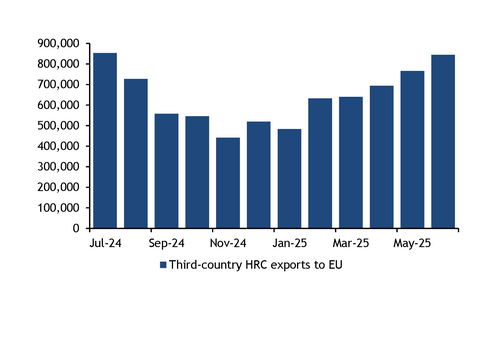

Third countries exported more hot-rolled coil (HRC) to the EU in June than any other month of this year, according to customs data.

Third countries exported 844,576t to the EU in June, the highest since last July, and the largest June volume since 2021.

The increase supports the notion that some buyers are booking more material to get ahead of CBAM and a potentially stricter safeguard mechanism, although 345,000t of this material came from Turkey and Ukraine, which is likely to have already landed. Service centres have said that recently import arrivals in the fourth quarter could constrain demand for new material. Some suggest appetite is currently softer for imported tonnes compared with domestic, as buyers expect significant volumes to land in the coming months.

Indonesia, which is currently exempt from the safeguard, shipped over 150,000t, at an average landed price of €467/t. This was the second-lowest price behind Japan, at €456/t. Most Japanese mills have already been hit with dumping duties of around 30pc.

In May, Indonesia shipped over 171,000t at a price of €436/t, €20/t below the next cheapest importer, Japan. Argus' twice weekly cif Italy HRC assessment averaged €515t in June. Material shipped from Indonesia in June is likely to arrive this month, or potentially last month, depending on when it was shipped.

Mill sources hope Indonesia could come into scope of the current safeguard mechanism in the fourth quarter, given other revisions made by the commission sine the last full review. Legal sources suggest it is technically possible, although it would require the commission to depart from its typical practice of annual reviews for developing country exemptions.

EU steelmakers have been watching prices and volumes from Indonesia closely, since a new exporter started selling into the EU at low prices. But there is only a limited dataset, so far, on its sales.

Indonesian mills are now likely to have sold their last allocations to the EU this year, after finalising October shipment recently. Appetite is weak for November exports from the country, as these could slip into January, meaning there is CBAM and quota risk; Eurofer has asked for no developing country exemptions from January 2026.