28.62TWh, edging higher from 28.09TWh a year earlier, and 26.85TWh in April, data from state-owned utility EVN show. Coal-fired power accounted for the bulk of the generation last month at 15.8TWh, although this was down from 17.08TWh a year earlier and 16.09TWh in April. Hydropower output rose to 7.65TWh, up by 64pc from a year earlier, and also rising from an estimated 4.7TWh in April.

EVN has asked all its units and plants to ensure stable supply of electricity, it said, and it will also ask local authorities to implement measures to save electricity to help manage loads on the grid.

Indonesian coal accounted for the bulk of Vietnam's imports at 2.9mn t in in May, little changed from a year earlier and from April, the customs data show. Imports from Australia rose to 2.38mn t in May, up from 1.18mn t a year earlier, and from 2.23mn t in April.