The country aims to lift gas exports to the EU, but this will require more investment in capacity, write Nader Itayim, John Gawthrop and James Keates

BP and its partners at Azerbaijan's offshore 1.2 trillion m³ Shakh Deniz field have approved a $2.9bn plan to boost gas production and extend the project's life. Further development of Shakh Deniz will support ambitious Azeri plans for increased gas exports to Europe, but additional investment in transport capacity remains crucial for this plan to succeed.

The Shakh Deniz Compression project — a third phase of development — "will access additional resources, extend production [life] and support continued delivery of important gas supplies to Europe", according to BP executive vice-president for production and operations Gordon Birrell. The project will target low-pressure gas reserves, enabling output of an extra 50bn m³ of gas and 25mn bl of condensate, following the installation of an unmanned compression platform. First gas is expected in 2029.

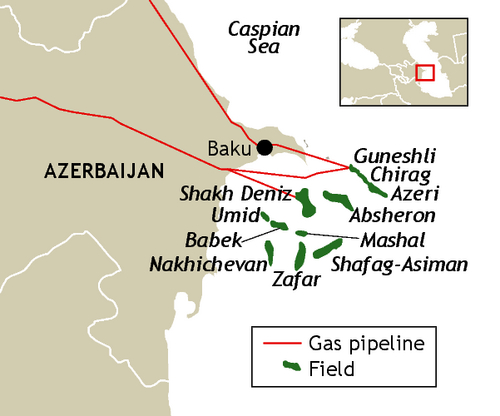

Shakh Deniz is the main source of Caspian gas exports to Europe and Turkey along Azerbaijan's southern corridor route. Its expansion plan follows a September deal to develop up to 113bn m³ of non-associated gas at Azerbaijan's offshore, BP-operated Azeri-Chirag-Guneshli (ACG) project — another key element in Baku's plans to boost exports to Europe. A revised production-sharing agreement (PSA) for ACG covers non-associated gas resources in formations above and below the producing oil reservoirs. First gas is expected by the end of 2025. In a separate move, BP and Socar agreed on Turkish state-owned TPAO taking a 30pc interest in the PSA for Azerbaijan's offshore Shafag-Asiman block, which is "expected to accelerate the evaluation of development opportunities for the block", BP says.

Azeri gas production in recent years rose steadily to 50.4bn m³ in 2024, mainly as a result of continued growth in Shakh Deniz output, as well as additional production from the Absheron field since 2023, data from the country's energy ministry show. Such growth was underpinned by rapidly rising export demand, which absorbed half of the country's production last year, with flows to Europe having climbed by 9pc to nearly 13bn m³. But total output was flat at 16.7bn m³ in January-April this year, reflecting lower demand from all export markets. Flows to Europe slowed by nearly 5pc, despite the region having lost most residual Russian supply following the halt to transit flows through Ukraine on 1 January.

Gaining ground

Azeri gas has taken on increased importance in Europe since the 2022-23 collapse of pipeline supplies from Russia, and Baku has committed to raise supply to Europe to 20bn m³/yr by 2027. But the country has repeatedly flagged the need for long-term contracts and further investment to expand transport capacity to fulfil this pledge, most recently at the 11th ministerial meeting of the Southern Gas Corridor Advisory Council held in April.

The 10bn m³/yr Trans-Adriatic Pipeline (Tap) could double its capacity without the need to lay additional pipes, but a market test concluded in January 2024 did not receive sufficient interest from market participants to underpin the investment. Tap capacity is set to grow by just 1.2bn m³/yr by the end of this year following a previous market test completed in January 2023 — with 1bn m³/yr allocated to Italy and 160mn m³/yr to Albania at the new Relievi Roskovec point. Albania has no downstream gas network and does not offtake from Tap, but Azerbaijan has expressed interest in investing in a distribution grid.

But even this moderate rise in flows could require tapping spare capacity in the Turkish network, given the lack of progress in previous plans to expand the 16bn m³/yr Trans-Anatolian Pipeline's capacity. At present, only 10bn m³/yr is booked for export to Europe and 6bn m³/yr to Turkey's domestic market.

| Azeri project shareholdings | % |

| Company | Stake |

| Shakh Deniz | |

| BP | 29.99 |

| Lukoil | 19.99 |

| TPAO | 19.00 |

| SGC* | 16.00 |

| Nico | 10.00 |

| MVM | 5.00 |

| Azeri-Chirag-Guneshli | |

| BP | 30.37 |

| Socar | 32.90 |

| Mol | 9.57 |

| Inpex | 9.31 |

| ExxonMobil | 6.79 |

| TPAO | 5.73 |

| Itochu | 3.65 |

| ONGC Videsh | 3.11 |

| *Socar holds 49% | |