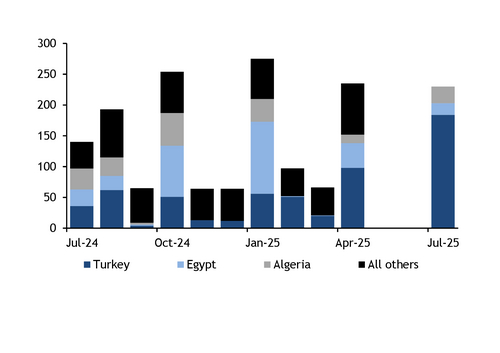

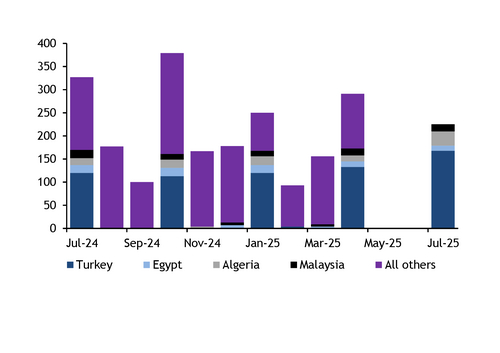

EU customs data for July show a sharp increase in imports of rebar and wire rod from origins under safeguard restrictions, particularly Turkey, suggesting high volumes of overall imports compared with previous quarters (see charts).

As already low EU construction demand slows for the summer, large inventories of competitively priced imported material are likely to exert significant pressure on prices in the bloc once trade picks up, if not before.

A total of 440,000t of rebar and wire rod from Turkey, Egypt and Algeria were cleared at EU ports in the first days of July as the quarterly quotas reset, compared with 310,000t imported in April this year and 249,000t in July 2024.

Tightening restrictions on imports from Egypt and Algeria over the past 12 months, now leaving the duty-free quotas for each origin capped at 27,500t for rebar and 15,000t for wire rod, have prompted a sharp surge in purchases from Turkey, which ultimately has overcompensated for the lower north African volumes.

This week's cleared volumes included 184,000t of rebar from Turkey, nearly doubling from a quarter earlier and increasing fivefold on the year, as well as 167,000t of wire rod and rebar in coils from Turkey, which was a more moderate increase of 39pc on the year. The 184,000t of rebar from Turkey will be subject to a 12.05pc duty, leading to a rough estimate of €510-560/t for the cfr price, plus duty, given that the bulk of it was booked at the end of April at $525-560/t fob Turkey. This week's Turkish wire rod clearance will be subject to a 10pc duty, while the 31,410t of wire rod cleared from Algeria will carry a 12.9pc duty.

There are no data so far on the volume of Indonesian wire rod clearing customs at EU ports this week, as the material is now not under a quota restriction. But large volumes, almost certainly close to 100,000t and potentially more than 200,000t, were booked for July clearance at $550-570/t cfr EU and will not be subject to an import duty.