The spread between US and European LNG prices will likely narrow further in 2026, but forward prices indicate US LNG supply under long-term contracts will remain comfortably profitable in international spot markets until at least summer 2027 as a wave of new supply comes on line.

A recent rally in the US natural gas market highlighted US LNG's tightening margins. The indicative long-term LNG contract price — 115pc of US benchmark Henry Hub plus a $3/mn Btu liquefaction fee — surpassed the Argus Gulf coast (AGC) spot fob price in early December for the first time in more than two years amid cold weather in the US, mild weather in Europe and high Atlantic basin freight rates. But the premium over the spot price was brief and caused no change to export schedules. The front-month Henry Hub contract quickly shed its gains on warmer weather, falling to $3.89/mn Btu on 16 December from a nearly three-year high of $5.29/mn Btu on 5 December. Prices hovered around $4/mn Btu through 19 December.

The impact was solely on profit margins rather than fundamentals. Customers of US LNG facilities did not need to cancel cargoes under take-or-pay provisions because a profit incentive to maximize exports remained. Liquefaction costs are considered sunk, and the spread between Henry Hub and European LNG prices remained wide enough to more than cover shipping costs.

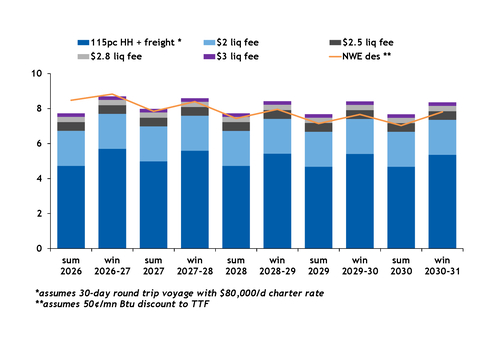

Though rising exports may add to domestic pricing volatility during cold winter weather through the end of the decade, US and European gas futures today indicate long-term offtake from US LNG terminals will remain profitable until the summer of 2027, assuming freight rates of $80,000/d and a 50¢/mn Btu discount to the European benchmark TTF for northwest European deliveries. At that time, contracts with $3/mn Btu liquefaction fees could surpass delivered LNG prices in northwest Europe, though the arbitrage for US gas would remain open for contracts with lower fees (see chart).

Fees now range between $2.50-2.80/mn Btu for US supply coming on line toward the end of the decade. Contracts with fees on either end of that range remain below European LNG prices until summer 2029 and summer 2028, respectively, assuming freight rates of $80,000/d.

But cargo cancellations are not always necessary when long-term US LNG contract prices surpass international prices. Terminal operators and their customers finalize annual delivery plans as well as upward and downward delivery tolerances before the start of each year, leaving less flexibility later in the year. If a customer wishes to cancel a cargo, they typically must notify the terminal up to two months in advance, which would likely only happen in an environment where the cost of 115pc of Henry Hub plus freight stabilizes above European LNG prices. The spread between Henry Hub and delivered European prices is wide enough to absorb freight costs through winter 2030-31.

If an offtaker opts for a lower quantity in its delivery tolerance or cancels a cargo, the volume returns to the terminal operator, which could still market and sell the cargo on the spot market. This effectively shifts the seller of a cargo from the LNG customer to the LNG terminal operator.

The likelihood of cancellations beyond 2027 may be higher in the spring and autumn shoulder seasons, when demand in Europe is typically lower. Depending on the previous winter, this may be more likely to occur in autumn, given the annual rebuild of Europe's underground gas inventories that begins in the spring.

Additional liquefaction capacity has already helped tighten margins for US LNG since Europe's conflict-driven volatility in 2022. The AGC fob's premium over the long-term indicative contract averaged $3.95/mn Btu through 19 December this year, down from $4.63/mn Btu, $5.37/mn Btu and $20.13/mn Btu in 2024, 2023 and 2022, respectively.

But the anticipated convergence of US and European LNG is not guaranteed. Geopolitical conflict could disrupt existing trade patterns. And lower prices in Europe will be contingent on new LNG projects, led by the US and Qatar, maintaining their timelines, which are prone to delays from supply chain issues and workforce constraints. This would add upside risk to international prices and downside risk for Henry Hub if the delays are in the US.