Liquidity in the voluntary carbon market (VCM) will be increasingly driven by demand for compliance schemes and high-integrity credits over the next 12 months.

Carbon project developers are increasingly shifting strategies to tap into the growing demand for offsets approved for the first phase of the Carbon Offsetting and Reduction Scheme for International Aviation (Corsia) or tagged with the Integrity Council for the Voluntary Carbon Market's high-integrity Core Carbon Principles (CCPs) label.

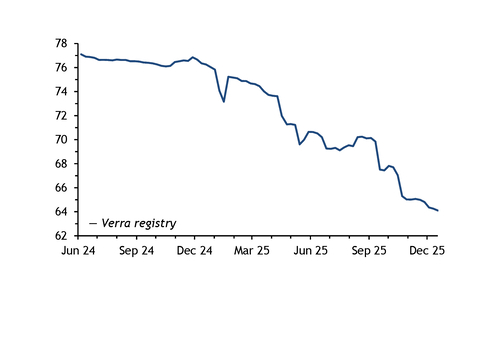

The first phase of Corsia — between 2024 and 2026 — was hamstrung this year by a persistent supply bottleneck. Only one government-run forestry project in Guyana made up the entire supply of Emissions Eligible Units (EEUs) for most of 2025 — about 15.8mn credits. Developers faced difficulty obtaining letters of authorisation (LOAs) from host countries — documents indicating their intention to apply a corresponding adjustment (CA) to carbon credits to avoid double counting. And once projects receive LOAs, to issue EEUs they must either demonstrate their host country has applied the CA — through its Biennial Transparency Report (BTR) submitted to the UN — or secure private insurance policies in case the host country retracts the CA. But concerns eased in late 2025 after several projects crossed the line to eligibility, bringing the total number of tagged EEUs to about 17.5mn.

Heading into 2026, Verra, the largest carbon registry in the world, is set to apply the tag to at least 5.1mn clean cookstoves credits after it approved insurance policies last week. And a significant chunk of supply is expected to come on line once countries submit their BTRs by the December 2026 deadline. On demand, uncertainty about participating countries and subjected airlines will be settled next year. The EU is expected to release a report reviewing the effectiveness of Corsia to achieve its climate target in July, based on which it might decide to expand its emissions trading system (ETS) to international aviation. This will partly hinge on whether the US — which so far has expressed public support for Corsia but has not taken any measures to implement it — will participate in the scheme.

High-integrity credits tagged with the CCPs label have been assessed broadly steady by Argus over 2025, with only landfill gas (LFG) credit prices in the US, Brazil and Bangladesh slightly increasing since the beginning of the year. The widely expected support for pricing has not materialised because buyers are not prepared to pay a premium for LFG CCPs credits yet, according to market participants. And despite several Integrity Council for the Voluntary Carbon Market (ICVCM) decisions to expand the scheme with the approval of carbon removal, clean cookstoves, and improved forest management methodologies, most CCPs supply is still made up of LFG credits.

Despite the relatively lacklustre premium for CCP LFG credits over their non-tagged counterparts, other areas of the market are expected to benefit much more significantly from the high-integrity label. Clean cookstoves developer Burn, for instance, will only issue CCPs-tagged credits or Corsia Phase 1-approved EEUs, it said, because these command a significant premium. Over-the-counter CP1 credits were assessed last week at $20.90/t CO2e and Burn said it has struck forward offtake deals for its CCPs supply at around $15-20/t CO2e. For developers, these markets are expected to unlock significantly more revenue than standard clean cookstoves credits in Africa, which are currently assessed at $3.15/t CO2e for vintages 2019 onwards.

Lastly, the highly liquid Katingan reducing emissions from deforestation and forest degradation (REDD+) project in Indonesia is expected to resume issuing credits in the next quarter, following a supply crunch that supported the Argus-assessed price to more than double from the beginning of 2025. A ban on fresh issuances from the government of Indonesia was lifted in October, but prices have continued to rise since. The most liquid vintage, 2020, was heard trading at levels above $11/t CO2e last week, nearly triple the $4.60/t CO2e price assessed in January.

And in the wider VCM, demand is expected to pick up next year after the Science Based Targets initiative publishes its second Corporate Net-Zero Standard, which could increase corporates' appetite for nature-based avoidance and removal credits. Emerging buyers' coalitions will continue to drive demand for tech-removal credits, with the anticipated launch of the Tech Gen group in the second quarter of 2026.

| Projects generating Corsia Phase 1-approved credits | t CO2e | |||

| Project ID | Credits issued | Registry | Developer | Country |

| 11677 | 1,508,719 | Gold Standard | Hestian Innovation | Malawi |

| 11732 | 184,500 | Gold Standard | Burn | Tanzania |

| 102 | 15,800,000 | ART | Guyana Forestry Commission | Guyana |