Fraud, uncertainty, competition from hydrotreated vegetable oil (HVO), changes to US biofuel regulations, technical issues and stubbornly weak margins are combining to negatively impact the Spanish biodiesel industry.

Spanish producers continue to complain about weak margins, with widespread talk of low production levels and units halting completely. These sentiments have continued all this year.

Some uncertainty over the EU's sustainability verification process, and its accreditation body the ISCC are also mentioned by companies. One producer said "everyone is waiting, for the ISCC to take action to remove certificates."

Some of these certificates concern imports of feedstock such as used cooking oil (UCO) but also cargoes of HVO from the Asia-Pacific region. Competition between biodiesel and HVO for blending into diesel is not new, has previously been the subject of ire in France and appears likely to remain problematic in Spain.

Fraud cases in excess of €500mn ($576mn) from 2023 remain outstanding, the end to the US' blenders tax credit — which has halted exports to the US — and operational issues with Spain's SICBIOS accounting system, are not helping the industry. The energy ministry this month extended the application for provisional tickets for the first half of the year to 31 August, as "technical issues with the system have prevented the correct functioning of the SICBIOS software."

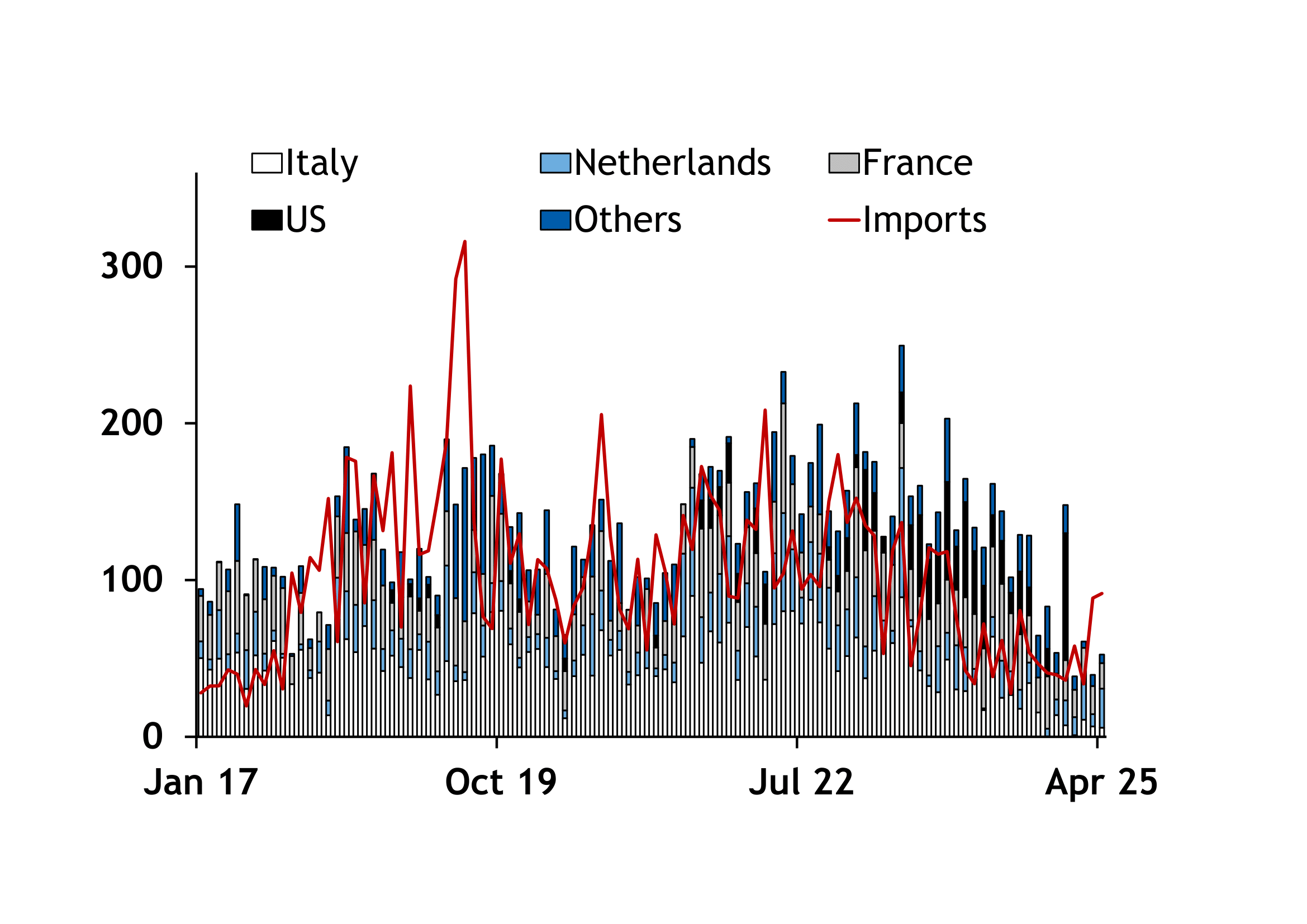

Spanish biodiesel imports have increased this year, pushing the country to being a net importer, which is rare. According to customs data, imports rose by 45pc on the year to 270,000t in January-April. The main increases came from the Netherlands, now Spain's largest supplier, which provided 105,000t, up from 70,000t on the year. Malaysia, Italy, Belgium and Malta all boosted supplies, shipping 25,000-40,000t. Cargoes labelled as Maltese are unusual and not supported by Argus tracking or Kpler data.

Exports continued to drop sharply — to 190,000t in January-April, lower by 67pc year on year and a 10-year low for the period (see chart). Spain has long acted as a distribution hub for imports from outside the EU, re-exporting cargoes to regional buyers, but these have all but halted. Exports of over 50,000t in April were the third lowest for any month since November 2017 — only January and March this year were lower.

Such low exports are in line with apparent weak production — assessed by Argus using import, export, demand and stocks data. This fell by 53pc on the year to 435,000t in the first four months of this year.