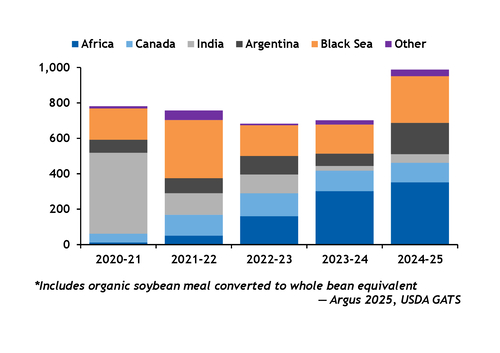

US organic soy imports skyrocketed over 2024-25, as new trade patterns stabilize in the wake of tariffs and military conflicts that roiled markets in recent years. This stability is likely to lessen upward price risks for the crop in the year ahead, but is not without challenges.

US organic soybean and soybean meal (soymeal) imports grew 68pc and 28pc, respectively, over the 2024-25 marketing year (September-August) from a year earlier, Argus data show. Imports of organic soymeal imports reached a new record while organic soybean imports were at their highest level since 2017-18.

US organic soy imports swelled — despite tariffs being levied against nearly all trading partners this year by US president Donald Trump's administration — as markets appeared to finally stabilize following multiple years of disruption, and growing US organic feed demand found a more diverse global supply chain.

Years of trade turmoil calm

US organic soy imports have been without a stable outlook since a near 270pc tariff was levied against Indian soybean meal in 2021, disrupting the flow of 60pc of US organic soy imports at that time.

While the decision to implement sharp duties on Indian organic soymeal pushed US organic soy prices to new heights, it also encouraged alternative suppliers — including the Black Sea, Africa, and Canada — to expand their organic soy production and exports.

Suppliers in the Black Sea region, primarily Russia, Ukraine and Turkey, responded to this opportunity first, nearly doubling their shipments to the US during 2021-22. The volumes declined in the following years, as the Ukraine-Russia conflict disrupted supplies, but they began recovering during 2024-25.

The US imported 143,000t of organic soybeans from the Black Sea region during 2024-25, up 178pc from a year earlier. This increase was driven by a nearly ten-fold increase in organic soybean imports from Ukraine, which reached their highest level since 2021-22, before the conflict with Russia disrupted trade.

Africa emerged more slowly than the Black Sea, but quickly became the largest, lowest-cost supplier of organic soy to the US.

Africa initially exported whole organic soybeans to the US, peaking at 69,300t in 2022-23, but those volumes quickly fell to just 1,140t in 2024 as exporters expanded crush capacity and switched to exporting soymeal. US imports of organic soymeal from Africa surged to a record 278,000t in 2024-25, up 41pc from a year earlier.

Import volumes could expand again during 2025-26. A recent US Department of Agriculture Foreign Agricultural Service report indicated that Togo plans to further expand organic crush capacity, allowing the country to increase exports to the US and EU.

Canada also increased its supply of organic soy to the US. From 2020-21 through 2024-25, Canada increased organic soy exports to the US by 120pc, shipping to the US 64,500t of soymeal and 28,400t of soybeans in the previous marketing year.

While global supplies appear to have stabilized, a broad negative response from US producers and processors to the increase in organic soy imports has emerged. Congress introduced bills targeting organic imports during 2024-25, including bills to increase testing on organic imports and fund grants to support domestic organic supplies over imports. Action from Congress or the National Organic Program against these imports are another risk factor in the market, as restrictions on imports would support US organic soy pricing.

Strong supply to limit price growth

The emergence of multiple, significant organic soy import suppliers to the US is expected to be a stabilizing factor for prices going forward.

As a result of the variety of trade partners, when supplies from one source start to wane, other sources can offer organic soybean exports to cover the gap.

The significant growth of US organic soy imports over the 2024-25 marketing year also pushed ending stocks for organic soybeans and soymeal to 91,400t and 90,100t, respectively, both up by 200pc or more from a year earlier, Argus data show. These strong stocks and imports are likely to keep organic soybean prices steady during the marketing year ahead, even as organic soymeal feed demand is expected to grow by 7pc.

The lower upside price risk in organic soybean markets has also encouraged US organic farmers to store organic corn over soybeans this fall, market contacts said. While this allowed end-users to buy organic soybeans easily around harvest, it will also likely mean a greater reliance on imports later in the marketing year.

Lower price risk could discourage end-users from holding stocks in the year ahead, which will reduce bids. As a result, producers can likely expect limited upside in the organic soy market as long as import supplies remain available.