Chinese buyers of Venezuelan crude are preparing to switch to Iranian, Russian or unsanctioned grades, or even lowering their run rates, given major supply concerns on the back of loading disruptions, which have prompted Venezuelan crude suppliers to pause their offers.

The US has seized two oil tankers off the coast of Venezuela in December. This has since led to loadings from Venezuela to China halting almost completely.

More market participants expect Venezuelan supplies to continue to be diverted away from China, after the capture of Venezuelan president Nicolas Maduro by the US, and US president Donald Trump's subsequent claims of "running" Venezuela.

The immediate changes to the flow of Venezuelan crude remain unclear, but Chinese buyers are concerned about a steep increase in exports to the US and a significant rise in spot values.

Venezuelan crude sellers in China have largely paused offers for cargoes this month, despite the unsold supplies in bonded storage in China, in floating storage off the coast of Malaysia and those on their way to Asia. Suppliers are now poised to hold off on offers to push spot differentials higher later, in anticipation of continued loading disruptions, traders said.

Chinese refiners could face major Venezuelan oil supply issues starting from around the March-arrival cycle.

Some refiners were looking for Venezuelan crude to be delivered in March, but no offers surfaced. "We are also preparing for lower throughputs or early maintenance if the worst scenario happens," a refinery official said.

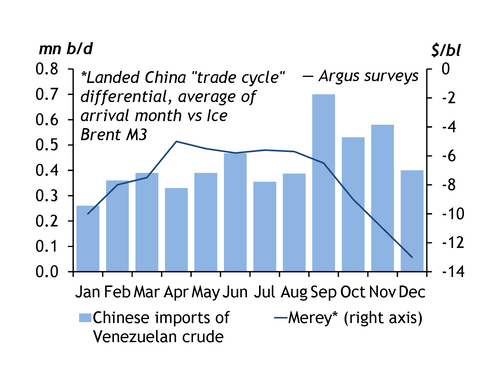

Venezuelan supplies are expected to be ample for Chinese buyers in the short term because they restocked in December. There were around 30mn bl of east-bounded cargoes that were loaded from Venezuela in November and December, said market participants. This is equivalent to around 500,000 b/d of cargoes to be delivered in China in January and February, when bitumen demand typically undergoes a seasonal lull.

Chinese market participants are also concerned over whether the Venezuelan oil fields that Chinese oil companies have invested in will deliver crude to China, as originally planned for later in 2026.

Alternative choices

There are around 10 regular Chinese buyers of Venezuelan crude — mostly asphalt producers — which have imported an average of around 430,000 b/d Venezuelan crude in 2025, Argus tracking and market data show, but they may now need to find alternatives.

Chinese independent refineries may have to face a shortage of cheap sanctioned heavy crude oil from Venezuela from March, some market participants said. Most independent refineries that steadily purchase Venezuelan crude oil are also regular buyers of other sanctioned crudes, such as Iranian and Russian crude oil. They might turn to Iranian or Russian crude oil if Venezuelan supply is unavailable. But this will affect their output of asphalt, as the asphalt yield of even the heaviest crude — Iranian Extra Heavy crude — is only 10-13pc, compared with 60pc of Merey. Some demand may also shift to Iranian Heavy, of which there is sufficient supply, given that the supply of Iranian Extra Heavy is only about 2 very large crude carriers/month.

Refineries that do not need to ensure downstream asphalt supply could turn to Iranian or Russian crude oil to maintain refining margins.

But some refineries that need to ensure a stable asphalt supply may have to pivot to expensive non-sanctioned heavy crude oil with high asphalt yields. This might amount to 130,000 b/d, a trader said. TMX low-TAN crude from Canada is currently the cheapest heavy crude oil, with a delivered price at around a $4.40/bl discount to Ice Brent, while the delivered price of Castilla from Colombia is at around a $2.60/bl discount to Ice Brent.

It is also possible that Chinese state-owned buyers increase their heavy crude purchases and raise asphalt production to offset the reduction in asphalt output from independent refineries. But it is still uncertain if this will become a trend given that overall asphalt demand is weak, some market participants said.