Some US refiners are boosting jet fuel production despite tariff-related economic uncertainties that could affect travel demand.

Marathon Petroleum, one of the largest US independent refiners, is spending millions to increase jet fuel capacity at its 253,000 b/d Robinson refinery in Illinois. The project will increase the refinery's flexibility to optimise jet output to meet growing demand, chief executive Maryann Mannen says. The company plans to spend $150mn on the project this year and another $50mn in 2026. Marathon would not disclose the planned jet capacity at the refinery but says the project will be ready by the end of 2026.

Another independent refiner, CVR Energy, is increasing jet capacity at its Coffeyville, Kansas, refinery. The company is installing piping and revamping storage tanks at the 132,000 b/d facility to enable 9,000 b/d of jet output by the end of the third quarter, chief executive David Lamp says. Jet production is not subject to a Renewable Volume Obligation, which means that CVR would not need to blend biofuels into it or purchase renewable identification number (RIN) credits as it would if producing diesel. Shifting production from diesel to jet will reduce CVR's annual RINs requirements, Lamp says.

At the same time, the opportunity to sell products to markets further west, where two major refineries are set to close, will continue to grow over the next few years, with jet being an important part of the mix, he says. Phillips 66 plans to shut its 139,000 b/d Los Angeles refinery by October, while independent Valero aims to close or repurpose its 145,000 b/d Benicia, California, refinery by April 2026. CVR has the capability to move products from the midcontinent to California but would need to weigh the potential benefits against the political, regulatory and cost environment in the state and, as a result, may favour other locations, it tells Argus. CVR at present produces jet at its 74,500 b/d Wynnewood, Oklahoma, refinery, shipping it primarily by truck or pipeline to midcontinent locations, but it can also move jet by rail.

Another independent, Delek, has upgraded its 83,000 b/d El Dorado, Arkansas, refinery to produce jet as part of a plan to boost profitability. The company did not disclose how much jet the refinery can produce.

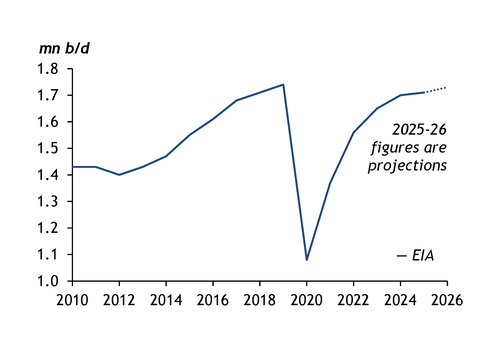

The investments come after US refineries produced a record share of jet in 2024, reflecting higher demand relative to other transport fuels, according to the EIA. The EIA in its most recent Short-Term Energy Outlook forecasts that US jet demand will average 1.71mn b/d in 2025 and 1.73mn b/d in 2026, up from 1.7mn b/d last year. But US airlines are signalling an uncertain outlook for jet demand, with most withdrawing full-year 2025 financial guidance when reporting first-quarter earnings, as President Donald Trump's evolving tariff plans have made it difficult to predict how travel activity will develop.

SAF conduct

Refiners nevertheless appear bullish on aviation fuels, including renewables. Specialty refiner Calumet will expand sustainable aviation fuel (SAF) output at its Montana plant sooner than expected — reaching 120mn-150mn USG/yr by the second quarter of 2026, with plans to boost capacity to 300mn USG/yr by 2028.

SAF margins have remained "stable and attractive", as the introduction of national mandates around the world compliment an already growing base of voluntary demand, chief executive Todd Borgmann says.

US independent Par Pacific's planned $90mn renewable fuels facility at its 94,000 b/d Kapolei, Hawaii, refinery, is near completion. The project will produce SAF and other products, and is expected to start up in the second half of 2025.