The return of Chevron's Venezuelan import waiver should restore balance to the US Gulf coast market for sour crudes and high-sulphur residue feedstocks.

The administration of US president Donald Trump appears to have handed Chevron back its waiver to import crude from its Venezuelan joint-venture operations with state-owned PdV after rescinding it in late May. Deliveries may not immediately return this month, Chevron chief executive Mike Wirth says. But the decision should mark the beginning of the end of a tight spell for sour crudes and residue feedstocks in the Gulf coast market.

"Since our licence changed in May, we have been engaged with the US government, working closely with the administration to ensure our compliance with our country's policies towards Venezuela," Wirth says. "This month, it looks like there will be a limited amount of oil that will begin flowing to the US from the Venezuela operations that we have an interest in, consistent with US sanctions policy."

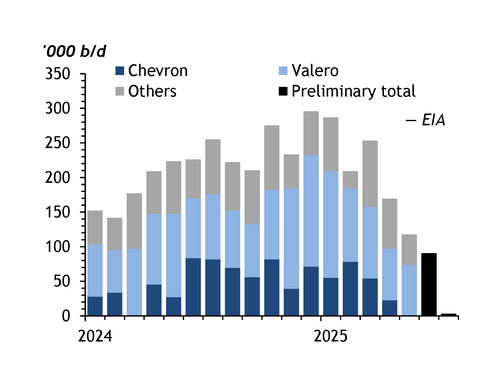

Venezuelan crude is sought after by US Gulf coast refiners that were built to process heavy grades. "It serves as a reliable source of supply for the American economy," Wirth says. Not all Chevron's exempted supply went to its own refineries. Independent Valero was a bigger customer, and Phillips 66 and PBF also took resold volumes, before deliveries tapered off last month (see graph).

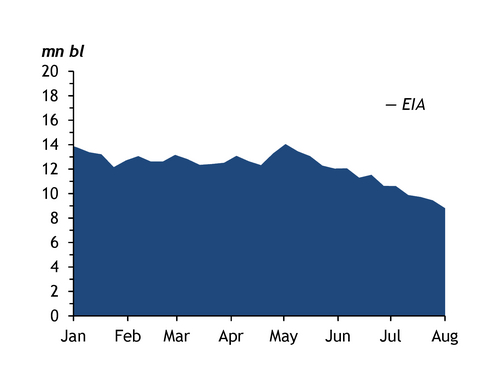

The return of Venezuelan crude will offer some respite to US refiners looking for heavy feedstocks. Most Venezuelan crude will go to highly upgraded refineries, typically those with coking units to upgrade heavy residues into higher-value light products. And with more heavy crude available, coking refineries will need to buy less high-sulphur fuel oil (HSFO), allowing stocks to recover. The draw from coking units starved of Venezuelan oil has contributed to a sharp tightening in fuel oil inventories on the Gulf coast since mid-June. Stockpiles fell by 600,000 bl to 8.8mn bl in the week to 1 August, extending declines for a sixth straight week, EIA data show (see graph). Fuel oil stocks have fallen to the lowest level in the 35-year stretch that the EIA has been keeping weekly records, and below any monthly reading going back to 1981.

Price impact

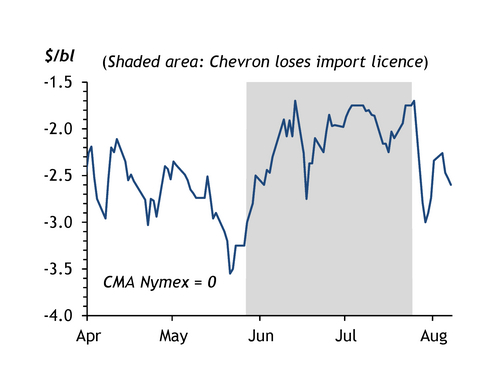

Heavy sour crude and fuel oil markets have been supported by the hiatus in Venezuelan supplies. Canadian WCS crude deliveries to the Houston area for September are averaging just $2.65/bl below benchmark WTI. And the market for August WCS deliveries traded at the narrowest discount to WTI since early 2021 (see graph). The spread between HSFO and sour crudes has reflected these tight conditions too. Fuel oil averaged less than a 70¢/bl premium to WCS on the Gulf coast in January-June. That same spread ballooned out to more than a $3.50/bl premium for fuel oil during the past six weeks.

Sour crude markets will also become better supplied as more offshore production comes on stream in the Gulf of Mexico. Beacon Offshore Energy's 120,000 b/d Shenandoah floating production system started delivering oil into Genesis' SYNC pipeline in July. The line connects to the Cameron Highway Oil Pipeline System (Chops), which feeds the SGC medium sour crude stream. BP recently started up the Argos Southwest Extension project, adding 20,000 b/d of oil equivalent to the existing platform. Argos output also goes into Chops to feed the SGC stream.

Genesis also expects to see first oil from LLOG Exploration's Salamanca project in the Gulf of Mexico in the third quarter after receiving flows from another new project in July. "We expect Salamanca's production to ramp relatively quickly over the subsequent few months after first production to its initial peak design of 40,000-50,000 b/d," Genesis chief executive Grant Sims says.