Australia's forecast bumper wheat crop could struggle to hit the global market in December because other crops may take up slots at the country's ports at the start of its winter crop export season.

Other origins, such as Argentina, could soak up any remaining demand in December, and if prices are attractive some buyers could fill their demand beyond December. If this is the case, Australia could face weaker demand — and lower bids from buyers at destination markets — in later months.

Also, recent marketing years have shown that when wheat prices are lower, Australian farmers tend to store wheat and sell other crops instead. If this is the case in 2025-26, Australia could again be left with large wheat stocks. And when global prices rise or the Australian dollar weakens against the US dollar, it could result in a spike in farmers' sales.

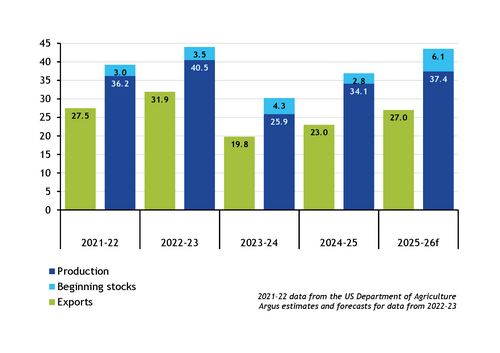

Argus forecast Australia's supply of wheat in 2025-26 (October-September) at a near-record high of 43.7mn t — including output, beginning stocks and imports. This is only 500,000t lower than the record reached in 2022-23.

Competition for port slots

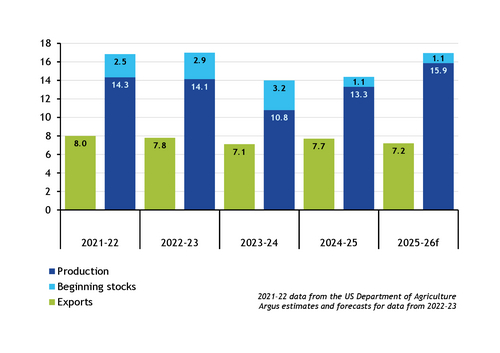

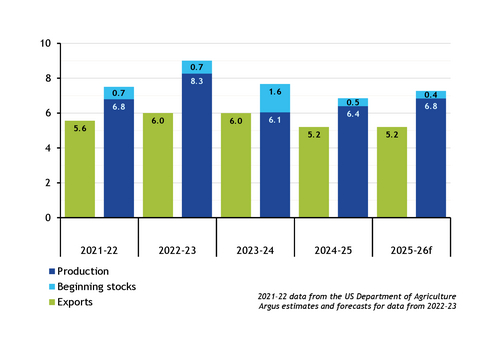

Supplies of barley and canola — Australia's other two major winter crops — are also forecast higher in 2025-26, with barley projected in line with the record 17mn t reached in 2022-23. This suggests tighter competition between the three main winter crops for port capacity at the height of harvest pressure in December. So far, market participants expect a sharper focus on barley and canola over wheat for loading in December.

Australian canola and barley are likely to be harvested before wheat, encouraging major bulk handlers to export these crops first to use up the full capacity of their supply chains, market participants said. And farmers are also likely to sell canola or barley rather than wheat, similar to previous seasons, according to some market participants.

Export opportunities for canola early in the season could also boost trade of this crop, especially if China fully reopens its market to Australian canola, in addition to a recent decision by the UAE to scrap its 5pc import tariff on Australian canola.

Argentinian wheat shines

As for competing origins, the quality of Argentina's new-crop lower protein milling wheat has been rated 97pc "good-to-excellent" by the Buenos Aires Grain Exchange. And Argentina is forecast to produce a bumper crop in 2025-26, according to Argus. Above average size and quality of Argentinian wheat have already attracted buyers in one of the main destinations for Australia's wheat exports — southeast Asia. If Argentina's crop quality proves higher than in previous seasons, the origin could attract more of those buyers who are usually prepared to pay a premium for Australian Standard White milling wheat.

That said, Argentina's exporters could focus on executing soybean contracts — instead of wheat — after a spike in soybean sales in late September. Additionally, Argentinian farmers' sales could also slow if the congressional elections on 26 October result in currency volatility, market participants said.

Ample Black Sea wheat supplies

Black Sea milling wheat has in previous seasons taken some of Australia's wheat export market share in southeast Asia. It could happen again if Black Sea fob prices come under pressure. One reason for this could be slower exports from the main producers so far in the 2025-26 northern hemisphere wheat season (July-June), which are leaving ample stocks for producers to offload later in the marketing year.

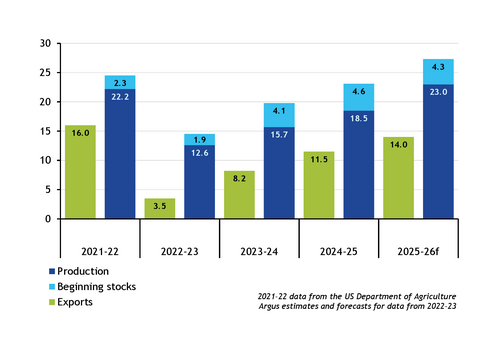

Despite higher output in Russia in 2025-26 than last season, Russian exports so far have lagged significantly behind last year's pace, according to Argus estimates.

The prices of wheat from Russia and the rest of the Black Sea region are too high, compared with Australian or Argentinian new-crop milling wheat in Australia's usual export markets in Asia.

As for Ukraine, exports have also lagged on the year, but total supplies are also lower — estimated at 22.9mn t, down slightly by 400,000t on the year, according to Argus. But the country's export pace lags, even when adjusting for lower forecast exports in 2025-26 — wheat exports and as of 5 October had reached one-third of the forecast total, compared with 40pc a year ago.