Pakistan is struggling to absorb all of its contracted LNG supplies, as rising costs reshape the role of LNG in the country's power mix, write Bonnie Lao and Ashima Sharma

Rising costs are causing Pakistan to switch from LNG to coal in its power sector, casting wider concerns over whether the global LNG market will be able to attract enough new customers for supply that is set to come on line in the next few years.

Pakistan was once seen as a key source of incremental LNG demand, but it appears to be readjusting its energy mix after struggling to absorb its contracted LNG supplies in recent months. It recently deferred as many as 24 deliveries originally planned for 2026 and is in negotiations on further cargo deferrals for subsequent years (see table). The government sees term LNG supplies as a threat to domestic production, with petroleum minister Ali Pervaiz Malik tying lower oil and gas exploration to LNG. Domestic gas producers are unable to sell gas to the power sector because regasified LNG (RLNG) plants are forced to run in order to absorb contractual supplies, Malik says.

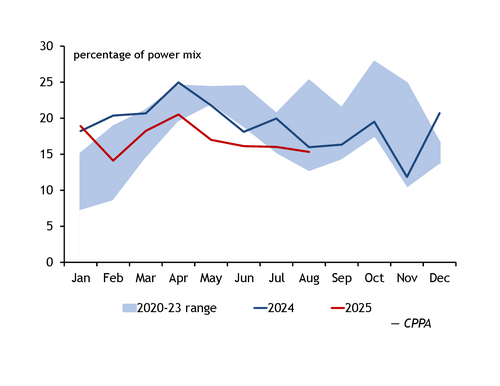

But competition with cheaper alternative fuels has weighed on LNG use for power generation this year so far, with RLNG accounting for 17pc of total power output in January-August compared with an average of about 20pc over 2020-23, Pakistan's state-owned Central Power Purchasing Agency says (see graph). RLNG has fallen in Pakistan's power grid merit order this year, government data show, encouraging more use of coal-fired plants and renewable power sources in place of RLNG, market participants say. That said, bottlenecks in north-south transmission lines can force more expensive plants to run before cheaper ones, energy minister Awais Leghari said last year. And high levels of contractualLNG imports force power producers to run RLNG-fired plants even when they are less profitable. The higher fuel costs are eventually passed on to consumers, Leghari said.

Pakistan has struggled with high LNG costs since late 2021, when a steady rise in LNG prices caused some of the country's suppliers to default on their contractual obligations. This led Pakistan to seek costly alternatives on the spot market while also resorting to load-shedding to depress demand. The high price environment was exacerbated by a steady depreciation of the Pakistani rupee against the US dollar in recent years, and the country is no longer able to subsidise energy costs as it did in the past. A recent decline in oil prices has gradually reduced the cost of Pakistan's term LNG supplies, which are all oil-linked, but prices are still much higher than when most of the contracts were negotiated. LNG deliveries to Pakistan have slowly recovered after falling sharply in 2022, but have remained below the 8.25mn t/yr it has in contractual obligations, and imports are on course to fall this year.

Power up

Pakistan is unlikely to expand its gas infrastructure because of the high costs involved, market participants say. It will instead look to make the most of its existing coal-fired plants and domestic coal reserves, while also ramping up solar and hydropower output, according to market participants.

Power costs in Pakistan are a double-edged sword for the government because while it makes money from selling electricity through its state-owned energy companies, it has to financially compensate independent power producers for their work maintaining certain facilities so that utilities can produce electricity when required, regardless of operating hours.But this policy, along with the country's heavy dependence on loans from the IMF and Asian Development Bank for energy infrastructure projects, and the debts it owes to Chinese-owned power projects in Pakistan, have paralysed its funding flows. The country has nearly defaulted on its debt several times in the past few years, requiring repeated bailouts from the IMF. These have forced the government to make energy sector reforms and price increases, such as a 2.5 rupee/litre (88¢/litre) levy on gasoline, fuel oil and diesel for the 2025-26 fiscal year. It recently scrapped the generating licence for a 660MW coal-fired unit at its Jamshoro coal project because of insufficient funding, further illustrating the government's intention to double-down on existing resources and curb expenditure on new gas infrastructure.

Pakistan has redirected its energy investment to the coal sector in the past 18 months, such as the 105km Thar coal rail project, due for completion in December. The rail line will connect domestic coal mines in the Thar region with Port Qasim, giving coal-dependent industries access to cheaper fuel supplies. And several Chinese investments focused on exploiting domestic coal reserves are currently under negotiation. Power plants running on imported coal have been running at much higher load factors this year so far, and Pakistan's seaborne coal imports rose by more than 20pc on the year in January-September, data from trade analytics platform Kpler show. The country's total coal-fired power generation from domestic and imported coal averaged 3.12 GW/month in January-August, compared with 2.31 GW/month over the same period last year, when load-shedding was exercised to save costs.

Buyer beware

Pakistan's attempt to exit the LNG market suggests attracting customers for the expected flood of new supply could be challenging and may require a variety of financing terms and mechanisms. Over 210mn t/yr of planned LNG projects have reached a final investment decision — absorbing all of this will require existing buyers to up their take and mean new customers are needed to grow the market.

New LNG customers are likely to come from developing countries, which typically have higher credit risks, weak currencies and frequent bouts of insufficient foreign exchange reserves. LNG is almost always sold in US dollars, so prospective customers from developing countries will need to take on the cost burden of using the US currency as well as LNG's higher prices compared with coal — which still has the largest power generation footprint among developing countries.

| Pakistan's term LNG deals | mn t/yr | ||

| Seller | Start date | End date | Volume |

| QatarEnergy | 2022 | 2023 | 3.00 |

| QatarGas | 2016 | 2031 | 3.75 |

| Eni | 2017 | 2032 | 0.75 |

| Socar* | 2023 | 2028 | 0.75 |

| *Initially due to expire in 2025, but extended for additional three years | |||